Rogers 2015 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

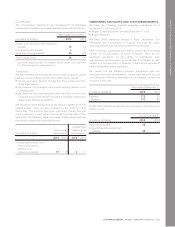

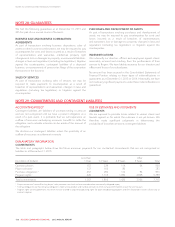

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

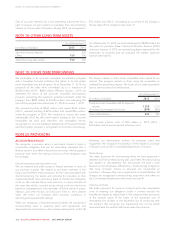

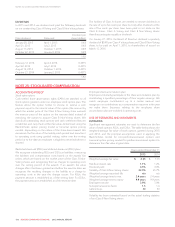

DIVIDENDS

In 2015 and 2014, we declared and paid the following dividends

on our outstanding Class A Voting and Class B Non-Voting shares:

Date declared Date paid

Dividend per

share (dollars)

January 28, 2015 April 1, 2015 0.48

April 21, 2015 July 2, 2015 0.48

August 13, 2015 October 1, 2015 0.48

October 22, 2015 January 4, 2016 0.48

1.92

February 12. 2014 April 4, 2014 0.4575

April 22, 2014 July 2, 2014 0.4575

August 14, 2014 October 1, 2014 0.4575

October 23, 2014 January 2, 2015 0.4575

1.83

The holders of Class A shares are entitled to receive dividends at

the rate of up to five cents per share but only after dividends at the

rate of five cents per share have been paid or set aside on the

Class B shares. Class A Voting and Class B Non-Voting shares

therefore participate equally in dividends.

On January 27, 2016, the Board of Directors declared a quarterly

dividend of $0.48 per Class A Voting share and Class B Non-Voting

share, to be paid on April 1, 2016, to shareholders of record on

March 13, 2016.

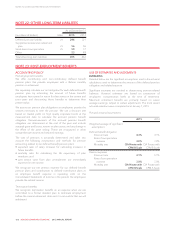

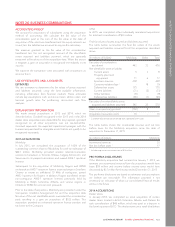

NOTE 25: STOCK-BASED COMPENSATION

ACCOUNTING POLICY

Stock option plans

Cash-settled share appreciation rights (SARs) are attached to all

stock options granted under our employee stock option plan. This

feature allows the option holder to choose to receive a cash

payment equal to the intrinsic value of the option (the amount by

which the market price of the Class B Non-Voting share exceeds

the exercise price of the option on the exercise date) instead of

exercising the option to acquire Class B Non-Voting shares. We

classify all outstanding stock options with cash settlement features

as liabilities and carry them at their fair value, determined using the

Black-Scholes option pricing model or trinomial option pricing

models, depending on the nature of the share-based award. We

remeasure the fair value of the liability each period and amortize it

to operating costs using graded vesting, either over the vesting

periodortothedateanemployeeiseligibletoretire(whicheveris

shorter).

Restricted share unit (RSU) and deferred share unit (DSU) plans

We recognize outstanding RSUs and DSUs as liabilities, measuring

the liabilities and compensation costs based on the awards’ fair

values, which are based on the market price of the Class B Non-

Voting shares, and recognizing them as charges to operating costs

over the vesting period of the awards. If an award’s fair value

changes after it has been granted and before the exercise date, we

recognize the resulting changes in the liability as a charge to

operating costs in the year the change occurs. For RSUs, the

payment amount is established as of the vesting date. For DSUs,

the payment amount is established as of the exercise date.

Employee share accumulation plan

Employees voluntarily participate in the share accumulation plan by

contributing a specified percentage of their regular earnings. We

match employee contributions up to a certain amount and

recognize our contributions as a compensation expense in the year

we make them. Expenses relating to the employee share

accumulation plan are included in operating costs.

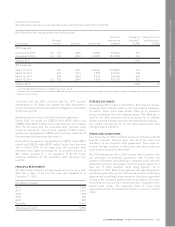

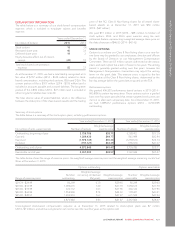

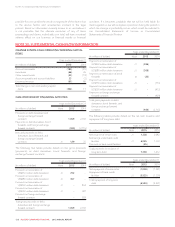

USE OF ESTIMATES AND JUDGMENTS

ESTIMATES

Significant management estimates are used to determine the fair

value of stock options, RSUs, and DSUs. The table below shows the

weighted-average fair value of stock options granted during 2015

and 2014, and the principal assumptions used in applying the

Black-Scholes model for non-performance-based options and

trinomial option pricing models for performance-based options to

determine their fair value at grant date:

Years ended December 31

2015 2014

Weighted average fair value $4.65$7.35

Risk-free interest rate 1.1% 1.2%

Dividend yield 4.5% 4.0%

Volatility of Class B Non-Voting shares 22.0% 25.7%

Weighted average expected life n/a n/a

Weighted average time to vest 2.4 years 2.4 years

Weighted average time to expiry 9.9 years 9.9 years

Employee exit rate 3.9% 3.9%

Suboptimal exercise factor 1.5 1.6

Lattice steps 50 50

Volatility has been estimated based on the actual trading statistics

of our Class B Non-Voting shares.

130 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT