Rogers 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

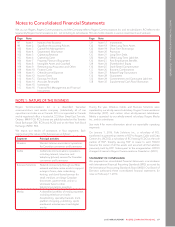

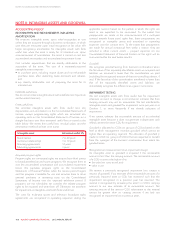

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

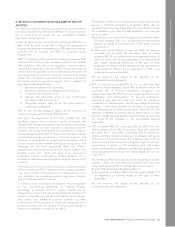

• Amendments to IAS 16, Property, Plant and Equipment and

IAS 38, Intangible Assets – In May 2014, the IASB issued

amendments to these standards to introduce a rebuttable

presumption that the use of revenue-based amortization

methods for intangible assets is inappropriate. The amendment

is effective prospectively for annual periods beginning on or after

January 1, 2016. The amended standard will not have a material

impact on our consolidated financial statements.

• Amendments to IFRS 11, Joint Arrangements – In May 2014, the

IASB issued an amendment to this standard requiring business

combination accounting to be applied to acquisitions of

interests in a joint operation that constitute a business. The

amendment is effective prospectively for annual periods

beginning on or after January 1, 2016. We will account for any

such transactions from January 1, 2016 prospectively in

accordance with the amended standard.

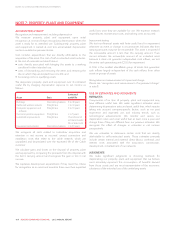

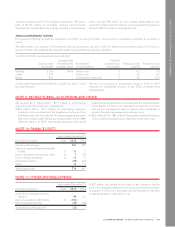

NOTE 3: CAPITAL RISK MANAGEMENT

Our objectives in managing capital are to ensure we have sufficient

liquidity to meet all of our commitments and to execute our

business plan. We define capital that we manage as shareholders’

equity and indebtedness (including current portion of our long-

term debt, long-term debt, and short-term borrowings).

We manage our capital structure, commitments, and maturities

and make adjustments based on general economic conditions,

financial markets, operating risks, our investment priorities, and

working capital requirements. To maintain or adjust our capital

structure, we may, with approval from our Board of Directors, issue

or repay debt and/or short-term borrowings, issue shares,

repurchase shares, pay dividends, or undertake other activities as

deemed appropriate under the circumstances. The Board of

Directors reviews and approves the annual capital and operating

budgets, as well as any material transactions that are not part of the

ordinary course of business, including proposals for acquisitions or

other major financing transactions, investments, or divestitures.

We monitor debt leverage ratios as part of the management of

liquidity and shareholders’ return to sustain future development of

the business, conduct valuation-related analyses, and make

decisions about capital.

The Rogers Platinum MasterCard program, as well as the wholly-

owned subsidiary through which it is operated, is regulated by the

Office of the Superintendent of Financial Institutions, which

requires that a minimum level of regulatory capital be maintained.

Rogers was in compliance with that requirement as at

December 31, 2015 and 2014. The capital requirements are not

material to the Company as at December 31, 2015 or

December 31, 2014.

With the exception of the Rogers Platinum MasterCard program

and the subsidiary through which it is operated, we are not subject

to externally imposed capital requirements. Our overall strategy for

capital risk management has not changed since December 31,

2014.

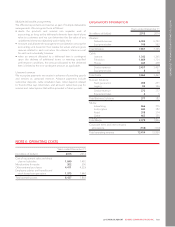

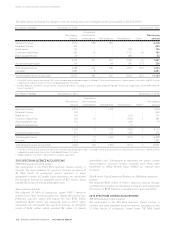

NOTE 4: SEGMENTED INFORMATION

ACCOUNTING POLICY

Reportable segments

We determine our reportable segments based on, among other

things, how our chief operating decision makers, the Chief

Executive Officer and Chief Financial Officer of RCI, regularly review

our operations and performance. They review adjusted operating

profit as the key measure of profit for the purpose of assessing

performance for each segment and to make decisions about the

allocation of resources. Adjusted operating profit is defined as

income before stock-based compensation, depreciation and

amortization, restructuring, acquisition and other, finance costs,

other (income) expense, and income taxes.

We follow the same accounting policies for our segments as those

described in the notes to our consolidated financial statements.

We account for transactions between reportable segments in the

same way we account for transactions with external parties and

eliminate them on consolidation.

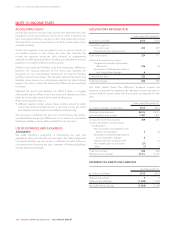

USE OF ESTIMATES AND JUDGMENTS

JUDGMENTS

We make significant judgments in determining our operating

segments. These are components that engage in business activities

from which they may earn revenue and incur expenses, for which

operating results are regularly reviewed by our chief operating

decision makers to make decisions about resources to be allocated

and assess component performance, and for which discrete

financial information is available.

EXPLANATORY INFORMATION

Our reportable segments are Wireless, Cable, Business Solutions,

and Media (note 1). All four segments operate substantially in

Canada. Corporate items and eliminations include our interests in

businesses that are not reportable operating segments, corporate

administrative functions, and eliminations of inter-segment revenue

and costs. Segment results include items directly attributable to a

segment as well as those that can be allocated on a reasonable basis.

100 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT