Rogers 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Economy and society

• Economic Performance: We strive to offer innovative solutions for

customers, create diverse and well-paying jobs, support small

businesses, pay our fair share of taxes, and deliver robust

dividends to shareholders. Beyond these direct economic

impacts, our performance produces indirect economic benefits

as well, including significant charitable donations and locally

procured goods and services.

• Supply Chain Management: Suppliers play a huge role in our

success, which is why we ensure that we have strong supplier

selection processes, and management, and that we conduct

business with socially and environmentally responsible

companies who share our values. Our Supplier Code of Conduct

sets out high standards for supplier performance in the areas of

ethics, labour rights, health and safety, environment, and

management systems.

• Public Policy: We participate actively in public policy discussions

that are relevant to our operations and are fully transparent

about our positions and activities. We are heavily involved with

governments and regulators at the federal level through our

Regulatory and Government Relations offices and teams in both

Toronto and Ottawa. The majority of our interactions take place

with two groups that regulate our activities: the CRTC and ISED

Canada.

See our annual Corporate Social Responsibility report on our

website (rogers.com/csr) for more about our social, environmental,

and community contributions and performance.

INCOME TAX AND OTHER GOVERNMENT PAYMENTS

We proactively manage our tax affairs to enhance Rogers’ business

decisions and optimize after-tax free cash flow available for

investment in our business and shareholder returns. We have

established comprehensive policies and procedures to ensure we

are compliant with all tax laws and reporting requirements,

including filing and making all requisite income and sales tax

returns and payments on a timely basis. As a part of this process,

we maintain open and cooperative relationships with revenue

authorities to minimize audit effort and reduce tax uncertainty while

engaging with government policy makers on taxation matters that

affect Rogers and its shareholders, employees, customers, and

other stakeholders.

Income tax payments

Rogers total income tax expense of $466 million in 2015 is close to

the expense computed on its accounting income at the statutory

rate of 26.5%. Cash income tax payments totaled $184 million in

2015. Cash income tax payments can differ from the tax expense

shown on the financial statements for various reasons, including

timing of payments. Our cash income tax this year is lower than our

tax expense principally as a result of the utilization of loss

carryforwards from the acquisition of Mobilicity and the significant

capital investment Rogers continues to make in our wireless and

broadband telecommunications network throughout Canada.

Similar to tax systems throughout the world, Canadian tax laws

generally permit these additions to property, plant and equipment

to be deducted for tax more quickly than they are depreciated for

financial statement recognition purposes.

Other government payments

In addition to paying income tax on the profits we earn, we

contribute significantly to Canadians by paying taxes and fees to

federal, provincial, and municipal governments as follows:

• various taxes on the salaries and wages we pay (payroll taxes) to

approximately 26,000 employees;

• property and business taxes;

• unrecoverable sales taxes and custom duties; and

• broadcast, spectrum, and other regulatory fees.

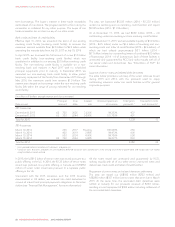

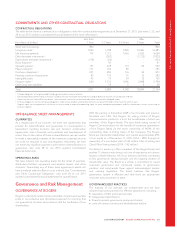

As outlined in the table below, the total cost to Rogers of these payments in 2015 was approximately $881 million.

(In millions of dollars)

Income

taxes

Non-recoverable

sales taxes Payroll taxes

Regulatory and

spectrum fees 1

Property and

business taxes

Total taxes and

other payments

Total payments 184 9 133 509 46 881

1Includes an allocation of $266 million relating to the $1.0 billion, $3.3 billion, and $24 million we paid for the acquisition of spectrum licences in 2008, 2014, and 2015,

respectively.

We also collected on behalf of the government approximately

$1,735 million in sales taxes on our products and services and

$561 million in employee payroll taxes.

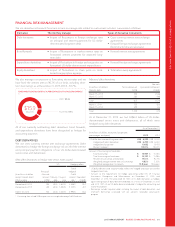

RISK MANAGEMENT

We are committed to continually strengthening our risk

management capabilities to protect and enhance shareholder

value. The purpose of risk management is not to eliminate risk but

to optimize trade-offs between risk and return to maximize value to

the organization.

RISK GOVERNANCE

The Board has overall responsibility for risk governance and

oversees management in identifying the principal risks we face in

our business and implementing appropriate risk assessment

processes to manage these risks. It delegates certain risk oversight

and management duties to the Audit and Risk Committee.

The Audit and Risk Committee discusses risk policies with

management and the Board and assists the Board in overseeing

our compliance with legal and regulatory requirements.

TheAuditandRiskCommitteealsoreviews:

• the adequacy of the internal controls that have been adopted to

safeguard assets from loss and unauthorized use, to prevent,

deter, and detect fraud, and to ensure the accuracy of the

financial records;

• the processes for identifying, assessing, and managing risks;

• our exposure to major risks and trends and management’s

implementation of risk policies and actions to monitor and

control these exposures;

68 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT