Rogers 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

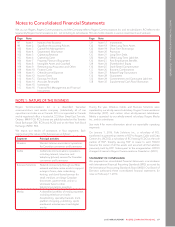

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2: SIGNIFICANT ACCOUNTING POLICIES

(a) BASIS OF PRESENTATION

All amounts are in Canadian dollars unless otherwise noted. Our

functional currency is the Canadian dollar. We prepare the

consolidated financial statements on a historical cost basis, except

for:

• certain financial instruments as disclosed in note 16, which are

measured at fair value;

• liabilities for stock-based compensation, which are measured at

fair value; and

• the net deferred pension liability, which is measured as

described in note 23.

(b) BASIS OF CONSOLIDATION

Subsidiaries are entities we control. We include the financial

statements of our subsidiaries in our consolidated financial

statements from the date we gain control of them until our control

ceases. We eliminate all intercompany transactions and balances

between our subsidiaries on consolidation.

(c) FOREIGN CURRENCY TRANSLATION

We translate amounts denominated in foreign currencies into

Canadian dollars as follows:

• monetary assets and monetary liabilities – at the exchange rate in

effect as at the date of the Consolidated Statements of Financial

Position;

• non-monetary assets, non-monetary liabilities, and related

depreciation and amortization expenses – at the historical

exchange rates; and

• revenue and expenses other than depreciation and amortization

– at the average rate for the month in which the transaction was

recognized.

(d) NEW ACCOUNTING PRONOUNCEMENTS ADOPTED IN

2015

We did not adopt any new or amended accounting

pronouncements that had a material impact on our 2015 annual

consolidated financial statements.

(e) ADDITIONAL SIGNIFICANT ACCOUNTING POLICIES,

ESTIMATES, AND JUDGMENTS

When preparing our consolidated financial statements,

management makes judgments, estimates, and assumptions that

affect how accounting policies are applied and the amounts we

report as assets, liabilities, revenue, and expenses. Our significant

accounting policies, estimates, and judgments are identified in this

note. Furthermore, the following information is disclosed

throughout the notes as identified in the table below:

• information about assumptions and estimation uncertainties that

have a significant risk of resulting in a material adjustment to the

amounts recognized in the consolidated financial statements;

• information about judgments made in applying accounting

policies that have the most significant effect on the amounts

recognized in the consolidated financial statements; and

• information on our significant accounting policies.

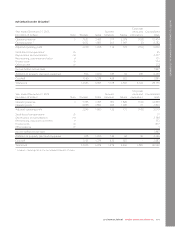

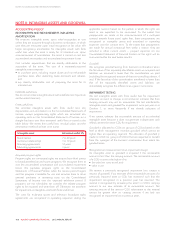

Note Topic Page Accounting Policy Use of Estimates Use of Judgments

4 Reportable Segments 100 X X

5 Revenue Recognition 102 X

7 Property, Plant and Equipment 104 X X X

8 Intangible Assets and Goodwill 106 X X X

12 Income Taxes 110 X X

13 Earnings Per Share 112 X

14 Accounts Receivable 112 X

15 Inventories 113 X

16 Financial Instruments 113 X X X

17 Investments 121 X

20 Provisions 122 X

23 Post-Employment Benefits 126 X X

25 Stock-Based Compensation 130 X X

26 Business Combinations 133 X X

29 Commitments and Contingent Liabilities 136 X X

98 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT