Rogers 2015 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

MARKET RISK

Market risk is the risk that changes in market prices, such as

fluctuations in the market prices of our available-for-sale

investments, our share price, foreign exchange rates, and interest

rates, will affect our income, cash flows, or the value of our financial

instruments. The derivative instruments we use to manage this risk

are described in this note.

Market price risk – publicly traded investments

We manage risk related to fluctuations in the market prices of our

investments in publicly traded companies by regularly reviewing

publicly available information related to these investments to

ensure that any risks are within our established levels of risk

tolerance. We do not engage in risk management practices such as

hedging, derivatives, or short selling with respect to our publicly

traded investments.

Market price risk – Rogers Class B shares

Our liability related to stock-based compensation is marked to

market each period. Stock-based compensation expense is

affected by the change in the price of our Class B Non-Voting

shares during the life of an award, including stock options, RSUs,

and DSUs. We use equity derivatives from time to time to manage

our exposure in our stock-based compensation liability. With

respect to our stock-based compensation, as a result of our equity

derivatives, a one dollar change in the price of a Rogers Class B

Non-Voting share would not have a material effect on net income.

Foreign exchange and interest rates

We use debt derivatives to manage risks from fluctuations in

foreign exchange rates associated with our US dollar-denominated

debt instruments, designating the debt derivatives as hedges of

specific debt instruments for accounting purposes. We use

expenditure derivatives to manage the foreign exchange risk in our

operations, designating them as hedges for certain of our

forecasted operational and capital expenditures. As at

December 31, 2015, all of our US dollar-denominated long-term

debt was hedged against fluctuations in foreign exchange rates

using debt derivatives. With respect to our long-term debt, as a

result of our debt derivatives, a one cent change in the Canadian

dollar relative to the US dollar would have no effect on net income.

A portion of our accounts receivable and accounts payable and

accrued liabilities is denominated in US dollars. Due to the short-

term nature of these receivables and payables, they carry no

significant market risk from fluctuations in foreign exchange rates as

at December 31, 2015.

We are exposed to risk of changes in market interest rates due to

the impact this has on interest expense for our short-term

borrowings, bank credit facilities, and our $250 million floating rate

senior unsecured notes. As at December 31, 2015, 90.3% of our

outstanding long-term debt and short-term borrowings was at

fixed interest rates.

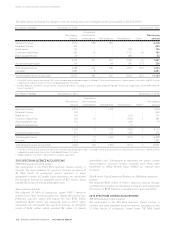

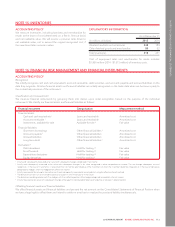

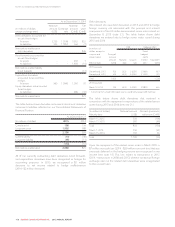

The table below summarizes a sensitivity analysis for significant

exposures with respect to our publicly traded investments, equity

derivatives, expenditure derivatives, and senior notes as at

December 31, 2015 and 2014 with all other variables held

constant. It shows how net income and other comprehensive

income would have been affected by changes in the relevant risk

variables.

Net income

Other

comprehensive

income

(Change in millions of dollars) 2015 2014 2015 2014

Share price of publicly

traded investments

$1 change ––14 14

Expenditure derivatives – change in

foreign exchange rate

$0.01 change in Cdn$ relative

to US$ ––87

Short-term borrowings

1% change in interest rates 66––

Senior notes (floating)

1% change in interest rates 22––

Bank credit facilities (floating)

1% change in interest rates 4–––

DERIVATIVE INSTRUMENTS

As at December 31, 2015, all of our US dollar-denominated long-

term debt instruments were hedged against fluctuations in foreign

exchange rates for accounting purposes.

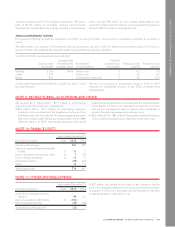

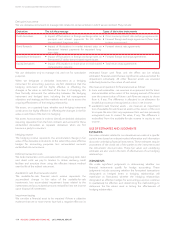

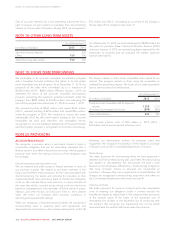

The tables below show our derivatives net asset (liability) position.

As at December 31, 2015

(In millions of dollars, except

exchange rates)

Notional

amount

(US$)

Exchange

rate

Notional

amount

(Cdn$)

Fair

value

(Cdn$)

Debt derivatives accounted for

as cash flow hedges:

As assets 5,900 1.0755 6,345 2,032

As liabilities 300 1.3367 401 (4)

Net mark-to-market asset

debt derivatives 2,028

Bond forwards accounted for

as cash flow hedges:

As liabilities – – 1,400 (91)

Expenditure derivatives

accounted for as cash flow

hedges:

As assets 1,140 1.2410 1,415 158

Equity derivatives not accounted

for as hedges:

As liabilities – – 286 (15)

Net mark-to-market asset 2,080

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 117