Rogers 2015 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

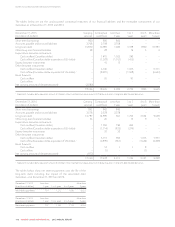

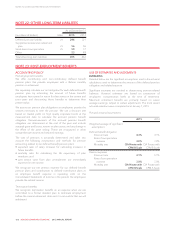

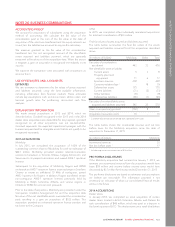

NOTE 22: OTHER LONG-TERM LIABILITIES

As at December 31

(In millions of dollars) Note 2015 2014

Deferred pension liability 23 296 321

Supplemental executive retirement

plan 23 56 56

Stock-based compensation 25 50 37

Other 53 48

Total other long-term liabilities 455 462

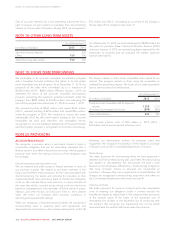

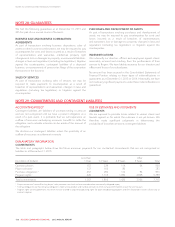

NOTE 23: POST-EMPLOYMENT BENEFITS

ACCOUNTING POLICY

Post-employment benefits

We offer contributory and non-contributory defined benefit

pension plans that provide employees with a lifetime monthly

pension on retirement.

We separately calculate our net obligation for each defined benefit

pension plan by estimating the amount of future benefits

employees have earned in return for their service in the current and

prior years and discounting those benefits to determine their

present value.

We accrue our pension plan obligations as employees provide the

services necessary to earn the pension. We use a discount rate

based on market yields on high quality corporate bonds at the

measurement date to calculate the accrued pension benefit

obligation. Remeasurements of the accrued pension benefit

obligation are determined at the end of the year and include

actuarial gains and losses, returns on plan assets, and any change in

theeffectoftheassetceiling.Thesearerecognizedinother

comprehensive income and retained earnings.

The cost of pensions is actuarially determined and takes into

account the following assumptions and methods for pension

accounting related to our defined benefit pension plans:

• expected rates of salary increases for calculating increases in

future benefits;

• mortality rates for calculating the life expectancy of plan

members; and

• past service costs from plan amendments are immediately

expensed in net income.

We recognize our net pension expense for our defined benefit

pension plans and contributions to defined contribution plans as

an employee benefit expense in operating costs on the

Consolidated Statements of Income in the periods the employees

provide the related services.

Termination benefits

We recognize termination benefits as an expense when we are

committed to a formal detailed plan to terminate employment

before the normal retirement date and it is not realistic that we will

withdraw it.

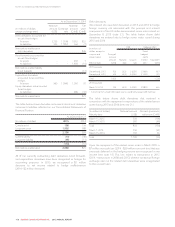

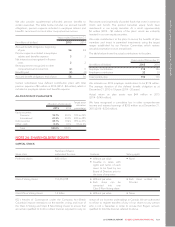

USE OF ESTIMATES AND JUDGMENTS

ESTIMATES

Detailed below are the significant assumptions used in the actuarial

calculations used to determine the amount of the defined pension

obligation and related expense.

Significant estimates are involved in determining pension-related

balances. Actuarial estimates are based on projections of

employees’ compensation levels at the time of retirement.

Maximum retirement benefits are primarily based on career

average earnings, subject to certain adjustments. The most recent

actuarial valuations were completed as at January 1, 2015.

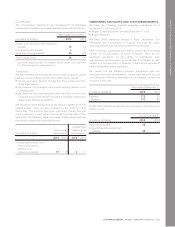

Principal actuarial assumptions

2015 2014

Weighted average of significant

assumptions:

Defined benefit obligation

Discount rate 4.3% 4.1%

Rate of compensation

increase 3.0% 3.0%

Mortality rate CIA Private with

CPM B Scale

CIA Private with

CPM B Scale

Pension expense

Discount rate 4.1% 5.1%

Rate of compensation

increase 3.0% 3.0%

Mortality rate CIA Private with

CPM B Scale

CIA Private with

CPM A Scale

126 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT