Rogers 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Phone revenue includes revenue from residential and small

business local telephony service from:

• monthly service fees;

• calling features such as voicemail, call waiting, and caller ID; and

• long distance calling.

The stable total operating revenue this year was a result of:

• the movement of Internet customers to higher speed and usage

tiers;

• a higher subscriber base for our Internet products;

• the impact and timing of general pricing increases implemented

over the past year, net of promotional pricing; and

• an adjustment pertaining to the anticipated usage of our loyalty

programs; offset by

• Television and Phone subscriber losses over the past year; and

• Television subscribers downgrading their service plans

compared to the prior year.

The implementation of a CRTC decision mandating that, effective

January 23, 2015, telecommunications providers could no longer

require customers to provide a minimum of 30 days’ notice when

canceling services effectively resulted in an extra month of

customer deactivations being counted this year. As cancellations

occur throughout the year, we believe this caused a $24 million

decrease in Cable operating revenue for the remainder of the year.

Internet revenue

The 8% increase in Internet revenue this year was a result of:

• the general movement of customers to higher speed and usage

tiers through the launch of our new IGNITE broadband Internet

offerings that provide subscribers with broader choices of speed

and data usage and incorporate bundled, value-added content;

• a larger Internet subscriber base; and

• the impact and timing of changes in Internet service pricing;

partially offset by

• declines in Internet additional usage revenue as portions of the

subscriber base move to the higher-value, unlimited usage plans.

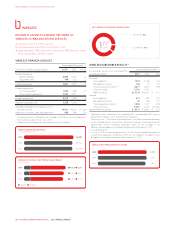

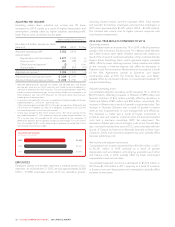

(IN THOUSANDS)

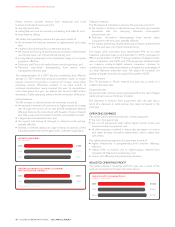

INTERNET SUBSCRIBERS

2015

2014

2013

2,048

2,011

1,961

No data available for the year 2013.

2015

2014

664%

700%

PERCENTAGE GROWTH IN INTERNET SUBSCRIBERS

WITH SERVICE OVER 100 Mbps

(%)

Television revenue

The 4% decrease in Television revenue this year was a result of:

• the decline in Television subscribers over the past year primarily

associated with the changing television consumption

environment; and

• Television subscribers downgrading their service plans

compared to the prior year; partially offset by

• the impact and timing of general pricing increases implemented

over the past year, net of promotional pricing.

The digital cable subscriber base represented 91% of our total

Television subscriber base as at December 31, 2015, compared to

88% as at December 31, 2014. The larger selection of digital content,

video-on-demand, and HDTV and PVR equipment combined with

our ongoing analog-to-digital network conversion continue to

contribute to the increasing penetration of digital as a percentage of

our total Television subscriber base. We expect to complete our

analog-to-digital conversion during the first quarter of 2016.

Phone revenue

The 7% decrease in Phone revenue this year was a result of a

smaller subscriber base.

Equipment sales

Equipment sales include revenue generated from the sale of digital

cable set-top boxes and Internet modems.

The decrease in revenue from equipment sales this year was a

result of a decrease in cable set-top box sales compared to the

prior year.

OPERATING EXPENSES

We assess Cable operating expenses in three categories:

• the cost of programming;

• the cost of equipment sales (cable digital set-top boxes and

Internet modem equipment); and

• all other expenses involved in day-to-day operations, to service

and retain existing subscriber relationships, and to attract new

subscribers.

The stable operating expenses this year were a result of:

• higher investments in programming and customer offerings;

offset by

• relative shifts in product mix to higher-margin Internet from

conventional Television broadcasting; and

• various cost efficiency and productivity initiatives.

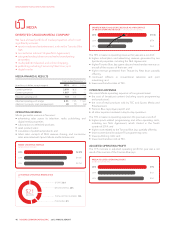

ADJUSTED OPERATING PROFIT

The stable adjusted operating profit this year was a result of the

revenue and expense changes described above.

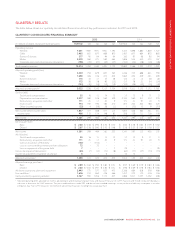

(IN MILLIONS OF DOLLARS)

CABLE ADJUSTED OPERATING PROFIT

2015

2014

2013

$1,658

$1,665

$1,718

46 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT