Rogers 2015 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

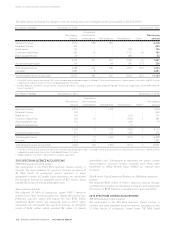

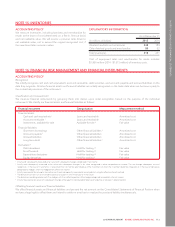

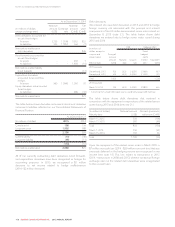

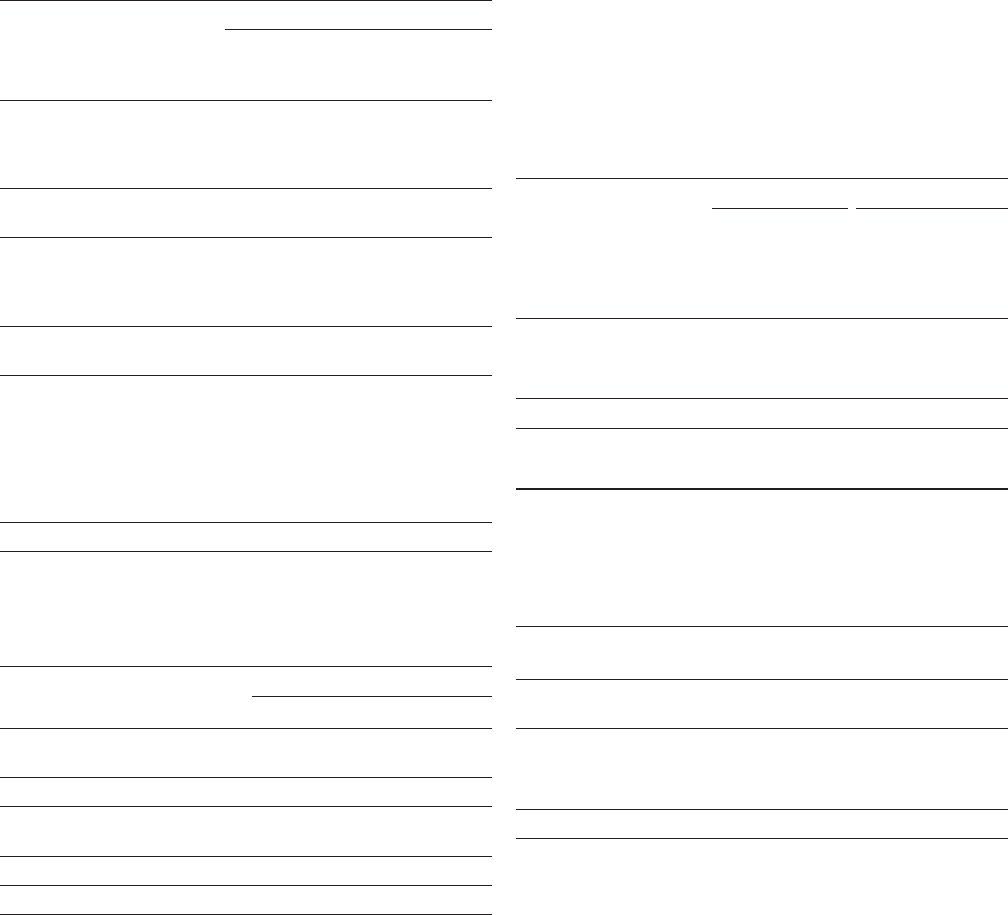

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

As at December 31, 2014

(In millions of dollars,

except exchange rates)

Notional

amount

(US$)

Exchange

rate

Notional

amount

(Cdn$)

Fair

value

(Cdn$)

Debt derivatives accounted for

as cash flow hedges:

As assets 5,725 1.0396 5,952 853

As liabilities 305 1.1857 362 (7)

Net mark-to-market asset

debt derivatives 846

Bond forwards accounted for

as cash flow hedges:

As assets – – 250 1

As liabilities – – 1,650 (14)

Net mark-to-market liability

bond forwards (13)

Expenditure derivatives

accounted for as cash flow

hedges:

As assets 960 1.0940 1,050 70

Equity derivatives not accounted

for as hedges:

As liabilities – – 286 (30)

Net mark-to-market asset 873

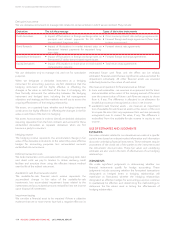

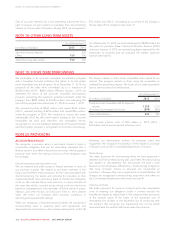

The table below shows derivative instruments assets and derivative

instruments liabilities reflected on our Consolidated Statements of

Financial Position.

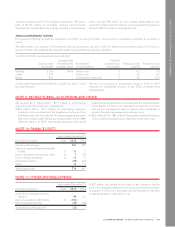

As at December 31

(In millions of dollars) 2015 2014

Current asset 198 136

Long-term asset 1,992 788

2,190 924

Current liability (15) (40)

Long-term liability (95) (11)

(110) (51)

Net mark-to-market asset 2,080 873

All of our currently outstanding debt derivatives, bond forwards,

and expenditure derivatives have been designated as hedges for

accounting purposes. In 2015, we recognized a $3 million

decrease to net income related to hedge ineffectiveness

(2014 – $2 million decrease).

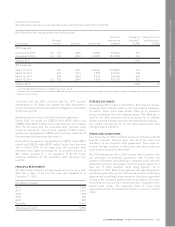

Debt derivatives

We entered into new debt derivatives in 2015 and 2014 to hedge

foreign currency risk associated with the principal and interest

components of the US dollar-denominated senior notes issued on

December 8, 2015 (note 21). The table below shows debt

derivatives we entered into to hedge senior notes issued during

2015 and 2014.

(In millions of

dollars, except for

coupon and

interest rates)

Effective date

US$ Hedging effect

Principal/

notional

amount

(US$)

Maturity

date

Coupon

rate

Fixed

hedged

Cdn$

interest

rate 1

Equivalent

Cdn$

2015 issuances

December 8, 2015 700 2025 3.625% 3.566% 937

December 8, 2015 300 2044 5.000% 5.145% 401

Total 1,000 1,338

2014 issuances

March 10, 2014 750 2044 5.000% 4.990% 832

1Converting from a fixed US$ coupon rate to a weighted average Cdn$ fixed rate.

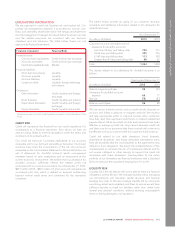

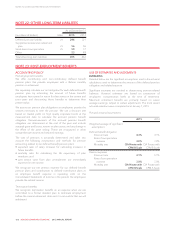

The table below shows debt derivatives that matured in

conjunction with the repayment or repurchase of the related senior

notes during 2015 and 2014 (see note 21).

(In millions of dollars)

Maturity date

Notional amount

(US$)

Net cash (proceeds)

settlement (Cdn$)

March 15, 2015 550 (106)

March 15, 2015 280 (48)

Total 830 (154)

March 1, 2014 750 (61)

March 15, 2014 350 26

Total 1,100 (35)

Upon the repayment of the related senior notes in March 2015, a

$7 million non-cash loss (2014 – $29 million non-cash loss) that was

previously deferred in the hedging reserve was recognized in net

income (see note 10). This loss relates to transactions in 2013

(2014 – transactions in 2008 and 2013) wherein contractual foreign

exchange rates on the related debt derivatives were renegotiated

to then-current rates.

118 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT