Rogers 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

One of our joint ventures has a non-controlling interest that has a

right to require our joint venture to purchase that non-controlling

interest at a future date at fair value. During 2015, we recognized a

$72 million loss (2014 – nil) relating to our share of the change in

the fair value of this obligation (see note 11).

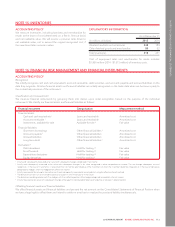

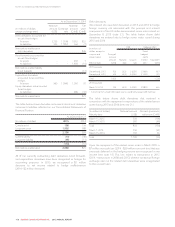

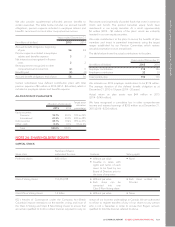

NOTE 18: OTHER LONG-TERM ASSETS

As at December 31

(In millions of dollars) 2015 2014

Spectrum licence deposits –250

Other 150 106

Total other long-term assets 150 356

As at December 31, 2014, we had total deposits of $250 million for

the option to purchase Shaw’s Advanced Wireless Services (AWS)

spectrum licences. In 2015, we received regulatory approval for this

transaction to proceed and we acquired the related spectrum

licences (see note 8).

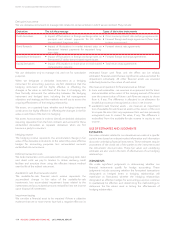

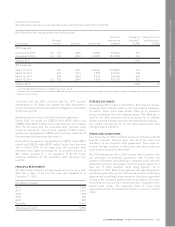

NOTE 19: SHORT-TERM BORROWINGS

We participate in an accounts receivable securitization program

with a Canadian financial institution that allows us to sell certain

trade receivables into the program. As at December 31, 2015, the

proceeds of the sales were committed up to a maximum of

$1,050 million (2014 – $900 million). Effective January 1, 2015, we

amended the terms of the accounts receivable securitization

program, increasing the maximum potential proceeds under the

program from $900 million to $1,050 million and extending the

term of the program from December 31, 2015 to January 1, 2018.

We received funding of $294 million and repaid $336 million

(2014 – received funding of $276 million and repaid $84 million),

under the program in 2015. We continue to service and retain

substantially all of the risks and rewards relating to the accounts

receivables we sold, and therefore, the receivables remain

recognized on our Consolidated Statements of Financial Position

and the funding received is recognized as short-term borrowings.

The buyer’s interest in these trade receivables ranks ahead of our

interest. The program restricts us from using the receivables as

collateral for any other purpose. The buyer of our trade receivables

has no claim on any of our other assets.

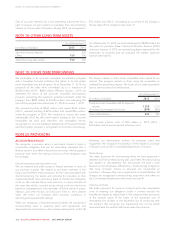

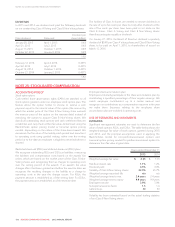

As at December 31

(In millions of dollars) 2015 2014

Trade accounts receivable sold to buyer as

security 1,359 1,135

Short-term borrowings from buyer (800) (842)

Overcollateralization 559 293

We incurred interest costs of $15 million in 2015 (2014 –

$14 million) which we recognized in finance costs.

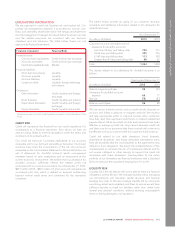

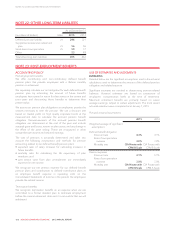

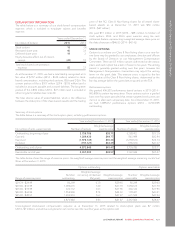

NOTE 20: PROVISIONS

ACCOUNTING POLICY

We recognize a provision when a past event creates a legal or

constructive obligation that can be reasonably estimated and is

likely to result in an outflow of economic resources. We recognize a

provision even when the timing or amount of the obligation may

be uncertain.

Decommissioning and restoration costs

We use network and other assets on leased premises in some of

our business activities. We expect to exit these premises in the

future and therefore make provisions for the costs associated with

decommissioning the assets and restoring the locations to their

original standards when we have a legal or constructive obligation

to do so. We calculate these costs based on a current estimate of

the costs that will be incurred, project those costs into the future

based on management’s best estimates of future trends in prices,

inflation, and other factors, and discount them to their present

value. We revise our forecasts when business conditions or

technological requirements change.

When we recognize a decommissioning liability, we recognize a

corresponding asset in property, plant and equipment and

depreciate the asset based on the corresponding asset’s useful life

following our depreciation policies for property, plant and

equipment. We recognize the accretion of the liability as a charge

to finance costs on the Consolidated Statements of Income.

Restructuring

We make provisions for restructuring when we have approved a

detailed and formal restructuring plan and either the restructuring

has started or management has announced the plan’s main

features to the employees affected by it. Restructuring obligations

that have uncertain timing or amounts are recognized as

provisions; otherwise they are recognized as accrued liabilities. All

charges are recognized in restructuring, acquisition and other on

the Consolidated Statements of Income (see note 9).

Onerous contracts

We make provisions for onerous contracts when the unavoidable

costs of meeting our obligation under a contract exceed the

benefits we expect to realize from it. We measure these provisions

atthepresentvalueoftheloweroftheexpectedcostof

terminating the contract or the expected cost of continuing with

the contract. We recognize any impairment loss on the assets

associatedwiththecontractbeforewemaketheprovision.

122 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT