Rogers 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

EXPLANATORY INFORMATION

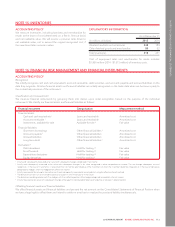

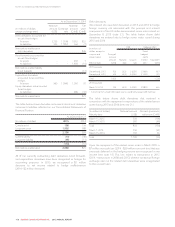

(In millions of dollars)

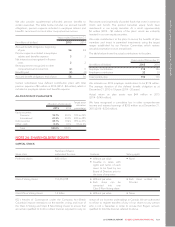

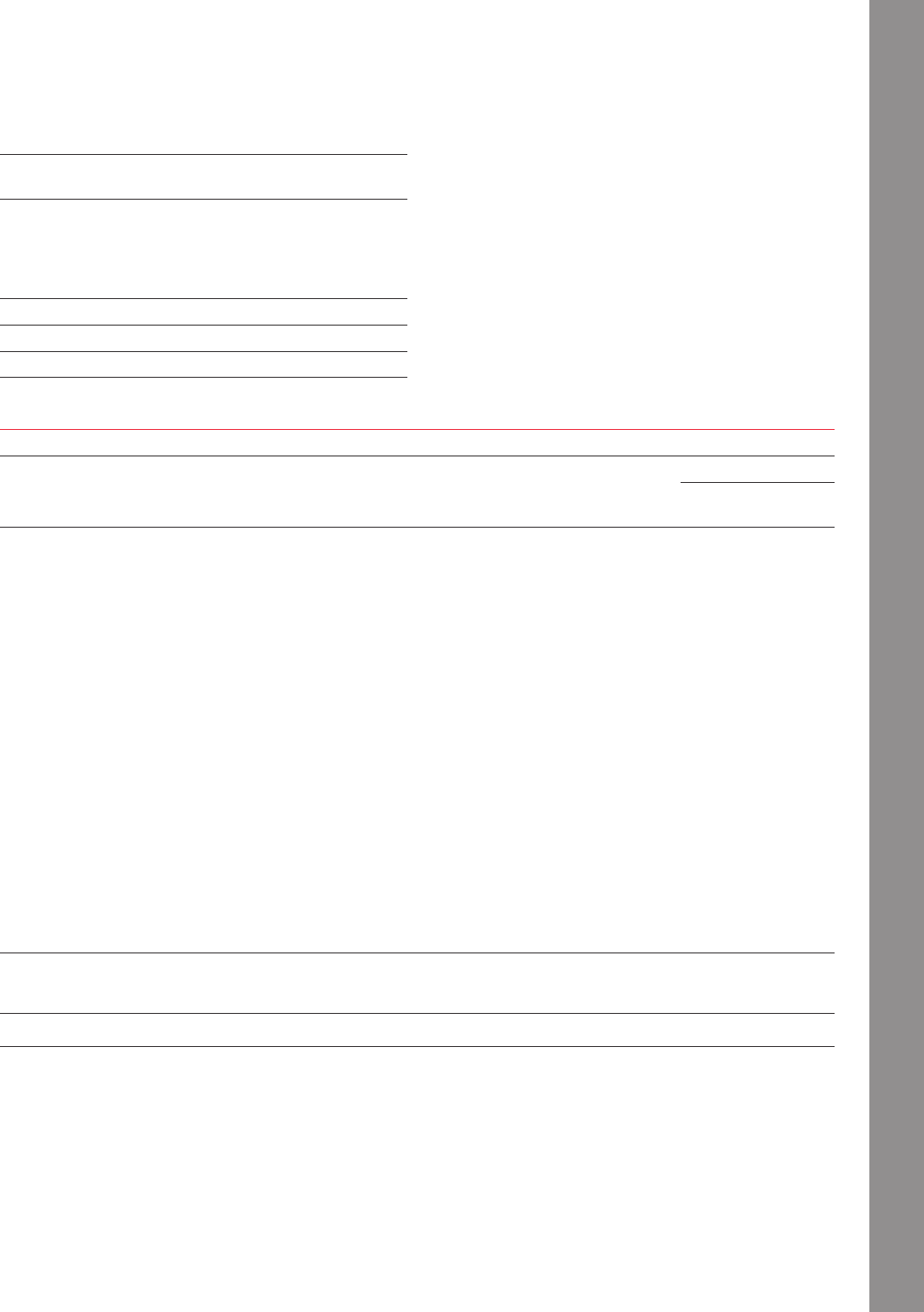

Decommissioning

Liabilities Other Total

December 31, 2014 33 29 62

Additions 8 – 8

Adjustments to existing provisions 2 – 2

Reversals – (5) (5)

Amounts used (3) (4) (7)

December 31, 2015 40 20 60

Current 10 – 10

Long-term 30 20 50

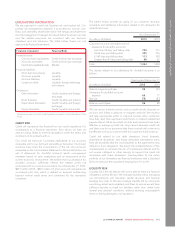

Cash outflows associated with our decommissioning liabilities are

generally expected to occur at the decommissioning dates of the

assets to which they relate, which are long-term in nature. The

timing and extent of restoration work that will be ultimately

required for these sites is uncertain.

Other provisions include various legal claims, which are expected

to be settled within five years.

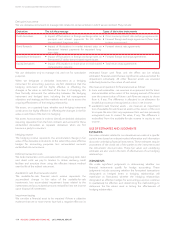

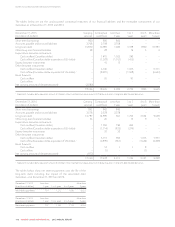

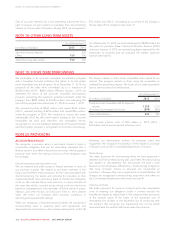

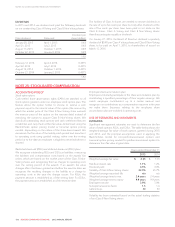

NOTE 21: LONG-TERM DEBT

As at December 31

(In millions of dollars, except interest rates)

Due

date

Principal

amount

Interest

rate 2015 2014

Bank credit facilities Floating 500 –

Senior notes 12015 US 550 7.500% –638

Senior notes 22015 US 280 6.750% –325

Senior notes 2016 1,000 5.800% 1,000 1,000

Senior notes 2017 500 3.000% 500 500

Senior notes 2017 250 Floating 250 250

Senior notes 2018 US 1,400 6.800% 1,938 1,624

Senior notes 2019 400 2.800% 400 400

Senior notes 2019 500 5.380% 500 500

Senior notes 2020 900 4.700% 900 900

Senior notes 2021 1,450 5.340% 1,450 1,450

Senior notes 2022 600 4.000% 600 600

Senior notes 2023 US 500 3.000% 692 580

Senior notes 2023 US 850 4.100% 1,176 986

Senior notes 2024 600 4.000% 600 600

Senior notes 2025 US 700 3.625% 969 –

Senior debentures 22032 US 200 8.750% 277 232

Senior notes 2038 US 350 7.500% 484 406

Senior notes 2039 500 6.680% 500 500

Senior notes 2040 800 6.110% 800 800

Senior notes 2041 400 6.560% 400 400

Senior notes 2043 US 500 4.500% 692 580

Senior notes 2043 US 650 5.450% 900 754

Senior notes 2044 US 1,050 5.000% 1,453 870

16,981 14,895

Deferred transaction costs and discounts (111) (108)

Less current portion (1,000) (963)

Total long-term debt 15,870 13,824

1Senior notes originally issued by Rogers Wireless Inc. which are unsecured obligations of RCI and for which RCP was an unsecured co-obligor as at December 31, 2015 and

December 31, 2014.

2Senior notes and debentures originally issued by Rogers Cable Inc. which are unsecured obligations of RCI and for which RCP was an unsecured guarantor as at December 31,

2015 and December 31, 2014.

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 123