Rogers 2015 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

business and sell telecommunication products and services. The

acquisition of the dealer stores provided increased product

penetration.

Source Cable Limited (Source)

In November 2014, we acquired 100% of the common shares of

Source for cash consideration of $156 million. Source is a television,

Internet, and phone service provider situated in Hamilton, Ontario,

and its subscriber footprint is situated adjacent to existing Rogers

cable systems.

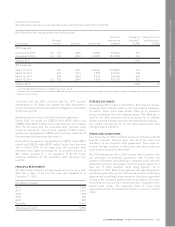

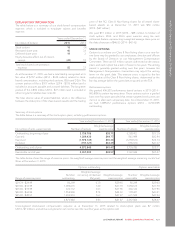

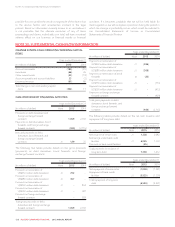

Final fair values of assets acquired and liabilities assumed

The table below summarizes the final fair values of the assets

acquired and liabilities assumed for all the acquisitions described

above.

(In millions of dollars)

Source

Cable

Dealer

stores Total

Fair value of consideration

transferred 156 46 202

Net identifiable asset or liability:

Cash 1 – 1

Current assets 2 2 4

Property, plant and

equipment 9 – 9

Customer relationships 138 35 73

Current liabilities (6) – (6)

Other liabilities (2) – (2)

Deferred tax liabilities (9) – (9)

Fair value of net identifiable assets

acquired and liabilities assumed 33 37 70

Goodwill 123 9 132

Acquisition transaction costs 1 – 1

Goodwill allocated to the

following segments Cable Wireless

1Customer relationships are amortized over a period of 5 years

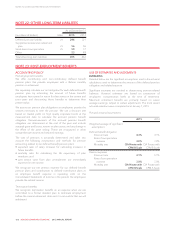

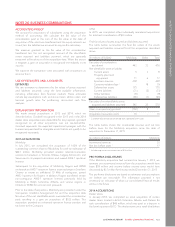

NOTE 27: RELATED PARTY TRANSACTIONS

CONTROLLING SHAREHOLDER

Our ultimate controlling shareholder is the Rogers Control Trust

(the Trust), which holds voting control of RCI. The beneficiaries of

the Trust are members of the Rogers family. Certain directors of RCI

represent the Rogers family.

We entered into certain transactions with private Rogers family

holding companies controlled by the Trust. These transactions, as

summarized below, were recognized at the amount agreed to by

the related parties and are subject to the terms and conditions of

formal agreements approved by the Audit and Risk Committee.

TRANSACTIONS WITH KEY MANAGEMENT PERSONNEL

Key management personnel include the directors and our most

senior corporate officers, who are primarily responsible for

planning, directing and controlling our business activities.

134 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT