Rogers 2015 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

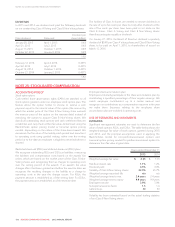

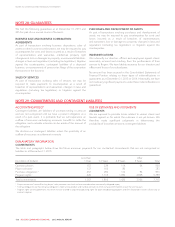

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 26: BUSINESS COMBINATIONS

ACCOUNTING POLICY

We account for acquisitions of subsidiaries using the acquisition

method of accounting. We calculate the fair value of the

consideration paid as the sum of the fair value at the date of

acquisition of the assets we transferred and the equity interests we

issued, less the liabilities we assumed to acquire the subsidiary.

We measure goodwill as the fair value of the consideration

transferred less the net recognized amount of the identifiable

assets acquired and liabilities assumed, which are generally

measured at fair value as of the acquisition date. When the excess

is negative, a gain on acquisition is recognized immediately in net

income.

We expense the transaction costs associated with acquisitions as

we incur them.

USE OF ESTIMATES AND JUDGMENTS

ESTIMATES

We use estimates to determine the fair values of assets acquired

and liabilities assumed, using the best available information,

including information from financial markets. These estimates

include key assumptions such as discount rates, attrition rates, and

terminal growth rates for performing discounted cash flow

analyses.

EXPLANATORY INFORMATION

We made several acquisitions in 2015 and 2014, which we

describe below. Goodwill recognized in the 2015 and in the 2014

dealer store acquisitions was deductible for tax purposes; goodwill

recognized on all other acquisitions was not tax-deductible.

Goodwill represents the expected operational synergies with the

business acquired and/or intangible assets that do not qualify to be

recognized separately.

2015 ACQUISITIONS

Mobilicity

In July 2015, we completed the acquisition of 100% of the

outstanding common shares of Mobilicity for cash consideration of

$443 million. Mobilicity provided wireless telecommunication

services to Canadians in Toronto, Ottawa, Calgary, Edmonton, and

Vancouver to its prepaid subscribers and owned AWS-1 spectrum

licences.

Subsequent to the acquisition of Mobilicity, Rogers and WIND

undertook an AWS-1 spectrum licence asset exchange in Southern

Ontario to create an additional 10 MHz of contiguous, paired

AWS-1 spectrum for Rogers. In addition, Rogers transferred certain

non-contiguous AWS-1 spectrum licences previously held by

Mobilicity in British Columbia, Alberta, and various regions in

OntariotoWINDfornominalcashproceeds.

Prior to the date of acquisition, Mobilicity was protected under the

Companies’ Creditors Arrangement Act and the acquisition date

fair value of the net identifiable assets exceeded the consideration

paid, resulting in a gain on acquisition of $102 million. This

acquisition provided an enhanced spectrum licence position and

tax losses to the Company.

Other

In 2015, we completed other individually immaterial acquisitions

for total cash consideration of $33 million.

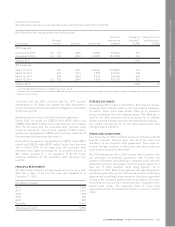

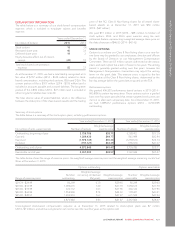

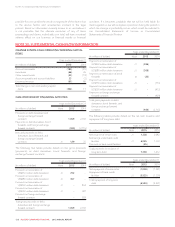

Final fair values of assets acquired and liabilities assumed

The table below summarizes the final fair values of the assets

acquired and liabilities assumed for all the acquisitions described

above.

(In millions of dollars) Mobilicity Other Total

Fair value of consideration

transferred 443 33 476

Net identifiable asset or liability:

Current assets 5 3 8

Property, plant and

equipment 11 6 17

Spectrum licences 458 – 458

Customer relationships 1–1919

Deferred tax assets 175 – 175

Current liabilities (31) (2) (33)

Other liabilities (8) – (8)

Deferred tax liabilities (65) (1) (66)

Fair value of net identifiable assets

acquired and liabilities assumed 545 25 570

(Gain on acquisition) goodwill (102) 8

Acquisition transaction costs 16 – 16

1Customer relationships are amortized over a period of seven years.

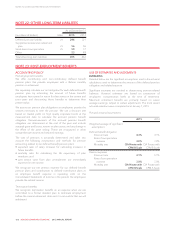

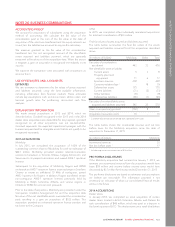

The table below shows the incremental revenue and net loss

before taxes for the Mobilicity acquisition since the date of

acquisition to December 31, 2015.

(In millions of dollars) Mobilicity

Incremental revenue 30

Net loss before taxes 117

1Includes acquisition transaction costs of $16 million.

PRO FORMA DISCLOSURES

If the Mobilicity acquisition had occurred on January 1, 2015, we

estimate our incremental revenue from the acquisition would have

been $59 million and income before income taxes would have

decreased by $17 million for the year ended December 31, 2015.

The pro forma disclosures are based on estimates and assumptions

we believe are reasonable. The information provided is not

necessarily an indication of what our consolidated financial results

will be in the future.

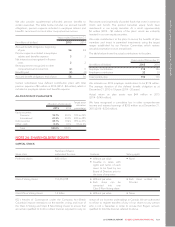

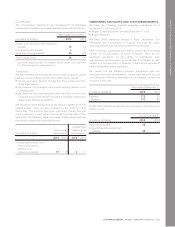

2014 ACQUISITIONS

Dealer stores

In January 2014, we completed an asset acquisition of certain

dealer stores located in British Columbia, Alberta, and Ontario for

cash consideration of $46 million, which was paid as a deposit in

the fourth quarter of 2013. The dealer stores are a retail distribution

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 133