Rogers 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

In 2014, we repaid or repurchased our US$750 million

($834 million) and US$350 million ($387 million) senior notes that

were due in March 2014. At the same time, the associated debt

derivatives were settled at maturity for net proceeds received of

$35 million, resulting in a net repayment of $1,186 million

including settlement of the associated debt derivatives.

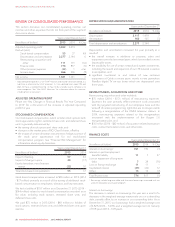

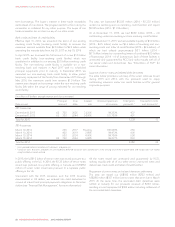

Weighted average cost of borrowings

Our borrowings had a weighted average cost of 4.82% as at

December 31, 2015 (2014 – 5.20%) and a weighted average term

to maturity of 10.8 years (2014 – 10.8 years). This comparatively

favourable decline in our 2015 weighted average interest rate

reflects the combined effects of:

• greater utilization of our bank credit facilities;

• our issuance of senior notes in December 2015 at comparatively

lower interest rates; and

• the scheduled repayments and repurchases of comparatively

more expensive senior notes made in March 2014 and March

2015.

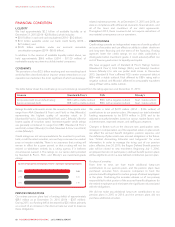

(%)

WEIGHTED AVERAGE COST OF BORROWINGS

2015

2014

2013

4.82%

5.20%

5.54%

RATIO OF ADJUSTED NET DEBT / ADJUSTED OPERATING PROFIT

2015

2014

2013

3.1x

2.9x

2.3x

Dividends

In 2015, we declared and paid dividends on each of our

outstanding Class A Voting and Class B Non-Voting shares. We

paid $977 million in cash dividends, an increase of $47 million from

2014. See “Dividends and Share Information” for more information.

Shelf prospectuses

We have two shelf prospectuses that qualify the offering of debt

securities from time to time. One shelf prospectus qualifies the

public offering of up to $4 billion of our debt securities in each of

the provinces of Canada (Canadian Shelf) and the other shelf

prospectus (together with a corresponding registration statement

filed with the US Securities and Exchange Commission) qualifies

the public offering of up to US$4 billion of our debt securities in

the United States and Ontario (US Shelf). Both the Canadian Shelf

and the US Shelf expire in March 2016. In March 2014, we issued

$1.25 billion of debt securities under the Canadian Shelf and

US$750 million ($832 million) of debt securities under the US Shelf.

In December 2015, we issued US$1,000 million ($1,338 million) of

debt securities under the US Shelf. See “Issuance of senior notes

and related debt derivatives” for more information.

Dissolution of RCP

On January 1, 2016, Fido Solutions Inc., a subsidiary of RCI,

transferred its partnership interest in RCP to Rogers Cable and Data

Centres Inc. (RCDCI), a subsidiary of RCI, leaving RCDCI as the sole

partner of RCP, thereby causing RCP to cease to exist. RCDCI

became the owner of all the assets and assumed all the liabilities

previously held by RCP. Subsequent to the reorganization, RCDCI

changed its name to Rogers Communications Canada Inc. (RCCI).

Effective January 1, 2016, as a result of the dissolution, RCP is no

longer a guarantor, or co-obligor, as applicable, for the Company’s

bank credit and letter of credit facilities, senior notes and

debentures, and derivative instruments. RCI continues to be the

obligor in respect of each of these, while RCCI remains either a co-

obligor or guarantor for the senior notes and debentures and a

guarantor, as applicable, for the bank credit and letter of credit

facilities and derivative instruments.

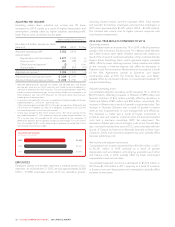

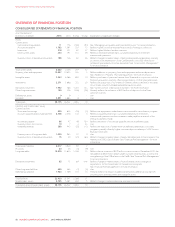

FREE CASH FLOW

Years ended December 31

(In millions of dollars) 2015 2014 % Chg

Adjusted operating profit 15,032 5,019 –

Deduct (add):

Additions to property, plant and

equipment 22,440 2,366 3

Interest on borrowings, net of

capitalized interest 732 756 (3)

Cash income taxes 3184 460 (60)

Free cash flow 11,676 1,437 17

1Adjusted operating profit and free cash flow are non-GAAP measures and should not

be considered as a substitute or alternative for GAAP measures. They are not defined

terms under IFRS, and do not have standard meanings, so may not be a reliable way

to compare us to other companies. See “Non-GAAP Measures” for information about

these measures, including how we calculate them.

2Additions to property, plant and equipment do not include expenditures for

spectrum licences.

3Cash income taxes are net of refunds received.

The 17% increase in free cash flow this year was mainly a result of:

• lower cash income tax payments resulting from the acquisition of

Mobilicity; partially offset by

• higher additions to property, plant and equipment.

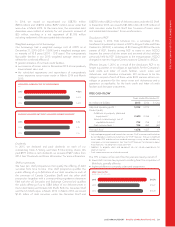

(IN MILLIONS OF DOLLARS)

FREE CASH FLOW

2015

2014

2013

$1,676

$1,437

$1,548

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 59