Rogers 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

ADDITIONS TO PROPERTY, PLANT AND EQUIPMENT

Additions to property, plant and equipment include costs

associated with acquiring property, plant and equipment and

placing it into service. The telecommunications business requires

extensive and continual investments, including investment in new

technologies and the expansion of capacity and geographical

reach. The expenditures related to the acquisition of spectrum

licences are not included in additions to property, plant and

equipment and do not factor into the calculation of free cash flow

or capital intensity. Please see “Managing Our Liquidity and

Financial Resources”, “Key Performance Indicators”, and “Non-

GAAP Measures” for more information.

Additions to property, plant and equipment are significant and

have a material impact on our cash flows, therefore our

management teams focus on planning, funding, and managing

them.

Additions to property, plant and equipment before related

changes to non-cash working capital represent capital assets to

which we took title. We believe this measure best reflects our cost

of property, plant and equipment in a given period and is a simpler

measure for comparing between periods.

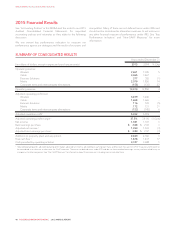

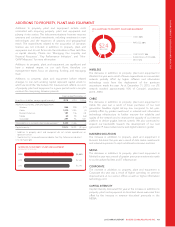

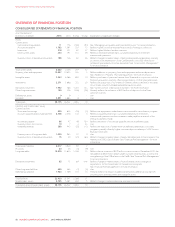

Years ended December 31

(In millions of dollars, except capital intensity) 2015 2014 % Chg

Additions to property, plant and equipment

Wireless 866 978 (11)

Cable 1,030 1,055 (2)

Business Solutions 187 146 28

Media 60 94 (36)

Corporate 297 93 n/m

Total additions to property, plant and equipment 12,440 2,366 3

Capital intensity 218.2% 18.4% (0.2 pts)

1Additions to property, plant and equipment do not include expenditures on

spectrum licences.

2Capital intensity is a key performance indicator. See “Key Performance Indicators”.

n/m: not meaningful.

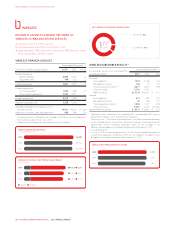

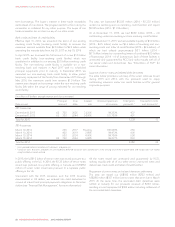

(IN MILLIONS OF DOLLARS)

ADDITIONS TO PROPERTY, PLANT AND EQUIPMENT

2015

2014

2013

$2,440

$2,366

$2,240

(%)

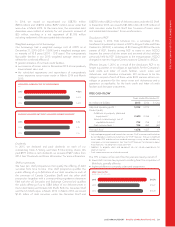

2015 ADDITIONS TO PROPERTY, PLANT AND EQUIPMENT

CABLE 42%

WIRELESS 36%

CORPORATE 12%

MEDIA 2%

BUSINESS SOLUTIONS 8%

$2.4

BILLION

WIRELESS

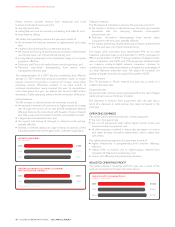

The decrease in additions to property, plant and equipment in

Wireless this year was a result of lower expenditures on our wireless

network, partially offset by higher software and information

technology costs from the deployment of the spectrum

acquisitions made this year. As at December 31, 2015, our LTE

network reached approximately 93% of Canada’s population

(2014 – 84%).

CABLE

The decrease in additions to property, plant and equipment in

Cable this year was a result of lower purchases of our next

generation NextBox digital set-top box compared to last year,

partially offset by greater investment in network and information

technology infrastructure to further improve the reliability and

quality of the network and to improve the capacity of our Internet

platform to deliver gigabit Internet speeds. We also continued to

expand our bandwidth towards the development of our next

generation IP-based video service and digital television guides.

BUSINESS SOLUTIONS

The increase in additions to property, plant and equipment in

Business Solutions this year was a result of data centre investments

and network expansion to reach additional customers and sites.

MEDIA

The decrease in additions to property, plant and equipment in

Media this year was a result of greater prior year investments made

to our broadcast facilities and IT infrastructure.

CORPORATE

The increase in additions to property, plant and equipment in

Corporate this year was a result of higher spending on premise

improvements at our various offices as well as higher information

technology costs.

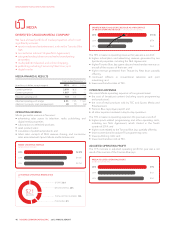

CAPITAL INTENSITY

Capital intensity decreased this year as the increase in additions to

property, plant and equipment as described above was more than

offset by the increase in revenue described previously in this

MD&A.

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 49