Rogers 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

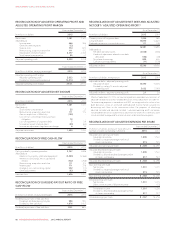

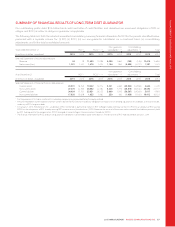

MANAGEMENT’S DISCUSSION AND ANALYSIS

RECONCILIATION OF ADJUSTED OPERATING PROFIT AND

ADJUSTED OPERATING PROFIT MARGIN

Years ended December 31

(In millions of dollars) 2015 2014

Net income 1,381 1,341

Add (deduct):

Income taxes 466 506

Other (income) expense (32) 1

Finance costs 774 817

Restructuring, acquisition and other 111 173

Depreciation and amortization 2,277 2,144

Stock-based compensation 55 37

Adjusted operating profit 5,032 5,019

Years ended December 31

(In millions of dollars, except percentages) 2015 2014

Adjusted operating profit margin:

Adjusted operating profit 5,032 5,019

Divided by: total operating revenue 13,414 12,850

Adjusted operating profit margin 37.5% 39.1%

RECONCILIATION OF ADJUSTED NET INCOME

Years ended December 31

(In millions of dollars) 2015 2014

Net income 1,381 1,341

Add (deduct):

Stock-based compensation 55 37

Restructuring, acquisition and other 111 173

Gain on acquisition of Mobilicity (102) –

Loss on non-controlling interest purchase

obligation 72 –

Loss on repayment of long-term debt 729

Income tax impact of above items (40) (62)

Income tax adjustment, legislative tax change 614

Adjusted net income 1,490 1,532

RECONCILIATION OF FREE CASH FLOW

Years ended December 31

(In millions of dollars) 2015 2014

Cash provided by operating activities 3,747 3,698

Add (deduct):

Additions to property, plant and equipment (2,440) (2,366)

Interest on borrowings, net of capitalized

interest (732) (756)

Restructuring, acquisition and other 111 173

Interest paid 771 778

Change in non-cash working capital 302 (11)

Other adjustments (83) (79)

Free cash flow 1,676 1,437

RECONCILIATION OF DIVIDEND PAYOUT RATIO OF FREE

CASH FLOW

Years ended December 31

(In millions of dollars, except percentages) 2015 2014

Dividend payout ratio of free cash flow:

Dividends declared during the year 988 942

Divided by: free cash flow 1,676 1,437

Dividend payout ratio of free cash flow 59% 66%

RECONCILIATION OF ADJUSTED NET DEBT AND ADJUSTED

NET DEBT / ADJUSTED OPERATING PROFIT 1

As at December 31

(In millions of dollars) 2015 2014

Current portion of long-term debt 1,000 963

Long-term debt 15,870 13,824

Deferred transaction costs and discounts 111 108

16,981 14,895

Add (deduct):

Netdebtderivativeassets (2,028) (846)

Credit risk adjustment related to net debt

derivatives (152) (39)

Short-term borrowings 800 842

Cash and cash equivalents (11) (176)

Adjusted net debt 15,590 14,676

As at December 31

(In millions of dollars, except ratios) 2015 2014

Adjusted net debt / adjusted operating profit

Adjusted net debt 15,590 14,676

Divided by: trailing 12 months adjusted

operating profit 5,032 5,019

Adjusted net debt / adjusted operating profit 3.1 2.9

1Effective September 30, 2015, we have retrospectively amended our calculation of

adjusted net debt to value the net debt derivatives without adjustment for credit risk.

For accounting purposes in accordance with IFRS, we recognize the fair values of our

debt derivatives using an estimated credit-adjusted mark-to-market valuation by

discounting cash flows to the measurement date. For purposes of calculating

adjusted net debt and adjusted net debt / adjusted operating profit, we believe

including debt derivatives valued without adjustment for credit risk is commonly used

to evaluate debt leverage and for market valuation and transactional purposes.

RECONCILIATION OF ADJUSTED EARNINGS PER SHARE

(In millions of dollars, except per share amounts;

number of shares outstanding in millions)

Years ended December 31

2015 2014

Adjusted basic earnings per share:

Adjusted net income 1,490 1,532

Divided by: weighted average number of

shares outstanding 515 515

Adjusted basic earnings per share $2.89 $2.97

Adjusted diluted earnings per share:

Adjusted net income 1,490 1,532

Dividedby:dilutedweightedaveragenumber

of shares outstanding 517 517

Adjusted diluted earnings per share $2.88 $2.96

Basic earnings per share:

Net income 1,381 1,341

Divided by: weighted average number of

shares outstanding 515 515

Basic earnings per share $2.68 $2.60

Diluted earnings per share:

Net income 1,381 1,341

Effect on net income of dilutive securities –(15)

Diluted net income 1,381 1,326

Dividedby:dilutedweightedaveragenumber

of shares outstanding 517 517

Diluted earnings per share $2.67 $2.56

86 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT