Rogers 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OPERATING EXPENSES

We assess operating expenses in two categories:

• the cost of wireless handsets and equipment; and

• all other expenses involved in day-to-day operations, to service

existing subscriber relationships, and to attract new subscribers.

The 24% increase in the cost of equipment sales this year was a

result of:

• a shift in the product mix of device sales and upgrades towards

higher-cost smartphones; and

• increased equipment sales volumes as discussed above, the

majority of which were higher-cost smartphones.

Total customer retention spending (primarily consisting of

subsidies on handset upgrades) increased by 12% this year as a

result of:

• increased device upgrades by existing subscribers due in part to

the industry’s double cohort, as discussed above; and

• increased subsidy rates provided on higher-cost smartphones;

partially offset by

• improvements in our sales channels resulting in lower

commissions.

Other operating expenses (excluding retention spending)

increased this year as a result of higher service costs and

incremental expenses resulting from our acquisition of Mobilicity,

partially offset by efficiency gains and improvements in cost

management.

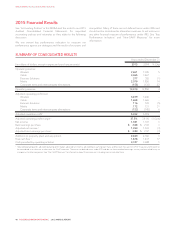

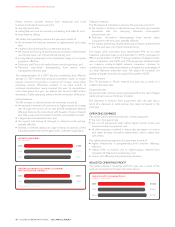

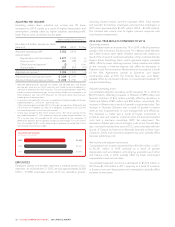

ADJUSTED OPERATING PROFIT

The marginal decrease in adjusted operating profit this year was a

result of higher operating revenue, partially offset by higher

operating expenses, as discussed above.

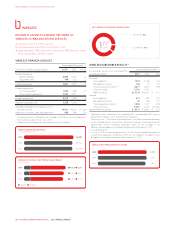

(IN MILLIONS OF DOLLARS)

WIRELESS ADJUSTED OPERATING PROFIT

2015

2014

2013

$3,239

$3,246

$3,157

(%)

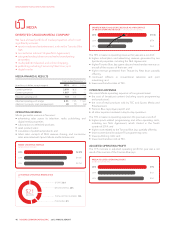

LTE COVERAGE AS A PERCENTAGE OF THE CANADIAN POPULATION

2015

2014

2013

93%

84%

75%

OTHER DEVELOPMENTS

Investment in Glentel

In May 2015, we completed our purchase of 50% of the common

shares of Glentel from BCE for cash consideration of $473 million.

Glentel is now jointly owned with BCE. Glentel is a large multicarrier

of wireless and wireline products and services with several hundred

Canadian wireless retail distribution outlets, as well as operations in

the US and Australia. Our investment in Glentel is accounted for as

a joint venture using the equity method.

Acquisition of Mobilicity

In July 2015, we completed the acquisition of 100% of the

outstanding common shares of Mobilicity for cash consideration of

$443 million. On acquisition, Mobilicity provided wireless

telecommunication services in Toronto, Ottawa, Calgary,

Edmonton, and Vancouver to its 154,000 prepaid subscribers and

owned AWS-1 spectrum licences.

Subsequent to the acquisition of Mobilicity, Rogers and WIND

undertook an AWS-1 spectrum licence asset exchange in Southern

Ontario to create an additional 10 MHz of contiguous, paired

AWS-1 spectrum for Rogers. In addition, Rogers transferred certain

non-contiguous AWS-1 spectrum licences to WIND in British

Columbia, Alberta, and various regions in Ontario for nominal cash

proceeds.

Spectrum licences

In April 2015, we participated in the 2500 MHz spectrum licence

auction in Canada. We were awarded 41 spectrum licences

consisting of 20 MHz blocks of contiguous, paired spectrum in

Canada’s major geographic markets. We paid to ISED Canada and

capitalized a total of $27 million for the licences, which included $3

million of costs directly attributable to the acquisition of the

spectrum licences.

In June 2015, we obtained AWS-1 spectrum licences from Shaw

after exercising a previously acquired option and paying the final

$100 million installment. We recognized the spectrum licences as

intangible assets of $352 million, which included $2 million of

directly attributable costs. The spectrum licences provide us with

more contiguous spectrum in British Columbia and Alberta.

Subsequent to exercising the option, other non-contiguous

spectrum acquired from Shaw was transferred to WIND.

44 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT