Rogers 2015 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

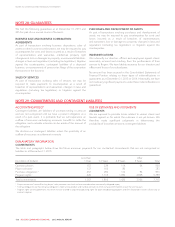

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

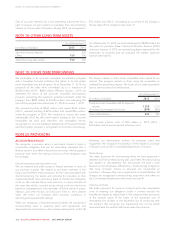

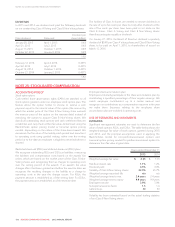

We also provide supplemental unfunded pension benefits to

certain executives. The table below includes our accrued benefit

obligations, pension expense included in employee salaries and

benefits, net interest cost and other comprehensive income.

Years ended December 31

(In millions of dollars) 2015 2014

Accrued benefit obligation, beginning

of year 56 49

Pension expense included in employee

salaries and benefits expense 32

Netinterestcostrecognizedinfinance

costs 22

Remeasurement recognized in other

comprehensive (income) loss (2) 5

Benefits paid (3) (2)

Accrued benefit obligation, end of year 56 56

Certain subsidiaries have defined contribution plans with total

pension expense of $3 million in 2015 (2014 – $2 million), which is

included in employee salaries and benefits expense.

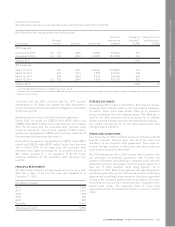

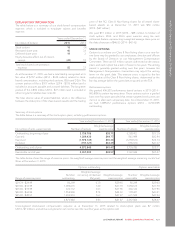

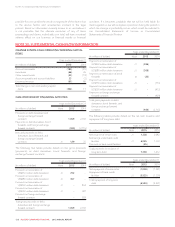

ALLOCATION OF PLAN ASSETS

Allocation of plan assets Target asset

allocation

percentage2015 2014

Equity securities:

Domestic 19.7% 20.3% 10% to 29%

International 41.3% 40.0% 29% to 48%

Debt securities 38.7% 39.4% 38% to 47%

Other – cash 0.3% 0.3% 0% to 2%

Total 100.0% 100.0%

Plan assets consist primarily of pooled funds that invest in common

stocks and bonds. The pooled Canadian equity funds have

investments in our equity securities. As a result, approximately

$3 million (2014 – $3 million) of the plans’ assets are indirectly

invested in our own equity securities.

We make contributions to the plans to secure the benefits of plan

members and invest in permitted investments using the target

ranges established by our Pension Committee, which reviews

actuarial assumptions on an annual basis.

The table below shows the actual contributions to the plans.

Years ended December 31

(In millions of dollars) 2015 2014

Employer contribution 118 106

Employee contribution 32 30

Total contribution 150 136

We estimate our 2016 employer contributions to be $119 million.

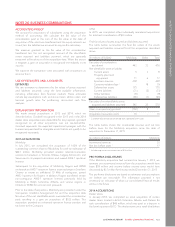

The average duration of the defined benefit obligation as at

December 31, 2015 is 19 years (2014 – 20 years).

Actual return on plan assets was $44 million in 2015

(2014 – $149 million).

We have recognized a cumulative loss in other comprehensive

income and retained earnings of $306 million as at December 31,

2015 (2014 – $324 million).

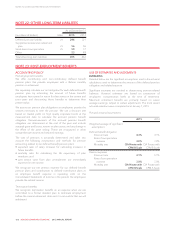

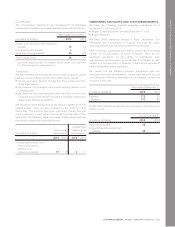

NOTE 24: SHAREHOLDERS’ EQUITY

CAPITAL STOCK

Share class

Number of shares

authorized for issue Features Voting rights

Preferred shares 400 million • Without par value

• Issuable in series, with

rights and terms of each

series to be fixed by our

Board of Directors prior to

the issue of any series

•None

Class A Voting shares 112,474,388 • Without par value

•Each share can be

converted into one

Class B Non-Voting share

• Each share entitled to

50 votes

Class B Non-Voting shares 1.4 billon • Without par value • None

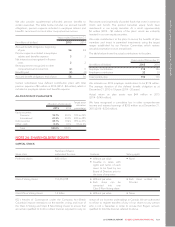

RCI’s Articles of Continuance under the Company Act (British

Columbia) impose restrictions on the transfer, voting and issue of

the Class A Voting and Class B Non-Voting shares to ensure that

we remain qualified to hold or obtain licences required to carry on

certain of our business undertakings in Canada. We are authorized

to refuse to register transfers of any of our shares to any person

who is not a Canadian in order to ensure that Rogers remains

qualifiedtoholdthelicencesreferredtoabove.

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 129