Rogers 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

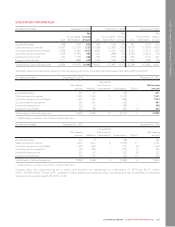

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 12: INCOME TAXES

ACCOUNTING POLICY

Income tax expense includes both current and deferred taxes. We

recognize income tax expense in net income unless it relates to an

item recognized directly in equity or other comprehensive income.

We provide for income taxes based on all of the information that is

currently available.

Current tax expense is tax we expect to pay or receive based on

our taxable income or loss during the year. We calculate the

current tax expense using tax rates enacted or substantively

enacted as at the reporting date, including any adjustment to taxes

payable or receivable related to previous years.

Deferred tax assets and liabilities arise from temporary differences

between the carrying amounts of the assets and liabilities we

recognize on our Consolidated Statements of Financial Position

and their respective tax bases. We calculate deferred tax assets and

liabilities using enacted or substantively enacted tax rates that will

apply in the years in which the temporary differences are expected

to reverse.

Deferred tax assets and liabilities are offset if there is a legally

enforceable right to offset current tax assets and liabilities and they

relate to income taxes levied by the same authority on:

•thesametaxableentity;or

• different taxable entities where these entities intend to settle

current tax assets and liabilities on a net basis or the tax assets

and liabilities will be realized and settled simultaneously.

We recognize a deferred tax asset for unused losses, tax credits,

and deductible temporary differences to the extent it is probable

that future taxable income will be available to use the asset.

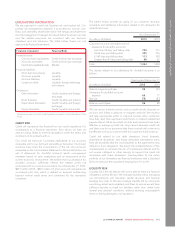

USE OF ESTIMATES AND JUDGMENTS

JUDGMENTS

We make significant judgments in interpreting tax rules and

regulations when we calculate income taxes. We make judgments

to evaluate whether we can recover a deferred tax asset based on

our assessment of existing tax laws, estimates of future profitability,

and tax planning strategies.

EXPLANATORY INFORMATION

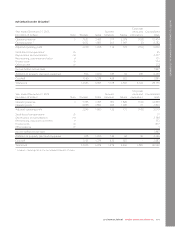

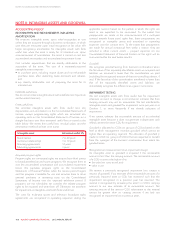

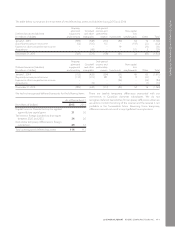

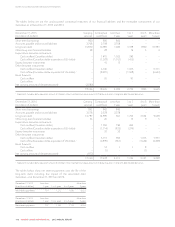

Years ended December 31

(In millions of dollars) 2015 2014

Current tax expense:

For current year 234 497

Adjustments from reassessment –14

Total current taxes 234 511

Deferred tax expense (recovery):

Origination (reversal) of temporary

differences 226 (5)

Revaluation of deferred tax balances

due to legislative changes 6–

Total deferred taxes 232 (5)

Total income taxes 466 506

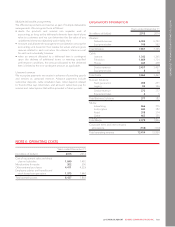

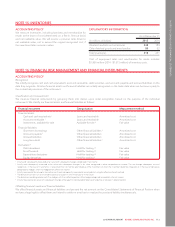

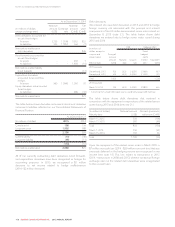

Thetablebelowshowsthedifferencebetweenincometax

expense computed by applying the statutory income tax rate to

income before income taxes and the income tax expense for the

year.

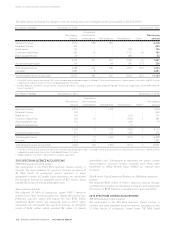

Years ended December 31

(In millions of dollars, except rates) 2015 2014

Statutory income tax rate 26.5% 26.5%

Income before income taxes 1,847 1,847

Computed income tax expense 489 489

Increase (decrease) in income taxes

resulting from:

Non-deductible (non-taxable) stock-

based compensation 5(2)

Revaluation of deferred tax balances

due to legislative changes 6–

Adjustments from reassessments –14

Non-taxablegainonacquisition (27) –

Other (7) 5

Total income taxes 466 506

Effectiveincometaxrate 25.2% 27.4%

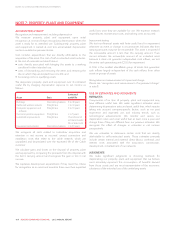

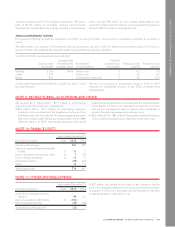

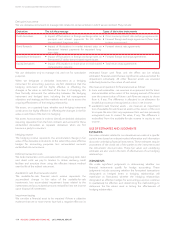

DEFERRED TAX ASSETS AND LIABILITIES

As at December 31

(In millions of dollars) 2015 2014

Deferred tax assets 99

Deferred tax liabilities (1,943) (1,769)

Net deferred tax liability (1,934) (1,760)

110 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT