Rogers 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

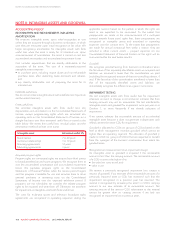

(f) RECENT ACCOUNTING PRONOUNCEMENTS NOT YET

ADOPTED

The IASB has issued the following new standards and amendments

to existing standards that will become effective in a future year and

will or could have an impact on our consolidated financial

statements in future periods:

• IFRS 15, Revenue from Contracts with Customers (IFRS 15) – In

May 2014, the IASB issued IFRS 15 which will supersede all

existing standards and interpretations in IFRS relating to revenue,

including IAS 18, Revenue and IFRIC 13, Customer Loyalty

Programmes.

IFRS 15 introduces a single model for recognizing revenue from

contracts with customers. This standard applies to all contracts

with customers, with only some exceptions, including certain

contracts accounted for under other IFRSs. The standard requires

revenue to be recognized in a manner that depicts the transfer of

promised goods or services to a customer and at an amount that

reflects the consideration expected to be received in exchange

for transferring those goods or services. This is achieved by

applying the following five steps:

1. Identify the contract with a customer;

2. Identify the performance obligations in the contract;

3. Determine the transaction price;

4. Allocate the transaction price to the performance

obligations in the contract; and

5. Recognize revenue when (or as) the entity satisfies a

performance obligation.

IFRS 15 also provides guidance relating to the treatment of

contract acquisition and contract fulfillment costs.

We expect the application of this new standard will have

significant impacts on our reported results, specifically with

regards to the timing of recognition and classification of revenue,

and the treatment of costs incurred in acquiring customer

contracts. The timing of recognition and classification of revenue

will be affected because IFRS 15 requires the estimation of total

consideration over the contract term at contract inception and

allocation of consideration to all performance obligations in the

contract based on their relative standalone selling prices. We

anticipate this will most significantly affect our Wireless

arrangements that bundle equipment and service together into

monthly service fees, which will result in an increase to

equipment revenue recognized at contract inception and a

decrease to network revenue recognized over the course of the

contracts.

The treatment of costs incurred in acquiring customer contracts

will be impacted as IFRS 15 requires certain contract acquisition

costs (such as sales commissions) to be recognized as an asset

and amortized into operating expenses over time. Currently,

such costs are expensed as incurred.

In addition, certain new assets and liabilities will be recognized

on our Consolidated Statements of Financial Position.

Specifically, a contract asset or contract liability will be

recognized to account for any timing differences between the

revenue recognized and the amounts billed to the customer.

Also, certain costs related to acquiring contracts (e.g. sales

commissions) will be recorded as assets and expensed over a

period consistent with the transfer of goods and services to

which the asset relates, instead of as incurred.

The standard is effective for annual periods beginning on or after

January 1, 2018 (as amended in September 2015). We are

required to retrospectively apply IFRS 15 to all contracts that are

not complete on the date of initial application and have the

option to either:

• restate each prior period and recognize the cumulative effect

of initially applying IFRS 15 as an adjustment to the opening

balance of equity at the beginning of the earliest period

presented; or

• retain prior period figures as reported under the previous

standards and recognize the cumulative effect of initially

applying IFRS 15 as an adjustment to the opening balance of

equity as at the date of initial application. This approach will

also require additional disclosures in the year of initial

application to explain how the relevant financial statement line

items would be affected by the application of IFRS 15 as

compared to previous standards.

We are assessing the impact of this standard on our

consolidated financial statements.

• IFRS 9, Financial Instruments (IFRS 9) – In July 2014, the IASB

issued the final publication of the IFRS 9 standard, which will

supersede IAS 39, Financial Instruments: recognition and

measurement (IAS 39). IFRS 9 includes revised guidance on the

classification and measurement of financial instruments,

including a new expected credit loss model for calculating

impairment on financial assets, and the new hedge accounting

guidance. It also carries forward the guidance on recognition

and derecognition of financial instruments from IAS 39. The

standard is effective for annual periods beginning on or after

January 1, 2018, with early adoption permitted. We are assessing

the impact of this standard on our consolidated financial

statements.

• IFRS 16, Leases (IFRS 16) – In January 2016, the IASB issued the

final publication of the IFRS 16 standard, which will supersede

the current IAS 17, Leases (IAS 17) standard. IFRS 16 introduces a

single accounting model for lessees and for all leases with a term

of more than 12 months, unless the underlying asset is of low

value. A lessee will be required to recognize a right-of-use asset,

representing its right to use the underlying asset, and a lease

liability, representing its obligation to make lease payments. The

accounting treatment for lessors will remain largely the same as

under IAS 17.

The standard is effective for annual periods beginning on or after

January 1, 2019, with early adoption permitted, but only if the

entity is also applying IFRS 15. We have the option to either:

• apply IFRS 16 with full retrospective effect; or

• recognize the cumulative effect of initially applying IFRS 16 as

an adjustment to opening equity at the date of initial

application.

We are assessing the impact of this standard on our

consolidated financial statements.

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 99