Rogers 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

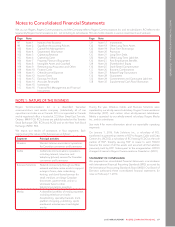

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

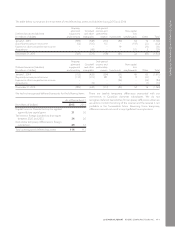

NOTE 7: PROPERTY, PLANT AND EQUIPMENT

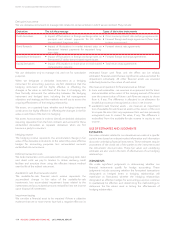

ACCOUNTING POLICY

Recognition and measurement, including depreciation

We measure property, plant and equipment upon initial

recognition at cost and begin recognizing depreciation when the

asset is ready for its intended use. Subsequently, property, plant

and equipment is carried at cost less accumulated depreciation

and accumulated impairment losses.

Cost includes expenditures that are directly attributable to the

acquisition of the asset. The cost of self-constructed assets includes:

• the cost of materials and direct labour;

• costs directly associated with bringing the assets to a working

condition for their intended use;

• costs of dismantling and removing the items and restoring the

site on which they are located (see note 20); and

• borrowing costs on qualifying assets.

We depreciate property, plant and equipment over its estimated

useful life by charging depreciation expense to net income as

follows:

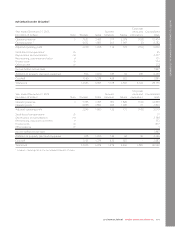

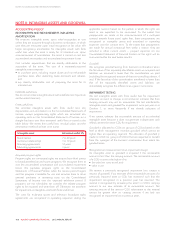

Asset Basis

Estimated

useful life

Buildings Diminishing balance 5 to 40 years

Cable and wireless network Straight-line 3 to 30 years

Computer equipment and

software

Straight-line 4 to 10 years

Customer premise equipment Straight-line 3 to 5 years

Leasehold improvements Straight-line Over shorter of

estimated useful

life or lease term

Equipment and vehicles Diminishing balance 3 to 20 years

We recognize all costs related to subscriber acquisition and

retention in net income as incurred, except connection and

installation costs that relate to the cable network, which are

capitalized and depreciated over the expected life of the Cable

customer.

We calculate gains and losses on the disposal of property, plant

and equipment by comparing the proceeds from the disposal with

the item’s carrying amount and recognize the gain or loss in net

income.

We capitalize development expenditures if they meet the criteria

for recognition as an asset and amortize them over their expected

useful lives once they are available for use. We expense research

expenditures, maintenance costs, and training costs as incurred.

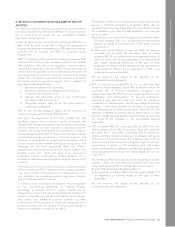

Impairment testing

We test non-financial assets with finite useful lives for impairment

whenever an event or change in circumstances indicates that their

carrying amounts may not be recoverable. The asset is impaired if

the recoverable amount is less than the carrying amount. If we

cannot estimate the recoverable amount of an individual asset

because it does not generate independent cash inflows, we test

the entire cash generating unit (CGU) for impairment.

A CGU is the smallest identifiable group of assets that generates

cash inflows largely independent of the cash inflows from other

assets or groups of assets.

Recognition and measurement of impairment charge

Please see “recognition and measurement of impairment charge”

in note 8.

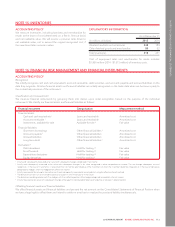

USE OF ESTIMATES AND JUDGMENTS

ESTIMATES

Components of an item of property, plant and equipment may

have different useful lives. We make significant estimates when

determining depreciation rates and asset useful lives, which require

taking into account company-specific factors, such as our past

experience and expected use, and industry trends, such as

technological advancements. We monitor and review our

depreciation rates and asset useful lives at least once a year and

change them if they are different from our previous estimates. We

recognize the effect of changes in estimates in net income

prospectively.

We use estimates to determine certain costs that are directly

attributable to self-constructed assets. These estimates primarily

include certain internal and external direct labour, overhead, and

interest costs associated with the acquisition, construction,

development, or betterment of our networks.

JUDGMENTS

We make significant judgments in choosing methods for

depreciating our property, plant and equipment that we believe

most accurately represent the consumption of benefits derived

from those assets and are most representative of the economic

substance of the intended use of the underlying assets.

104 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT