Rogers 2015 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Issuance of senior notes

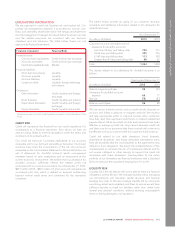

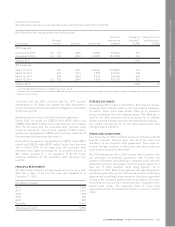

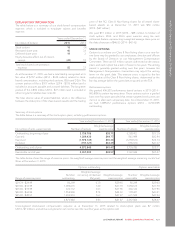

The table below provides a summary of the senior notes that we issued in 2015 and 2014.

(In millions of dollars, except interest rates and discounts)

Date Issued

Principal

amount Due date Interest rate

Discount/

premium at

issuance

Total gross

proceeds 1

(Cdn$)

Transaction costs

and discounts 2

(Cdn$)

2015 issuances

December 8, 2015 US 700 2025 3.625% 99.252% 937

December 8, 2015 US 300 2044 5.000% 101.700% 401

Total for 2015 1,338 13

2014 issuances

March 10, 2014 250 2017 Floating 100.000% 250

March 10, 2014 400 2019 2.80% 99.972% 400

March 10, 2014 600 2024 4.00% 99.706% 600

March 10, 2014 US 750 2044 5.00% 99.231% 832

Total for 2014 2,082 24

1Gross proceeds before transaction costs and discounts (see note 30).

2Transaction costs and discounts are included as deferred transaction costs and discounts in the carrying value of the long-term debt, and recognized in net income using the

effective interest method.

Concurrent with the 2015 issuances and the 2014 issuance

denominated in US dollars, we entered into debt derivatives to

convert all interest and principal payment obligations to Canadian

dollars (see note 16).

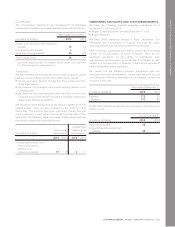

Repayment of senior notes and related derivative settlements

During 2015, we repaid our US$550 million ($702 million) and

US$280 million ($357 million) senior notes that were due in March

2015. At the same time, the associated debt derivatives were

settled at maturity for net proceeds received of $154 million,

resulting in a net repayment of $905 million including settlement of

the associated debt derivatives (see note 16).

During 2014, we repaid or repurchased our US$750 million ($834

million) and US$350 million ($387 million) senior notes that were

due in March 2014. At the same time, the associated debt

derivatives were settled at maturity for net proceeds received of

$35 million, resulting in a net repayment of $1,186 million

including settlement of the associated debt derivatives (see

note 16).

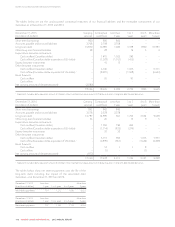

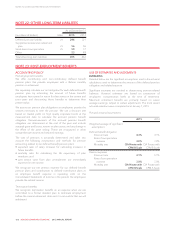

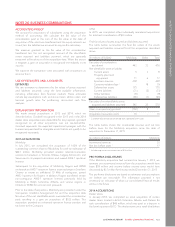

PRINCIPAL REPAYMENTS

The table below shows the principal repayments on our long-term

debt due in each of the next five years and thereafter as at

December 31, 2015.

(In millions of dollars)

2016 1,000

2017 1,250

2018 1,938

2019 900

2020 900

Thereafter 10,993

Total long-term debt 16,981

FOREIGN EXCHANGE

We recognized $11 million in 2015 (2014 – $11 million) in foreign

exchange losses in finance costs on the Consolidated Statements

of Income. These losses were entirely offset by an equivalent

amount reclassified from the hedging reserve. The offset was a

result of the debt derivatives being accounted for as effective

hedges against the foreign exchange risk related to the principal

and interest components of our US dollar-denominated debt

throughout 2015 and 2014.

TERMS AND CONDITIONS

As at December 31, 2015 and 2014, we were in compliance with all

financial covenants, financial ratios, and all of the terms and

conditions of our long-term debt agreements. There were no

financial leverage covenants in effect other than those under our

bank credit and letter of credit facilities.

The 8.75% debentures due in 2032 contain debt incurrence tests

and restrictions on additional investments, sales of assets, and

payment of dividends, all of which are suspended in the event the

public debt securities are assigned investment grade ratings by at

least two of three specified credit rating agencies. As at

December 31, 2015, these public debt securities were assigned an

investment grade rating by each of the three specified credit rating

agencies and, accordingly, these restrictions have been suspended

as long as the investment grade ratings are maintained. Our other

senior notes do not have any of these restrictions, regardless of the

related credit ratings. The repayment dates of certain debt

agreements can also be accelerated if there is a change in control

of RCI.

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 125