Rogers 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

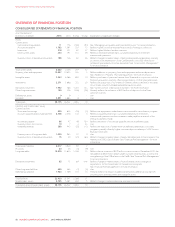

MANAGEMENT’S DISCUSSION AND ANALYSIS

Managing Our Liquidity and Financial Resources

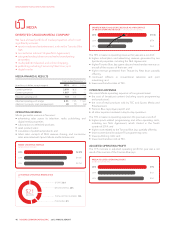

SOURCES AND USES OF CASH

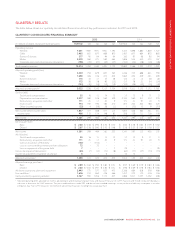

OPERATING, INVESTING AND FINANCING ACTIVITIES

Years ended December 31

(In millions of dollars) 2015 2014

Cash provided by operating activities before changes in non-cash working capital, income taxes paid, and

interest paid 5,004 4,925

Change in non-cash operating working capital items (302) 11

Cash provided by operating activities before income taxes paid and interest paid 4,702 4,936

Income taxes paid (184) (460)

Interest paid (771) (778)

Cash provided by operating activities 3,747 3,698

Investing activities:

Additions to property, plant and equipment (2,440) (2,366)

Additions to program rights (64) (231)

Changes in non-cash working capital related to property, plant and equipment and intangible assets (116) 153

Acquisitions and other strategic transactions, net of cash acquired (1,077) (3,456)

Other (70) (51)

Cash used in investing activities (3,767) (5,951)

Financing activities:

Proceeds received on short-term borrowings 294 276

Repayment of short-term borrowings (336) (84)

Issuance of long-term debt 7,338 3,412

Repayment of long-term debt (6,584) (2,551)

Proceeds on settlement of debt derivatives and forward contracts 1,059 2,150

Payments on settlement of debt derivatives, forward contracts, and bond forwards (930) (2,115)

Transaction costs incurred (9) (30)

Dividends paid (977) (930)

Cash (used in) provided by financing activities (145) 128

Change in cash and cash equivalents (165) (2,125)

Cash and cash equivalents, beginning of year 176 2,301

Cash and cash equivalents, end of year 11 176

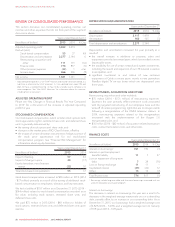

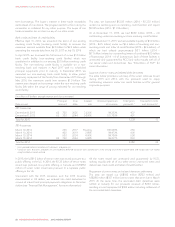

OPERATING ACTIVITIES

The 1% increase in cash provided by operating activities this year

was a result of lower cash income tax payments resulting from the

acquisition of Mobilicity, partially offset by higher net investment in

non-cash working capital.

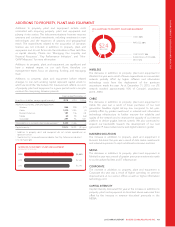

INVESTING ACTIVITIES

Additions to property, plant and equipment

We spent $2,440 million this year on property, plant and

equipment additions before changes in non-cash working capital

items, which was 3% higher than 2014. See “Additions to Property,

Plant and Equipment” for more information.

Acquisitions and other strategic transactions

We made total payments of $129 million this year related to the

acquisition of 2500 MHz spectrum licences and Shaw spectrum

licences (including $2 million of related transaction costs) and $948

million related to the acquisitions of Mobilicity, our investment in

Glentel, certain dealer stores, and IAI. Expenditures in 2014 were

for the acquisition of our 700 MHz spectrum and our acquisition of

Source Cable.

Additions to program rights

This year, we spent $64 million on additions to program rights. We

spent $231 million last year on additions to program rights

primarily as a result of the NHL Agreement.

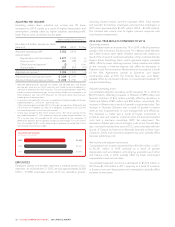

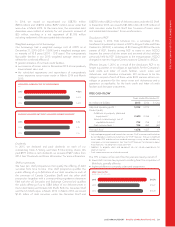

FINANCING ACTIVITIES

Accounts receivable securitization

The $294 million (2014 – $276 million) of funding we received this

year under our accounts receivable securitization program and the

related $336 million (2014 – $84 million) of repayments we made

changed our total funding under the program to $800 million as at

December 31, 2015 (2014 – $842 million). As at December 31,

2015, the program was committed to fund up to a maximum of

$1,050 million (2014 – $900 million). Effective January 2015, we

amended the terms of the program, increasing the maximum

potential proceeds under the program to $1.05 billion and

extending the term to January 1, 2018.

We continue to service and retain substantially all of the risks and

rewards relating to the accounts receivables we sell, and therefore,

the receivables remain recognized on our consolidated statements

of financial position and the funding received is recorded as short-

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 57