Rogers 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

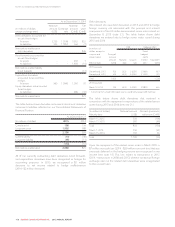

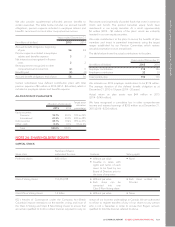

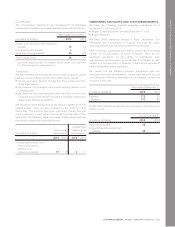

Sensitivity of key assumptions

In the sensitivity analysis shown below, we determine the defined

benefit obligation using the same method used to calculate the

defined benefit obligation we recognize on the Consolidated

Statements of Financial Position. We calculate sensitivity by

changing one assumption while holding the others constant. This

leads to limitations in the analysis as the actual change in defined

benefit obligation will likely be different from that shown in the

table, since it is likely that more than one assumption will change at

a time, and that some assumptions are correlated.

Increase (decrease)

in accrued benefit

obligation

Increase (decrease)

in pension

expense

(In millions of dollars) 2015 2014 2015 2014

Discount rate

Impact of 0.5% increase (146) (141) (18) (15)

Impact of 0.5% decrease 167 162 19 16

Rate of future compensation

increase

Impact of 0.25% increase 18 18 33

Impact of 0.25% decrease (18) (18) (3) (3)

Mortality rate

Impact of 1 year increase 39 35 43

Impact of 1 year decrease (41) (36) (4) (3)

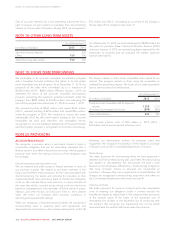

EXPLANATORY INFORMATION

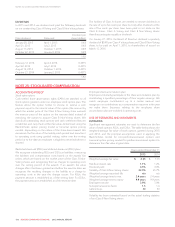

We have contributory and non-contributory defined benefit

pension plans that are made available to most of our employees.

The plans provide pensions based on years of service, years of

contributions, and earnings. We do not provide any non-pension

post-retirement benefits. We also provide unfunded supplemental

pension benefits to certain executives.

We sponsor a number of pension arrangements for employees,

including defined benefit and defined contributions plans. The

Rogers Defined Benefit Plan provides a defined pension based on

years of service and earnings, and with no increases in retirement

for inflation. Participation in the plan is voluntary and enrolled

employees are required to make regular contributions into the

plan. In 2009 and 2011, we purchased group annuities for our then

retirees. Accordingly, the current plan members are primarily active

Rogers employees as opposed to retirees. An unfunded

supplemental pension plan is provided to certain senior executives

to provide benefits in excess of amounts that can be provided from

the defined pension plan under the Canada Income Tax Act’s

maximum pension limits.

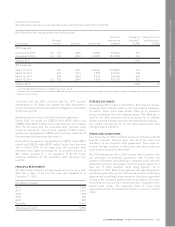

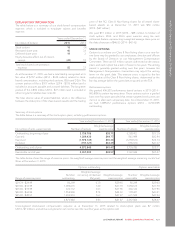

We also sponsor smaller defined benefit pension plans in addition

to the Rogers Defined Benefit Plan. The Pension Plan for

Employees of Rogers Communications Inc. and the Rogers

Pension Plan for Selkirk Employees are legacy closed defined

benefit pension plans. The Pension Plan for Certain Federally

Regulated Employees of Rogers Cable Communications Inc. is

similar to the main pension plan but only federally regulated Cable

business employees are eligible to participate.

In addition to the defined benefit pension plans, we also provide

defined contributions plans to certain unionized New Brunswick

employees, employees of the Toronto Blue Jays and Rogers

Centre, and some US subsidiaries. Additionally, we also provide

other tax-deferred savings arrangements including a Group RRSP

and a Group TFSA program which are accounted for as deferred

contribution arrangements.

The assets of the defined benefit pension plans are held in

segregated accounts isolated from our assets. We administer the

defined benefit pension plans pursuant to applicable regulations,

the Statement of Investment Policies and Procedures and to the

mandateofthePensionCommitteeoftheBoardofDirectors.The

Pension Committee of the Board of Directors oversees our

administration of the defined benefit pension plans, which includes

the following principal areas:

• overseeing the funding, administration, communication and

investment management of the plans;

• selecting and monitoring the performance of all third parties

performing duties in respect of the plans, including audit,

actuarial and investment management services;

• proposing, considering and approving amendments to the

defined benefit pension plans;

• proposing, considering and approving amendments of the

Statement of Investment Policies and Procedures;

• reviewing management and actuarial reports prepared in

respect of the administration of the defined benefit pension

plans; and

• reviewing and approving the audited financial statements of the

defined benefit pension plan funds.

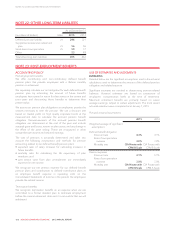

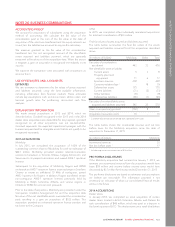

The assets of the defined benefit pension plans are invested and

managed following all applicable regulations and the Statement of

Investment Policies and Procedures with the objective of having

adequate funds to pay the benefits promised by the plan, and

reflect the characteristics and asset mix of each defined benefit

pension plan. Investment and market return risk is managed by:

• contracting professional investment managers to execute the

investment strategy following the Statement of Investment

Policies and Procedures and regulatory requirements;

• specifying the kinds of investments that can be held in the plans

and monitoring compliance;

• using asset allocation and diversification strategies; and

• purchasing annuities from time to time.

The funded pension plans are registered with the Office of the

Superintendent of Financial Institutions and are subject to the

Federal Pension Benefits Standards Act. The plans are also

registered with the Canada Revenue Agency and are subject to the

Canada Income Tax Act. The benefits provided under the plans

and the contributions to the plans are funded and administered in

accordance with all applicable legislation and regulations.

There are risks related to contribution increases, inadequate plan

surplus, unfunded obligations and return risk for the defined

benefit pension plans, which we mitigate through the governance

described above. Any significant changes to these defined benefit

pension plans items may affect our future cash flows.

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 127