Rogers 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

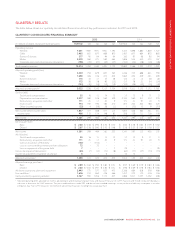

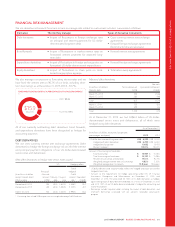

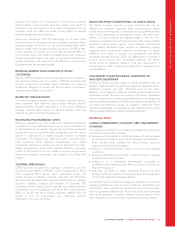

MARK-TO-MARKET VALUE

We record our derivatives using an estimated credit-adjusted,

mark-to-market valuation, calculated in accordance with IFRS.

As at December 31, 2015

(In millions of dollars, except

exchange rates)

Notional

amount

(US$)

Exchange

rate

Notional

amount

(Cdn$)

Fair

value

(Cdn$)

Debt derivatives accounted for

as cash flow hedges:

As assets 5,900 1.0755 6,345 2,032

As liabilities 300 1.3367 401 (4)

Net mark-to-market asset

debt derivatives 2,028

Bond forwards accounted for

as cash flow hedges:

As liabilities – – 1,400 (91)

Expenditure derivatives

accounted for as cash flow

hedges:

As assets 1,140 1.2410 1,415 158

Equity derivatives not

accounted for as hedges:

As liabilities – – 286 (15)

Net mark-to-market asset 2,080

As at December 31, 2014

(In millions of dollars, except

exchange rates)

Notional

amount

(US$)

Exchange

rate

Notional

amount

(Cdn$)

Fair

value

(Cdn$)

Debt derivatives accounted for

as cash flow hedges:

As assets 5,725 1.0396 5,952 853

As liabilities 305 1.1857 362 (7)

Net mark-to-market asset

debt derivatives 846

Bond forwards accounted for as

cash flow hedges:

As assets – – 250 1

As liabilities – – 1,650 (14)

Net mark-to-market liability

bond forwards 1,900 (13)

Expenditure derivatives

accounted for as cash flow

hedges:

As assets 960 1.0940 1,050 70

Equity derivatives not

accounted for as hedges:

As liabilities – – 286 (30)

Net mark-to-market asset 873

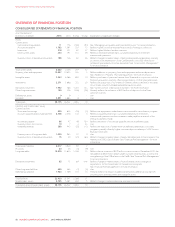

ADJUSTED NET DEBT AND ADJUSTED NET DEBT /

ADJUSTED OPERATING PROFIT

We use adjusted net debt and adjusted net debt / adjusted

operating profit to conduct valuation-related analysis and make

capital structure-related decisions. Adjusted net debt includes

long-term debt, net debt derivatives assets or liabilities, short-term

borrowings, and cash and cash equivalents.

As at December 31

(In millions of dollars, except ratios) 2015 2014

Long-term debt 116,981 14,895

Net debt derivative assets valued without

any adjustment for credit risk 2(2,180) (885)

Short-term borrowings 800 842

Cash and cash equivalents (11) (176)

Adjusted net debt 315,590 14,676

Adjusted net debt / adjusted operating

profit 3, 4 3.1 2.9

1Includes current and long-term portion of long-term debt before the reduction in

carrying value arising from purchase accounting and deferred transaction costs and

discounts. See “Reconciliation of adjusted net debt” in the section “Non-GAAP

Measures” for the calculation of this amount.

2Effective September 30, 2015, we retrospectively amended our calculation of

adjusted net debt to value the net debt derivatives without adjustment for credit risk.

For accounting purposes in accordance with IFRS, we recognize the fair values of our

debt derivatives using an estimated credit-adjusted mark-to-market valuation by

discounting cash flows to the measurement date. For purposes of calculating

adjusted net debt and adjusted net debt / adjusted operating profit, we believe

including debt derivatives valued without adjustment for credit risk is commonly used

to evaluate debt leverage and for market valuation and transactional purposes. As at

December 31, 2015, the net debt derivative assets presented in the table above

consist of the credit-adjusted net debt derivative assets of $2,028 million (2014 –

$846 million) and the credit risk adjustment of $152 million (2014 – $39 million).

3Adjusted net debt and adjusted net debt / adjusted operating profit are non-GAAP

measures and should not be considered as a substitute or alternative for GAAP

measures. These are not defined terms under IFRS and do not have standard

meanings, so may not be a reliable way to compare us to other companies. See

“Non-GAAP Measures” for information about these measures, including how we

calculate them.

4Adjusted net debt / adjusted operating profit is measured using adjusted operating

profit for the last 12 consecutive months.

In addition to the cash and cash equivalents as at December 31,

2015 noted above, we held $966 million of marketable equity

securities in publicly traded companies as at December 31, 2015

(2014 – $1,130 million).

Our adjusted net debt increased by $914 million this year and our

adjusted net debt / adjusted operating profit increased to 3.1. This

increase is primarily attributable to our acquisitions and investments

made in 2015. Our long-term target for adjusted net debt /

adjusted operating profit remains a range of 2.0 to 2.5.

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 63