Rogers 2015 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

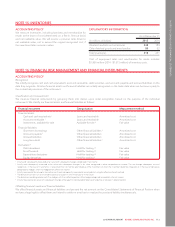

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

EXPLANATORY INFORMATION

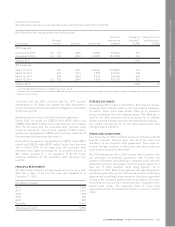

We are exposed to credit risk, liquidity risk, and market risk. Our

primary risk management objective is to protect our income, cash

flows, and ultimately, shareholder value. We design and implement

the risk management strategies discussed below to ensure our risks

and the related exposures are consistent with our business

objectives and risk tolerance. The table below shows our risk

exposure by financial instrument.

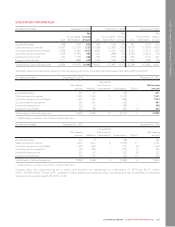

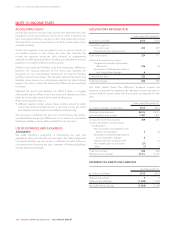

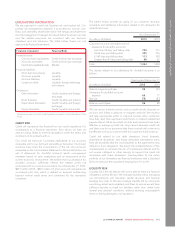

Financial instrument Financial Risks

Financial assets

Cash and cash equivalents Credit and foreign exchange

Accounts receivable Credit and foreign exchange

Investments, available-for-sale Market

Financial liabilities

Short-term borrowings Liquidity

Accounts payable Liquidity

Accrued liabilities Liquidity

Long-term debt Liquidity, foreign exchange

and interest

Derivatives 1

Debt derivatives Credit, liquidity and foreign

exchange

Bond forwards Credit, liquidity and interest

Expenditure derivatives Credit, liquidity and foreign

exchange

Equity derivatives Credit, liquidity and market

1Derivatives can be in an asset or liability position at a point in time historically or in the

future.

CREDIT RISK

Credit risk represents the financial loss we could experience if a

counterparty to a financial instrument, from whom we have an

amount owing, failed to meet its obligations under the terms and

conditions of its contracts with us.

Our credit risk exposure is primarily attributable to our accounts

receivable and to our debt and expenditure derivatives. Our broad

customer base limits the concentration of this risk. Our accounts

receivable on the Consolidated Statements of Financial Position are

net of allowances for doubtful accounts, which management

estimates based on prior experience and an assessment of the

current economic environment. We believe that our allowance for

doubtful accounts sufficiently reflects the related credit risk

associated with our accounts receivable. As at December 31, 2015,

$461 million (2014 – $461 million) of gross accounts receivable are

considered past due, which is defined as amounts outstanding

beyond normal credit terms and conditions for the respective

customers.

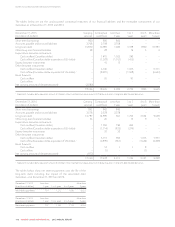

The tables below provide an aging of our customer accounts

receivable and additional information related to the allowance for

doubtful accounts.

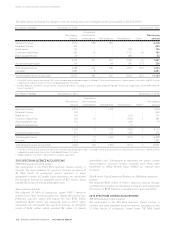

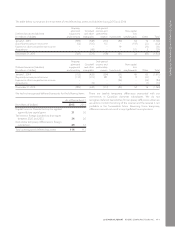

As at December 31

(In millions of dollars) 2015 2014

Customer accounts receivables (net of

allowance for doubtful accounts)

Less than 30 days past billing date 759 713

30-60 days past billing date 305 326

61-90 days past billing date 113 108

Greater than 90 days past billing date 66 62

Total 1,243 1,209

The activity related to our allowance for doubtful accounts is as

follows:

Years ended December 31

(In millions of dollars) 2015 2014

Balance, beginning of year 98 104

Allowance for doubtful accounts

expense 66 77

Net use (78) (83)

Balance, end of year 86 98

We use various internal controls, such as credit checks, deposits on

account, and billing in advance, to mitigate credit risk. We monitor

and take appropriate action to suspend services when customers

have fully used their approved credit limits or violated established

payment terms. While our credit controls and processes have been

effective in managing credit risk, they cannot eliminate credit risk

and there can be no assurance that these controls will continue to

be effective or that our current credit loss experience will continue.

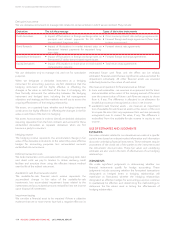

Credit risk related to our debt derivatives, bond forwards,

expenditure derivatives, and equity derivatives (derivatives) arises

from the possibility that the counterparties to the agreements may

default on their obligations. We assess the creditworthiness of the

counterparties to minimize the risk of counterparty default, and do

not require collateral or other security to support the credit risk

associated with these derivatives. Counterparties to the entire

portfolio of our derivatives are financial institutions with a Standard

& Poor’s rating (or the equivalent) ranging from A+ to AA-.

LIQUIDITY RISK

Liquidity risk is the risk that we will not be able to meet our financial

obligations as they fall due. We manage liquidity risk by managing

our commitments and maturities, capital structure, and financial

leverage (see note 3). We also manage liquidity risk by continually

monitoring actual and projected cash flows to ensure we will have

sufficient liquidity to meet our liabilities when due, under both

normal and stressed conditions, without incurring unacceptable

losses or risking damage to our reputation.

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 115