Rogers 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

term borrowings. The buyer’s interest in these trade receivables

ranks ahead of our interest. The program restricts us from using the

receivables as collateral for any other purpose. The buyer of our

trade receivables has no claim on any of our other assets.

Bank credit and letter of credit facilities

Effective April 16, 2014, we amended the terms of our existing

revolving credit facility (revolving credit facility) to increase the

maximum amount available from $2.0 billion to $2.5 billion while

extending the maturity date from July 20, 2017 to July 19, 2019.

In April 2015, we borrowed the full amount of a new $1.0 billion

bank credit facility (non-revolving credit facility) which was

established in addition to our existing $2.5 billion revolving credit

facility. The non-revolving credit facility is available on a non-

revolving basis and matures in April 2017 with no scheduled

principal repayments prior to maturity. In December 2015, we

amended our non-revolving bank credit facility to allow partial,

temporary repayment of this facility from December 2015 through

May 2016; the maximum credit limit remains $1.0 billion. The

interest rate charged on borrowings under the non-revolving credit

facility falls within the range of pricing indicated for our revolving

credit facility.

This year, we borrowed $6,025 million (2014 – $1,330 million)

under our revolving and non-revolving credit facilities and repaid

$5,525 million (2014 – $1,330 million).

As at December 31, 2015, we had $500 million (2014 — nil)

outstanding under our revolving and non-revolving credit facilities.

As at December 31, 2015, we had available liquidity of $3.0 billion

(2014 – $2.5 billion) under our $3.6 billion of revolving and non-

revolving credit and letter of credit facilities (2014 – $2.6 billion), of

which we had utilized approximately $0.1 billion (2014 –

$0.1 billion) related to outstanding letters of credit and $0.5 billion

of borrowings (2014 – nil of borrowings). Each of these facilities is

unsecured and guaranteed by RCCI and ranks equally with all of

our senior notes and debentures. See “Dissolution of RCP” for

more information.

Issuance of senior notes and related debt derivatives

The table below provides a summary of the senior notes we issued

during 2015 and 2014, with the proceeds used to repay

outstanding advances under our credit facilities and for general

corporate purposes.

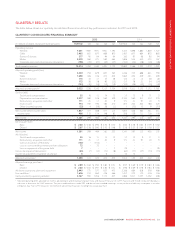

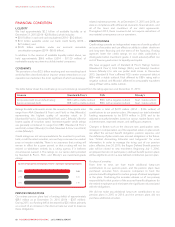

(In millions of dollars, except interest and discount rates)

Date issued

Principal

amount

Due

date

Interest

rate

Discount/premium

at issuance

Total gross

proceeds 1

Transaction costs

and discounts 2

2015 issuances

December 8, 2015 US 700 2025 3.625% 99.252% 937

December 8, 2015 US 300 2044 5.000% 101.700% 401

Total for 2015 1,338 13

2014 issuances

March 10, 2014 250 2017 Floating 100.000% 250

March 10, 2014 400 2019 2.80% 99.972% 400

March 10, 2014 600 2024 4.00% 99.706% 600

March 10, 2014 US 750 2044 5.00% 99.231% 832

Total for 2014 2,082 24

1Gross proceeds before transaction costs, discounts, and premiums.

2Transaction costs, discounts, and premiums are included as deferred transaction costs and discounts in the carrying value of the long-term debt, and recognized in net income

using the effective interest method.

In 2015, the US$1.0 billion of senior notes was issued pursuant to a

public offering in the US. In 2014, the $1.25 billion of senior notes

issued was pursuant to a public offering in Canada and US$750

million of senior notes issued was pursuant to a separate public

offering in the US.

Concurrent with the 2015 issuances, and the 2014 issuance

denominated in US dollars, we entered into debt derivatives to

convert all interest and principal payments obligations to Canadian

dollars (see “Financial Risk Management” for more information).

All the notes issued are unsecured and guaranteed by RCCI,

ranking equally with all of our other senior unsecured notes and

debentures, bank credit and letter of credit facilities.

Repayment of senior notes and related derivative settlements

This year, we repaid our US$550 million ($702 million) and

US$280 million ($357 million) senior notes that were due in March

2015. At the same time, the associated debt derivatives were

settled at maturity for net proceeds received of $154 million,

resulting in a net repayment of $905 million including settlement of

the associated debt derivatives.

58 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT