Rogers 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

REVIEW OF CONSOLIDATED PERFORMANCE

This section discusses our consolidated operating income, net

income, and other expenses that do not form part of the segment

discussions above.

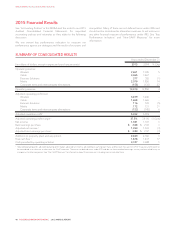

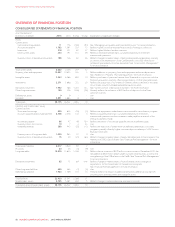

Years ended December 31

(In millions of dollars) 2015 2014 % Chg

Adjusted operating profit 15,032 5,019 –

Deduct (add):

Stock-based compensation 55 37 49

Depreciation and amortization 2,277 2,144 6

Restructuring, acquisition and

other 111 173 (36)

Finance costs 774 817 (5)

Other (income) expense (32) 1n/m

Income taxes 466 506 (8)

Net income 1,381 1,341 3

1Adjusted operating profit is a non-GAAP measure and should not be considered as a

substitute or alternative for GAAP measures. It is not a defined term under IFRS and

does not have a standard meaning, so may not be a reliable way to compare us to

other companies. See “Non-GAAP Measures” for information about this measure,

including how we calculate it.

ADJUSTED OPERATING PROFIT

Please see “Key Changes in Financial Results This Year Compared

to 2014” for a discussion of the increase in adjusted operating

profit this year.

STOCK-BASED COMPENSATION

Our stock-based compensation, which includes stock options (with

stock appreciation rights), restricted share units, and deferred share

units, is generally determined by:

• the vesting of stock options and share units; and

• changes in the market price of RCI Class B shares; offset by

• the impact of certain derivative instruments to hedge a portion of

the stock price appreciation risk for our stock-based

compensation program. See “Financial Risk Management” for

information about equity derivatives.

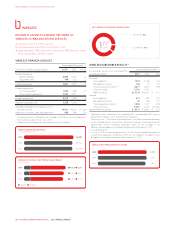

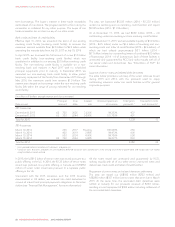

Years ended December 31

(In millions of dollars) 2015 2014

Impact of vesting 57 44

Impact of change in price 20 (17)

Equity derivatives, net of interest

receipt (22) 10

Total stock-based compensation 55 37

Stock-based compensation increased to $55 million in 2015 (2014

- $37 million) primarily as a result of the vesting of additional stock-

based compensation to employees, directors, and key executives.

We had a liability of $157 million as at December 31, 2015 (2014 –

$144 million) related to stock-based compensation recorded at its

fair value, including stock options, restricted share units, and

deferred share units.

We paid $73 million in 2015 (2014 – $48 million) to holders of

stock options, restricted share units, and deferred share units upon

exercise.

DEPRECIATION AND AMORTIZATION

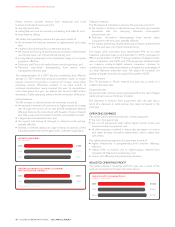

Years ended December 31

(In millions of dollars) 2015 2014 % Chg

Depreciation 2,117 1,979 7

Amortization 160 165 (3)

Total depreciation and amortization 2,277 2,144 6

Depreciation and amortization increased this year primarily as a

result of:

• the overall increase in additions to property, plant and

equipment over the last several years, which has resulted in more

depreciable assets;

• the availability for use of certain network and system investments,

including the launch and expansion of our LTE network in various

municipalities; and

• significant investment in, and rollout of, new customer

equipment at Cable in recent years, mostly in next generation

NextBox digital TV set-top boxes which are depreciated over

three years.

RESTRUCTURING, ACQUISITION AND OTHER

Restructuring, acquisition and other included:

• $75 million (2014 – $131 million) of restructuring expenses.

Expenses this year primarily reflect severance costs associated

with the targeted restructuring of our employee base and the

write-off of certain programming rights that are no longer usable

following a reorganization of the OMNI television stations. In

2014, restructuring expenses related to the reorganization

associated with the implementation of the Rogers 3.0

reorganization plan; and

• $36 million (2014 – $42 million) of acquisition-related transaction

costs, contract termination costs, and other costs.

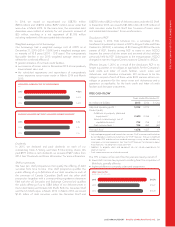

FINANCE COSTS

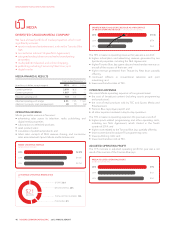

Years ended December 31

(In millions of dollars) 2015 2014 % Chg

Interest on borrowings 1761 782 (3)

Interest on post-employment

benefits liability 11 757

Loss on repayment of long-term

debt 729 (76)

Loss on foreign exchange 11 11 –

Capitalized interest (29) (26) 12

Other 13 14 (7)

Total finance costs 774 817 (5)

1Borrowings include long-term debt and short-term borrowings associated with our

accounts receivable securitization program.

Interest on borrowings

The decrease in interest on borrowings this year was a result of a

decrease in the weighted average interest rate on our outstanding

debt, partially offset by an increase in our outstanding debt. As at

December 31, 2015, our borrowings had a weighted average cost

of 4.82% (2014 – 5.20%) and a weighted average term to maturity

of 10.8 years (2014 – 10.8 years).

50 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT