Rogers 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

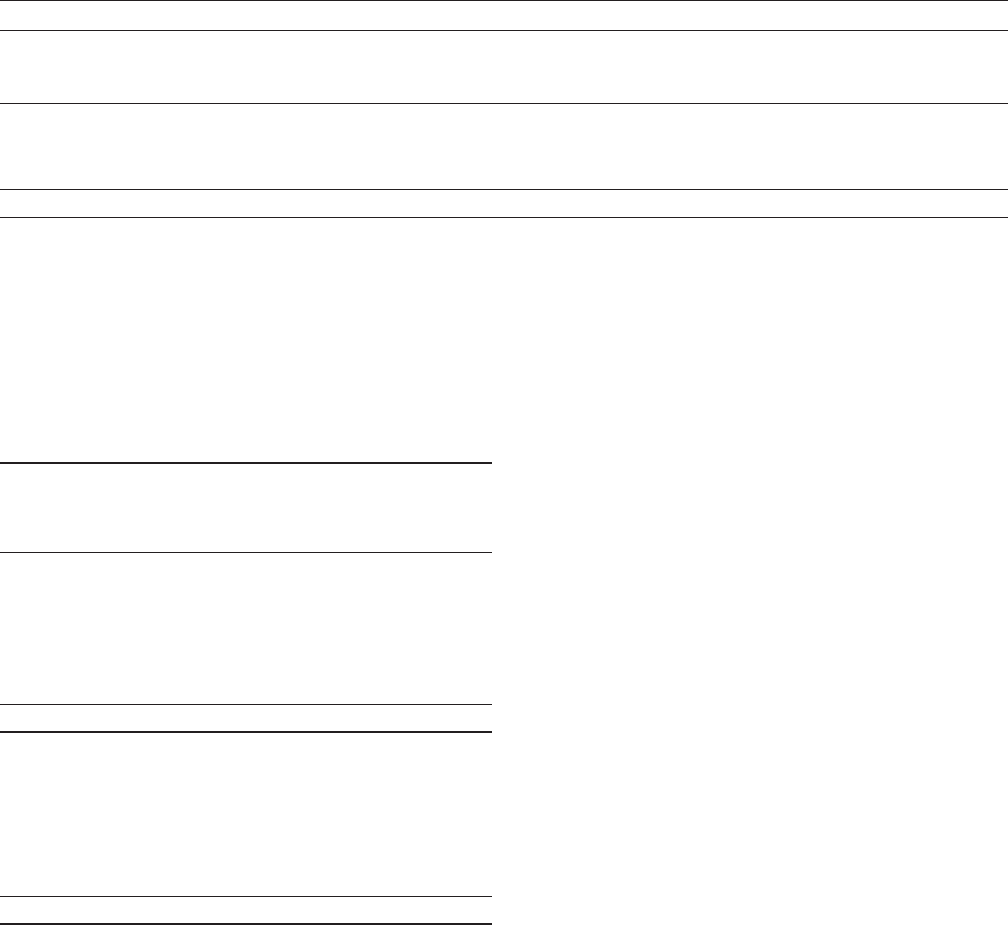

BOND FORWARDS

From time to time, we use extendible bond forward derivatives

(bond forwards) to hedge interest rate risk on the debt instruments

we expect to issue in the future. As at December 31, 2015,

approximately $5.5 billion of our outstanding public debt matures

over the next five years (2014 – $5.2 billion) and we anticipate that

we will issue public debt over that time to fund at least a portion of

those maturities together with other general corporate funding

requirements. We use bond forwards for risk management

purposes only. The bond forwards noted below have been

designated as hedges for accounting purposes.

During 2014, we entered into bond forwards to hedge the

underlying Government of Canada (GoC) interest rate risk that will

comprise a portion of the interest rate risk associated with our

anticipated future debt issuances. As a result of these bond

forwards, we hedged the underlying GoC 10-year rate on

$1.5 billion notional amount for anticipated future debt issuances

from 2015 to 2018 and the underlying GoC 30-year rate on

$0.4 billion notional amount for December 31, 2018. The bond

forwards are effective from December 2014.

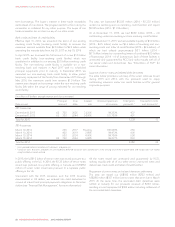

On December 8, 2015, we exercised the $500 million notional

bond forward due December 31, 2015 in relation to the issuance

of the US$700 million senior notes due 2025 and paid $25 million

to settle the derivative. The amount paid represents the fair value of

the bond forward at the time of settlement and will be amortized to

finance costs over the life of the $700 million senior notes due

2025. For our remaining bond forwards, we reset the rates and

extended the next re-pricing dates.

As at December 31, 2015 we had $1.4 billion notional amount of bond forwards outstanding (2014 – $1.9 billion), all of which were

designated as hedges for accounting purposes.

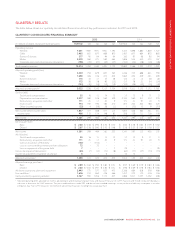

(In millions of dollars, except interest rates)

GoC term (years) Effective date Maturity date 1

Notional

amount

Hedged GoC

interest rate as at

December 31, 2015

Hedged GoC

interest rate as at

December 31, 2014 12015 2014

10 December 2014 December 31, 2015 500 – 2.05% –500

10 December 2014 January 4, 2017 500 2.34% 2.04% 500 500

10 December 2014 April 30, 2018 500 2.23% 2.07% 500 500

30 December 2014 December 31, 2018 400 2.52% 2.41% 400 400

Total 1,900 1,400 1,900

1Bond forwards with maturity dates beyond December 31, 2015 are subject to GoC rate re-setting from time to time. The $500 million due April 2018 was extended in October

2015 to reset in April 2016. The $500 million due January 2017 was extended in December 2015 to reset in January 2017. The $400 million due December 2018 was extended in

December 2015 to reset in January 2017.

EXPENDITURE DERIVATIVES

We use foreign currency forward contracts (expenditure derivatives)

to hedge the foreign exchange risk on the notional amount of certain

forecasted US dollar-denominated expenditures. The table below

shows the expenditure derivatives into which we entered to manage

foreign exchange risk related to certain forecasted expenditures.

(In millions of dollars, except exchange rates)

Notional trade date Maturity dates

Notional

amount

(US$)

Exchange

Rate

Converted

amount

(Cdn$)

April 2015 July 2015 to

December 2016 270 1.2222 330

June 2015 January 2016 to

December 2016 60 1.2167 73

September 2015 January 2016 to

December 2016 360 1.3194 475

October 2015 January 2017 to

December 2017 300 1.2933 388

Total during 2015 990 1.2788 1,266

February 2014 January 2015 to

April 2015 200 1.1100 222

May 2014 May 2015 to

December 2015 232 1.0948 254

June 2014 January 2015 to

December 2015 288 1.0903 314

July 2014 January 2016 to

December 2016 240 1.0833 260

Total during 2014 960 1.0940 1,050

The expenditure derivatives noted above have been designated as

hedges for accounting purposes. In the year ended December 31,

2015, we settled US$810 million (2014 – US$900 million) of

expenditure derivatives for $902 million (2014 – $923 million).

As at December 31, 2015, we had US$1,140 million of expenditure

derivatives outstanding (2014 – US$960 million) with terms to

maturity ranging from January 2016 to December 2017

(2014 – January 2015 to December 2015) at an average rate of

$1.24/US$ (2014 – $1.09/US$).

EQUITY DERIVATIVES

We use stock-based compensation derivatives (equity derivatives)

to hedge the market price appreciation risk of the RCI Class B

shares granted under our stock-based compensation programs. As

at December 31, 2015, we had equity derivatives for 5.7 million RCI

Class B shares with a weighted average price of $50.37. These

derivatives have not been designated as hedges for accounting

purposes. We record changes in their fair value as a stock-based

compensation expense, or offset thereto, which serves to offset a

substantial portion of the impact of changes in the market price of

RCI Class B shares on the accrued value of the stock-based

compensation liability for our stock-based compensation

programs. In April 2015, we executed extension agreements for

each of our equity derivative contracts under substantially the same

terms and conditions with revised expiry dates to April 2016 (from

April 2015).

62 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT