Rogers 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FINANCIAL RISK MANAGEMENT

We use derivative instruments from time to time to manage risks related to our business activities, summarized as follows:

Derivative The risk they manage Types of derivative instruments

Debt derivatives • Impact of fluctuations in foreign exchange rates

on principal and interest payments for US dollar-

denominated long-term debt

• Cross-currency interest rate exchange

agreements

• Forward foreign exchange agreements

(from time to time as necessary)

Bond forwards • Impact of fluctuations in market interest rates on

forecasted interest payments for expected long-

term debt

• Forward interest rate agreements

Expenditure derivatives • Impact of fluctuations in foreign exchange rates on

forecasted US dollar-denominated expenditures

• Forward foreign exchange agreements

Equity derivatives • Impact of fluctuations in share price on stock-

based compensation expense

• Total return swap agreements

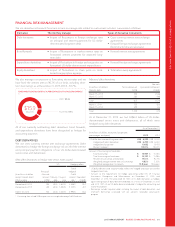

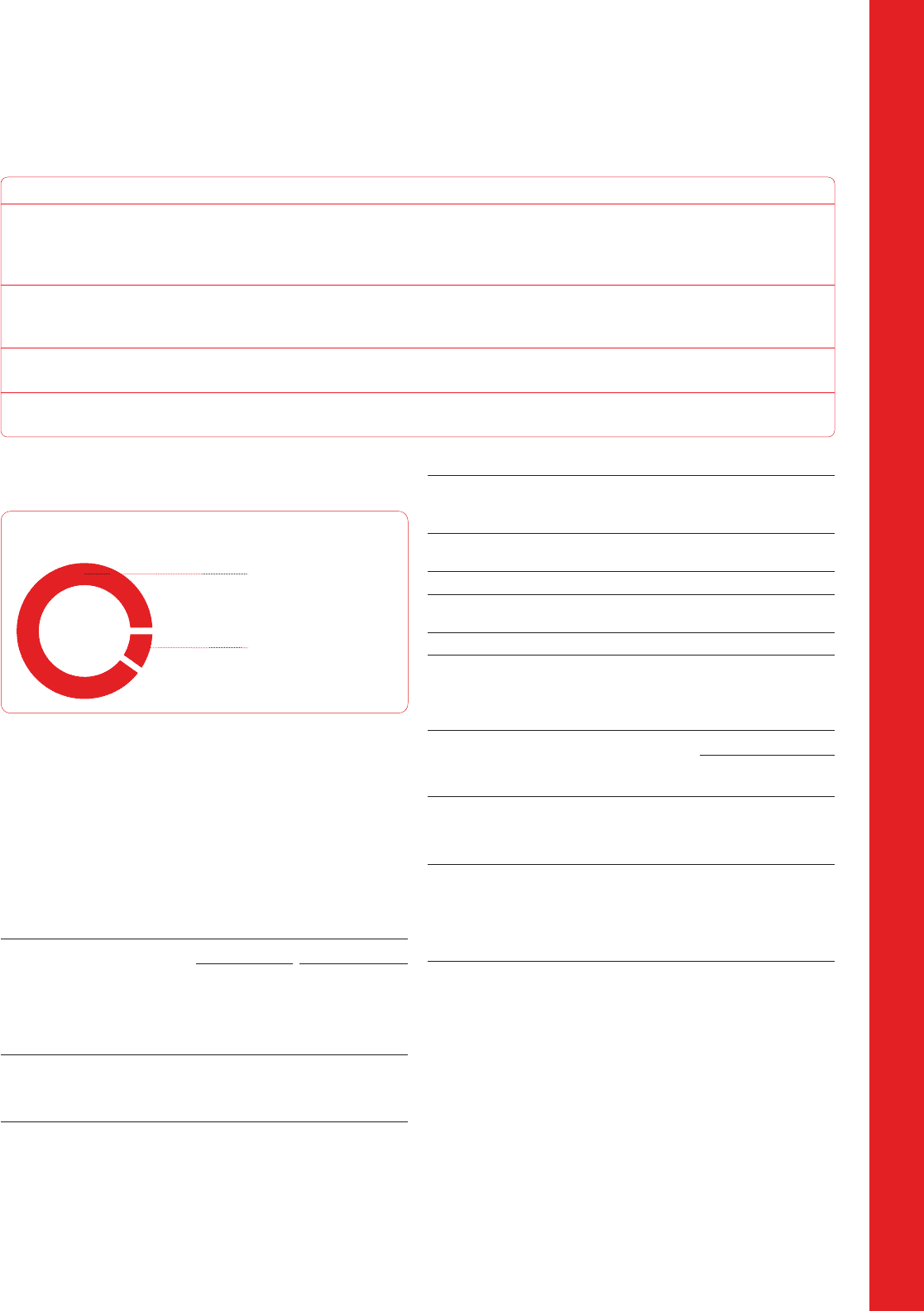

We also manage our exposure to fluctuating interest rates and we

have fixed the interest rate on 90.3% of our debt, including short-

term borrowings, as at December 31, 2015 (2014 – 92.7%).

(%)

FIXED AND FLOATING DEBT AS A PERCENTAGE OF TOTAL BORROWINGS

FIXED 90.3%

FLOATING 9.7%

$15.9

BILLION

All of our currently outstanding debt derivatives, bond forwards,

and expenditure derivatives have been designated as hedges for

accounting purposes.

DEBT DERIVATIVES

We use cross-currency interest rate exchange agreements (debt

derivatives) to hedge the foreign exchange risk on all of the interest

and principal payment obligations of our US dollar-denominated

senior notes and debentures.

New debt derivatives to hedge new senior notes issued

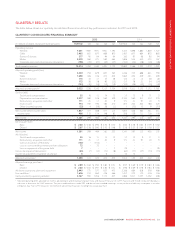

US Hedging effect

(In millions of dollars,

except interest rates)

Effective date

Principal/

Notional

amount

(US$)

Maturity

date

Coupon

rate

Fixed

hedged

Cdn$

interest

rate 1

Equivalent

(Cdn$)

December 8, 2015 700 2025 3.625% 3.566% 937

December 8, 2015 300 2044 5.000% 5.145% 401

March 10, 2014 750 2044 5.000% 4.990% 832

1Converting from a fixed US$ coupon rate to a weighted average Cdn$ fixed rate.

Matured debt derivatives

(In millions of dollars)

Maturity date

Notional amount

(US$)

Net cash

(proceeds) settlement

(Cdn$)

March 15, 2015 550 (106)

March 15, 2015 280 (48)

Total 830 (154)

March 1, 2014 750 (61)

March 15, 2014 350 26

Total 1,100 (35)

As at December 31, 2015, we had US$6.2 billion of US dollar-

denominated senior notes and debentures, all of which were

hedged using debt derivatives.

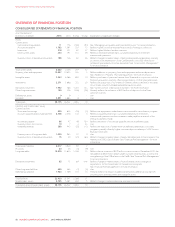

As at December 31

(In millions of dollars, except exchange rates,

percentages, and years) 2015 2014

US dollar-denominated long-term debt 1US$ 6,200 US$ 6,030

Hedged with debt derivatives US$ 6,200 US$ 6,030

Hedged exchange rate 1.0882 1.0470

Percent hedged 2100.0% 100.0%

Amount of borrowings at fixed rates 3

Total borrowings $ 15,947 $ 15,055

Total borrowings at fixed rates $ 14,397 $ 13,963

Percent of borrowings at fixed rates 90.3% 92.7%

Weighted average interest rate on borrowings 4.82% 5.20%

Weighted average term to maturity 10.8 years 10.8 years

1US dollar-denominated long-term debt reflects the hedged exchange rate and the

hedged interest rate.

2Pursuant to the requirements for hedge accounting under IAS 39, Financial

Instruments: Recognition and Measurement, on December 31, 2015, and

December 31, 2014, RCI accounted for 100% of its debt derivatives as hedges

against designated US dollar-denominated debt. As a result, on December 31, 2015

and 2014, 100% of our US dollar-denominated debt is hedged for accounting and

economic purposes.

3Borrowings include long-term debt, including the impact of debt derivatives, and

short-term borrowings associated with our accounts receivable securitization

program.

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 61