Rogers 2015 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

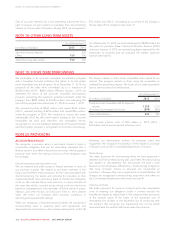

FAIR VALUES OF FINANCIAL INSTRUMENTS

The carrying value of cash and cash equivalents, accounts

receivable, short-term borrowings, and accounts payable and

accrued liabilities approximate their fair values because of the

short-term nature of these financial instruments.

We determine the fair value of each of our publicly traded

investments using quoted market values. We determine the fair

value of our private investments by using implied valuations from

follow-on financing rounds, third party sale negotiations, or market-

based approaches. These are applied appropriately to each

investment depending on its future operating and profitability

prospects.

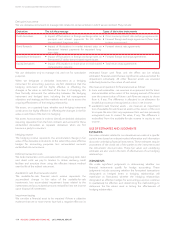

The fair values of each of our public debt instruments are based on

the year-end estimated market yields. We determine the fair values

of our debt derivatives and expenditure derivatives using an

estimated credit-adjusted mark-to-market valuation by discounting

cash flows to the measurement date. In the case of debt derivatives

and expenditure derivatives in an asset position, the credit spread

for the financial institution counterparty is added to the risk-free

discount rate to determine the estimated credit-adjusted value for

each derivative. For these debt derivatives and expenditure

derivatives in a liability position, our credit spread is added to the

risk-free discount rate for each derivative.

The fair values of our equity derivatives are based on the quoted

market value of RCI’s Class B Non-Voting shares.

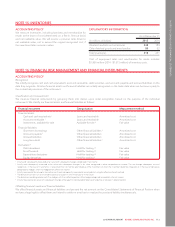

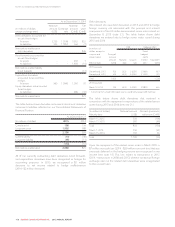

Our disclosure of the three-level fair value hierarchy reflects the

significance of the inputs used in measuring fair value:

• financial assets and financial liabilities in Level 1 are valued by

referring to quoted prices in active markets for identical assets

and liabilities;

• financial assets and financial liabilities in Level 2 are valued using

inputs based on observable market data, either directly or

indirectly, other than the quoted prices; and

• Level 3 valuations are based on inputs that are not based on

observable market data.

There were no material financial instruments categorized in Level 3

as at December 31, 2015 and 2014 and there were no transfers

between Level 1, Level 2, or Level 3 during the respective periods.

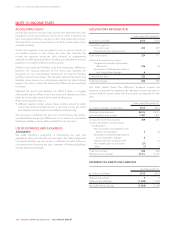

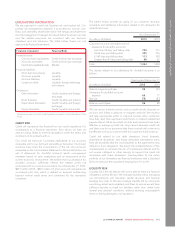

The table below shows the financial instruments carried at fair value.

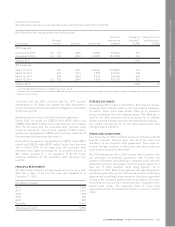

As at December 31

Carrying value Level 1 Level 2

(In millions of dollars) 2015 2014 2015 2014 2015 2014

Financial assets

Available-for-sale, measured at fair value:

Investments in publicly traded companies 966 1,130 966 1,130 ––

Held-for-trading:

Debt derivatives accounted for as cash flow hedges 2,032 853 ––2,032 853

Bond forwards accounted for as cash flow hedges –1–––1

Expenditure derivatives accounted for as cash flow hedges 158 70 ––158 70

Total financial assets 3,156 2,054 966 1,130 2,190 924

Financial liabilities

Held-for-trading:

Debt derivatives accounted for as cash flow hedges 47––47

Bond forwards accounted for as cash flow hedges 91 14 ––91 14

Equity derivatives not accounted for as cash flow hedges 15 30 ––15 30

Total financial liabilities 110 51 ––110 51

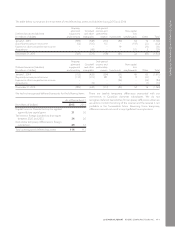

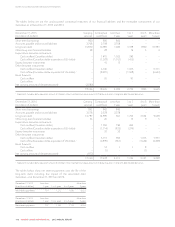

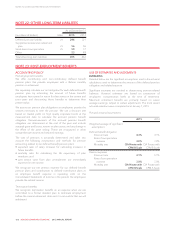

The fair value of our long-term debt is estimated as follows:

As at December 31

(In millions of dollars) 2015 2014

Carrying amount Fair value 1Carrying amount Fair value 1

Long-term debt (including current portion) 16,870 18,252 14,787 16,584

1Long-term debt (including current portion) is measured at Level 2 in the three-level fair value hierarchy, based on year-end trading values.

We did not have any non-derivative held-to-maturity financial assets during the years ended December 31, 2015 and 2014.

120 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT