Rogers 2015 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

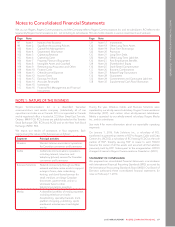

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

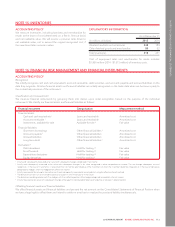

USE OF ESTIMATES AND JUDGMENTS

ESTIMATES

We use estimates in determining the recoverable amount of

intangible assets and goodwill.

The determination of the recoverable amount for the purpose of

impairment testing requires the use of significant estimates, such

as:

• future cash flows;

• terminal growth rates; and

• discount rates.

We estimate value in use for impairment tests by discounting

estimated future cash flows to their present value. We estimate the

discounted future cash flows for periods of up to five years,

depending on the CGU, and a terminal value. The future cash flows

are based on our estimates and expected future operating results

of the CGU after considering economic conditions and a general

outlook for the CGU’s industry. Our discount rates consider market

rates of return, debt to equity ratios and certain risk premiums,

among other things. The terminal value is the value attributed to

the CGU’s operations beyond the projected time period of the

cash flows using a perpetuity rate based on expected economic

conditions and a general outlook for the industry.

We determine fair value less costs to sell in one of the following two

ways:

• Analyzing discounted cash flows – we estimate the discounted

future cash flows for periods of five to ten years, depending on

the CGU, and a terminal value, similar to the value in use

methodology described above, while applying assumptions

consistent with those a market participant would make. Future

cash flows are based on our estimates of expected future

operating results of the CGU. Our estimates of future cash flows,

terminal values and discount rates consider similar factors to

those described above for value in use estimates.

• Usingamarketapproach–weestimatetherecoverableamount

of the CGU using multiples of operating performance of

comparable entities and precedent transactions in that industry.

We make certain assumptions for the discount and terminal growth

rates to reflect variations in expected future cash flows. These

assumptions may differ or change quickly depending on economic

conditions or other events. It is therefore possible that future

changes in assumptions may negatively affect future valuations of

CGUs and goodwill, which could result in impairment losses.

If our estimate of the asset’s or CGU’s recoverable amount is less

than its carrying amount, we reduce its carrying amount to the

recoverable amount and recognize the loss in net income

immediately.

JUDGMENTS

We make significant judgments that affect the measurement of our

intangible assets and goodwill.

Judgment is applied when deciding to designate our spectrum

and broadcast licences as assets with indefinite useful lives since we

believe the licences are likely to be renewed for the foreseeable

future such that there is no limit to the period that these assets are

expected to generate net cash inflows. We make judgments to

determine that these assets have indefinite lives, analyzing all

relevant factors, including the expected usage of the asset, the

typical life cycle of the asset, and anticipated changes in the market

demand for the products and services the asset helps generate.

After review of the competitive, legal, regulatory, and other factors,

it is our view that these factors do not limit the useful lives of our

spectrum and broadcast licences.

Judgment is also applied in choosing methods for amortizing our

intangible assets and program rights that we believe most

accurately represent the consumption of those assets and are most

representative of the economic substance of the intended use of

the underlying assets.

Finally, we make judgments in determining CGUs and the

allocation of goodwill to CGUs or groups of CGUs for the purpose

of impairment testing.

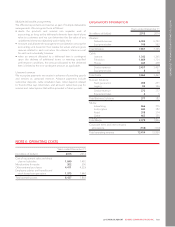

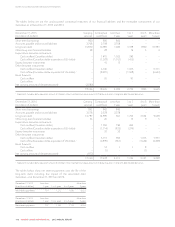

EXPLANATORY INFORMATION

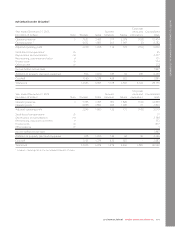

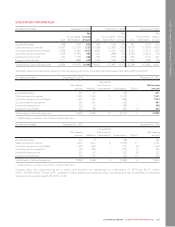

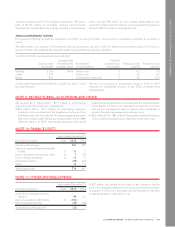

(In millions of dollars) December 31, 2015 December 31, 2014 December 31, 2013

Cost prior to

impairment

losses

Accumulated

amortization

Accumulated

impairment

losses

Net

carrying

amount

Cost prior to

impairment

losses

Accumulated

amortization

Accumulated

impairment

losses

Net

carrying

amount

Cost prior to

impairment

losses

Accumulated

amortization

Accumulated

impairment

losses

Net

carrying

amount

Indefinite-life intangible assets:

Spectrum licences 6,416 – – 6,416 5,576 – – 5,576 2,275 – – 2,275

Broadcast licences 324 – (99) 225 324 – (99) 225 324 – (99) 225

Finite-life intangible assets:

Brand names 420 (270) (14) 136 420 (255) (14) 151 438 (257) (14) 167

Customer relationships 1,609 (1,414) – 195 1,620 (1,339) – 281 1,543 (1,234) – 309

Roaming agreements 523 (488) – 35 523 (444) – 79 523 (400) – 123

Marketing agreements 10 (10) – –10 (10) – – 9 (8) – 1

Acquired program rights 332 (91) (5) 236 343 (62) (5) 276 168 (52) (5) 111

Total intangible assets 9,634 (2,273) (118) 7,243 8,816 (2,110) (118) 6,588 5,280 (1,951) (118) 3,211

Goodwill 4,112 – (221) 3,891 4,104 – (221) 3,883 3,972 – (221) 3,751

Total intangible assets and

goodwill 13,746 (2,273) (339) 11,134 12,920 (2,110) (339) 10,471 9,252 (1,951) (339) 6,962

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 107