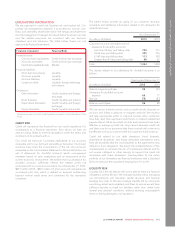

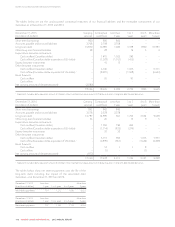

Rogers 2015 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

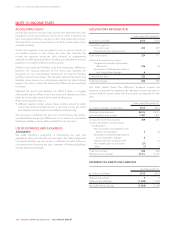

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 15: INVENTORIES

ACCOUNTING POLICY

We measure inventories, including handsets and merchandise for

resale, at the lower of cost (determined on a first-in, first-out basis)

and net realizable value. We will reverse a previous write down to

net realizable value, not to exceed the original recognized cost, if

the inventories later increase in value.

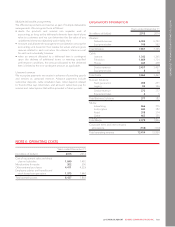

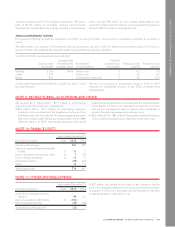

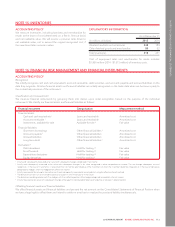

EXPLANATORY INFORMATION

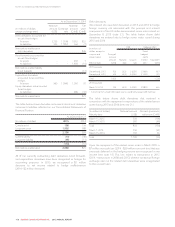

As at December 31

(In millions of dollars) 2015 2014

Wireless handsets and accessories 238 189

Other finished goods and merchandise 80 62

Total inventories 318 251

Cost of equipment sales and merchandise for resale includes

$1,966 million (2014 - $1,615 million) of inventory costs.

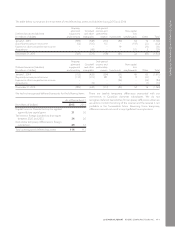

NOTE 16: FINANCIAL RISK MANAGEMENT AND FINANCIAL INSTRUMENTS

ACCOUNTING POLICY

Recognition

We initially recognize cash and cash equivalents, accounts receivable, debt securities, and accounts payable and accrued liabilities on the

date they originate. All other financial assets and financial liabilitiesareinitiallyrecognizedonthetradedatewhenwebecomeapartyto

the contractual provisions of the instrument.

Classification and measurement

We measure financial instruments by grouping them into classes upon initial recognition, based on the purpose of the individual

instruments. We classify our financial assets and financial liabilities as follows:

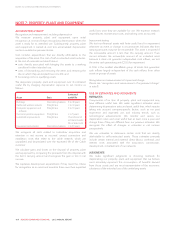

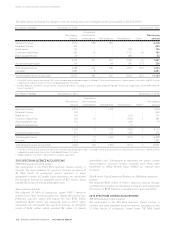

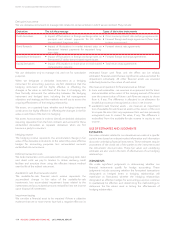

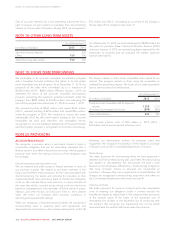

Financial instrument Categorization Measurement method

Financial assets

Cash and cash equivalents 1Loans and receivable Amortized cost

Accounts receivable 1Loans and receivable Amortized cost

Investments, available-for-sale Available-for-sale 2Fair value

Financial liabilities

Short-term borrowings Other financial liabilities 3Amortized cost

Accounts payable 1Other financial liabilities Amortized cost

Accrued liabilities Other financial liabilities Amortized cost

Long-term debt Other financial liabilities 3Amortized cost

Derivatives 4

Debt derivatives Held-for-trading 2,5 Fair value

Bond forwards Held-for-trading 2,5 Fair value

Expenditure derivatives Held-for-trading 2,5 Fair value

Equity derivatives Held-for-trading 6Fair value

1Initially and subsequently measured at fair value with subsequent changes recognized in net income.

2Initially and subsequently measured at fair value with subsequent changes in fair value recognized in other comprehensive income. The net change subsequent to initial

recognition, in the case of investments, is reclassified into net income upon disposal of the investment or when the investment becomes impaired, or in the case of derivatives

designated as hedges, when the hedged item affects net income.

3Initially measured at fair value plus transaction costs and subsequently measured at amortized cost using the effective interest method.

4The derivatives can be in an asset or liability position at a point in time historically or in the future.

5The derivatives are designated as cash flow hedges with the ineffective portion of the hedge recognized immediately into net income.

6Initially measured at fair value with subsequent changes offset against stock-based compensation expense or recovery in operating costs.

Offsetting financial assets and financial liabilities

We offset financial assets and financial liabilities and present the net amount on the Consolidated Statements of Financial Position when

we have a legal right to offset them and intend to settle on a net basis or realize the asset and liability simultaneously.

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 113