Rogers 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’S DISCUSSION AND ANALYSIS

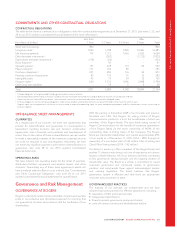

CREDIT RATINGS

Credit ratings provide an independent measure of credit quality of

an issuer of securities and can affect our ability to obtain short- and

long-term financing and the terms of the financing. If rating

agencies lower the credit ratings on our debt, particularly a

downgrade below investment grade, it could adversely affect our

cost of financing and access to liquidity and capital.

INCOME TAXES AND OTHER TAXES

We collect, pay, and accrue significant amounts of income and

other taxes such as federal and provincial sales, employment, and

property taxes.

We have recorded significant amounts of deferred income tax

liabilities and current income tax expense, and calculated these

amounts based on substantively enacted income tax rates in effect

at the relevant time. A legislative change in these rates could have a

material effect on the amounts recorded and payable in the future.

We provide for income and indirect taxes based on all currently

available information and believe that we have adequately

provided for these items. The calculation of applicable taxes in

many cases, however, requires significant judgment in interpreting

tax rules and regulations. Our tax filings are subject to audits, which

could materially change the amount of current and deferred

income tax assets, liabilities, and provisions, and could, in certain

circumstances, result in the assessment of interest and penalties.

While we believe we have paid and provided for adequate

amounts of tax, our business is complex and significant judgment is

required in interpreting how tax legislation and regulations apply to

us.

LITIGATION RISKS

SYSTEM ACCESS FEE – SASKATCHEWAN

In 2004, a class action was commenced against providers of

wireless communications in Canada under the Class Actions Act

(Saskatchewan). The class action relates to the system access fee

wireless carriers charge to some of their customers. The plaintiffs

are seeking unspecified damages and punitive damages, which

would effectively be a reimbursement of all system access fees

collected.

In 2007, the Saskatchewan Court granted the plaintiffs’ application

to have the proceeding certified as a national, “opt-in” class action

where affected customers outside Saskatchewan must take specific

steps to participate in the proceeding. In 2008, our motion to stay

the proceeding based on the arbitration clause in our wireless

service agreements was granted. The Saskatchewan Court directed

that its order, in respect of the certification of the action, would

exclude customers who are bound by an arbitration clause from

the class of plaintiffs.

In 2009, counsel for the plaintiffs began a second proceeding

under the Class Actions Act (Saskatchewan) asserting the same

claims as the original proceeding. If successful, this second class

action would be an “opt-out” class proceeding. This second

proceeding was ordered conditionally stayed in 2009 on the basis

that it was an abuse of process.

In 2013, the plaintiffs applied for an order to be allowed to proceed

with the second system access fee class action. However, the court

denied this application and the second action remains

conditionally stayed.

At the time the Saskatchewan class action was commenced in

2004, corresponding claims were filed in multiple jurisdictions

across Canada, although no active steps were taken by the

plaintiffs. In 2014, the Nova Scotia Supreme Court declined to stay

or dismiss the corresponding claim brought by the plaintiffs in

Nova Scotia as an abuse of process. In April 2015, the Nova Scotia

Court of Appeal permanently stayed the Nova Scotia claim. The

plaintiffs are seeking leave to appeal to the Supreme Court of

Canada. The Manitoba Court of Queen’s Bench unconditionally

stayed the corresponding claim brought in Manitoba as an abuse

of process. A decision from the Manitoba Court of Appeal is

pending. A similar decision has been issued by the British

Columbia Court of Appeal. In 2015, the Court of Queen’s Bench of

Alberta declined to dismiss the corresponding claim in Alberta. In

October 2015, the Alberta Court of Appeal granted our appeal

and dismissed the claim in Alberta. We have not recognized a

liability for this contingency.

SYSTEM ACCESS FEE – BRITISH COLUMBIA

In December 2011, a class action was launched in British Columbia

against providers of wireless communications in Canada in

response to the system access fee wireless carriers charge to some

of their customers. The class action related to allegations of

misrepresentations contrary to the Business Practices and

Consumer Protection Act (British Columbia), among other things.

The plaintiffs sought unspecified damages and restitution. In June

2014, the court denied the plaintiffs’ certification application,

concluding that there is nothing in the term “system access fee” to

suggest it is a fee to be remitted to the government. An appeal by

the plaintiffs was dismissed by the British Columbia Court of

Appeal in 2015, finding that the conclusion of the trial judge was

unassailable. The plaintiffs are seeking leave to appeal to the

Supreme Court of Canada. We have not recognized a liability for

this contingency.

911 FEE

In June 2008, a class action was launched in Saskatchewan against

providers of wireless communications services in Canada. It involves

allegations of breach of contract, misrepresentation, and false

advertising, among other things, in relation to the 911 fee that had

been charged by us and the other wireless telecommunication

providers in Canada. The plaintiffs are seeking unspecified

damages and restitution. The plaintiffs intend to seek an order

certifying the proceeding as a national class action in

Saskatchewan. We have not recognized a liability for this

contingency.

CELLULAR DEVICES

In July 2013, a class action was launched in British Columbia against

providers of wireless communications in Canada and

manufacturers of wireless devices. The class action relates to the

alleged adverse health effects incurred by long-term users of

cellular devices. The plaintiffs are seeking unspecified damages

74 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT