Rogers 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

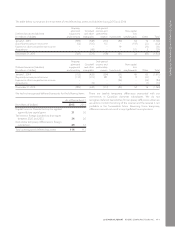

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

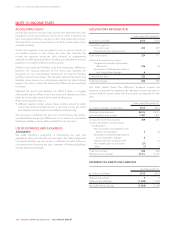

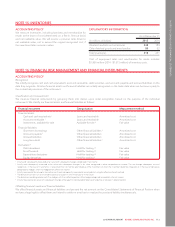

NOTE 13: EARNINGS PER SHARE

ACCOUNTING POLICY

We calculate basic earnings per share by dividing the net income

or loss attributable to our Class A and Class B shareholders by the

weighted average number of Class A and Class B shares

outstanding during the year.

We calculate diluted earnings per share by adjusting the net

income or loss attributable to Class A and Class B shareholders and

the weighted average number of Class A and Class B shares

outstanding for the effect of all dilutive potential common shares.

We use the treasury stock method for calculating diluted earnings

per share, which considers the impact of employee stock options

and other potentially dilutive instruments.

Options with tandem stock appreciation rights or cash payment

alternatives are accounted for as cash-settled awards. As these

awards can be exchanged for common shares of the Company,

they are considered potentially dilutive and are included in the

calculation of the Company’s diluted net earnings per share if they

have a dilutive impact in the period.

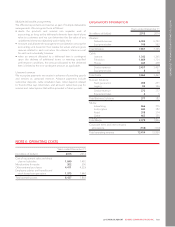

EXPLANATORY INFORMATION

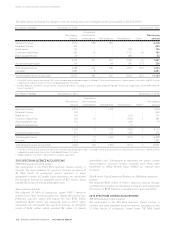

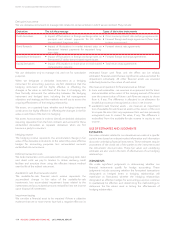

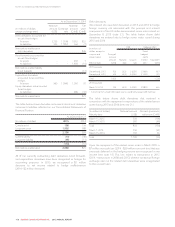

Years ended December 31

(In millions of dollars, except per share

amounts)

2015 2014

Numerator (basic) – Net income for

the year 1,381 1,341

Denominator – Number of shares (in

millions):

Weighted average number of

shares outstanding – basic 515 515

Effect of dilutive securities (in millions):

Employee stock options and

restricted share units 22

Weighted average number of shares

outstanding – diluted 517 517

Earnings per share:

Basic $2.68 $2.60

Diluted $2.67 $2.56

In 2014, the accounting for stock-based compensation using the

equity-settled method was determined to be more dilutive than

using the cash-settled method. As a result, net income for 2014

was reduced by $15 million in the diluted earnings per share

calculation to account for these awards as if they were equity-

settled. There was no such impact in 2015.

A total of 1,107,344 options were out of the money for 2015

(2014 – 1,257,117). These options were excluded from the

calculation of the effect of dilutive securities because they were

anti-dilutive.

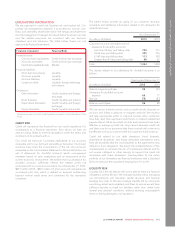

NOTE 14: ACCOUNTS RECEIVABLE

ACCOUNTING POLICY

We initially recognize accounts receivable on the date they

originate. We measure accounts receivable initially at fair value, and

subsequently at amortized cost, with changes recognized in net

income. We measure an impairment loss for accounts receivable as

the excess of the carrying amount over the present value of future

cash flows we expect to derive from it, if any. The difference is

allocated to an allowance for doubtful accounts and recognized as

alossinnetincome.

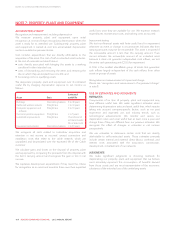

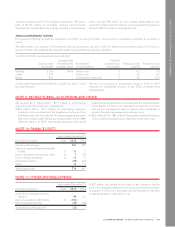

EXPLANATORY INFORMATION

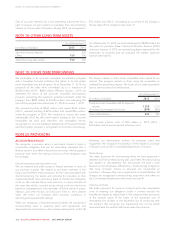

As at December 31

(In millions of dollars) 2015 2014

Customer accounts receivable 1,329 1,307

Other accounts receivable 549 382

Allowance for doubtful accounts (86) (98)

Total accounts receivable 1,792 1,591

112 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT