Rogers 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’S DISCUSSION AND ANALYSIS

Wireless

• A wireless subscriber is represented by each identifiable

telephone number.

• We report wireless subscribers in two categories: postpaid and

prepaid. Postpaid and prepaid include voice-only subscribers,

data-only subscribers, and subscribers with service plans

integrating both voice and data.

• Wireless prepaid subscribers are considered active for a period

of 180 days from the date of their last revenue-generating usage.

Cable

• Cable Television and Internet subscribers are represented by a

dwelling unit; Cable Phone subscribers are represented by line

counts.

• When there is more than one unit in one dwelling, such as an

apartment building, each tenant with cable service is counted as

an individual subscriber, whether the service is invoiced

separately or included in the tenant’s rent. Institutional units, like

hospitals or hotels, are each considered one subscriber.

• Cable Television, Internet, and Phone subscribers include only

those subscribers who have service installed and operating, and

who are being billed accordingly.

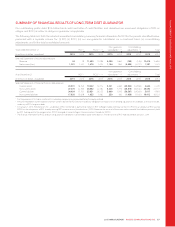

SUBSCRIBER CHURN

Subscriber churn is a measure of the number of subscribers that

deactivated during a period as a percentage of the total subscriber

base, usually calculated on a monthly basis. Subscriber churn

measures our success in retaining our subscribers. We calculate it

by dividing the number of Wireless subscribers that deactivated

(usually in a month) by the aggregate numbers of subscribers at

the beginning of the period. When used or reported for a period

greater than one month, subscriber churn represents the sum of

the number of subscribers deactivating for each period incurred

divided by the sum of the aggregate number of subscribers at the

beginning of each period incurred.

POSTPAID AVERAGE REVENUE PER ACCOUNT

Commencing in the first quarter of 2015, we began disclosing

postpaid average revenue per account (ARPA) as one of our key

performance indicators. PostpaidARPAhelpsusidentifytrends

and measure our success in attracting and retaining multiple-

device accounts. A single Wireless postpaid account typically

provides subscribers with the advantage of allowing for the pooling

of plan attributes across multiple devices and on a single bill. Each

Wireless postpaid account is typically represented by an

identifiable billing account number. A single Wireless postpaid

account may include more than one identifiable telephone

number and receive monthly Wireless services for a variety of

connected devices including smartphones, basic phones, tablets,

and other devices. Wireless postpaid accounts under our various

brand names are considered separate accounts. We calculate

Wireless postpaid ARPA by dividing total Wireless postpaid

network revenue (monthly) by the average number of Wireless

postpaid accounts for the same time period.

BLENDED AVERAGE REVENUE PER USER

Blended average revenue per user (ARPU) helps us identify trends

and measure our success in attracting and retaining higher value

subscribers. We calculate blended ARPU by dividing network

revenue (monthly) by the average total number of Wireless

subscribersforthesametimeperiod.

CAPITAL INTENSITY

Capital intensity allows us to compare the level of our additions to

property, plant and equipment to that of other companies within

the same industry. Our additions to property, plant and equipment

do not include expenditures on spectrum licences. We calculate

capital intensity by dividing additions to property, plant and

equipment by operating revenue. For Wireless, capital intensity is

calculated using total network revenue. We use it to evaluate the

performance of our assets and when making decisions about

additions to property, plant and equipment. We believe that

certain investors and analysts use capital intensity to measure the

performance of asset purchases and construction in relation to

revenue.

DIVIDEND PAYOUT RATIOS

We calculate the dividend payout ratio by dividing dividends

declared for the year by net income or free cash flow for the year.

We use dividends as a percentage of net income and free cash

flow to conduct analysis and assist with determining the dividends

we should pay.

RETURN ON ASSETS

We use return on assets to measure our efficiency in using our

assets to generate net income. We calculate return on assets by

dividing net income for the year by total assets as at year-end.

84 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT