Rogers 2015 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

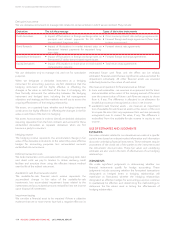

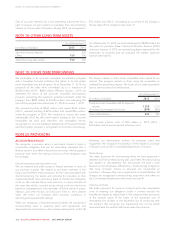

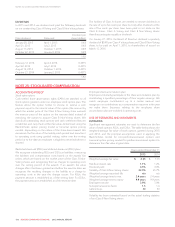

Each of the above senior notes and debentures are unsecured and,

as at December 31, 2015 and December 31, 2014, were

guaranteed by RCP, ranking equally with all of RCI’s other senior

notes, debentures, bank credit facilities, and letter of credit facilities.

We use derivatives to hedge the foreign exchange risk associated

with the principal and interest components of all of our US dollar-

denominated senior notes and debentures (see note 16).

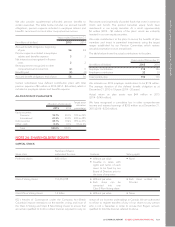

Effective January 1, 2016, as a result of the dissolution of RCP (see

note 1), RCP is no longer a guarantor or co-obligor, as applicable,

for the Company’s bank credit and letter of credit facilities, senior

notes and debentures, and derivative instruments. RCI continues to

be the obligor in respect of each of these, while RCCI is either a co-

obligor or guarantor for the senior notes and debentures and a

guarantor, as applicable, for the bank credit and letter of credit

facilities and derivative instruments.

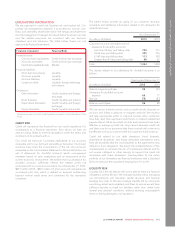

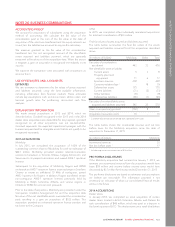

WEIGHTED AVERAGE INTEREST RATE

Our effective weighted average rate on all debt and short-term

borrowings, as at December 31, 2015, including the effect of all of

the associated debt derivative instruments and the exercised bond

forward, was 4.82% (2014 – 5.20%).

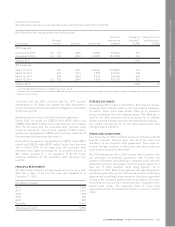

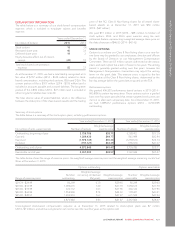

BANK CREDIT AND LETTER OF CREDIT FACILITIES

In 2015, we entered into a new bank credit facility (non-revolving

credit facility) that provides access to $1.0 billion of non-revolving

borrowings, in addition to our existing $2.5 billion revolving credit

facility (revolving credit facility). The non-revolving credit facility

matures in April 2017 with no scheduled principal repayments prior

to maturity. The interest rate charged on borrowings under the

non-revolving credit facility falls within the range of pricing

indicated for our revolving credit facility.

In December 2015, we amended our non-revolving bank credit

facility to allow partial, temporary repayment of this facility from

December 2015 through May 2016; the maximum credit limit

remains $1.0 billion.

During 2015, we borrowed $6,025 million (2014 – $1,330 million)

under our revolving and non-revolving credit facilities and repaid

$5,525 million (2014 – $1,330 million) (see note 30).

In April 2014, we re-negotiated the terms of our revolving credit

facility to increase the maximum amount available from $2.0 billion

to $2.5 billion while extending the maturity date from July 2017 to

July 2019. The $2.5 billion revolving credit facility is available on a

fully revolving basis until maturity and there are no scheduled

reductions prior to maturity. The interest rate charged on

borrowings from the revolving credit facility ranges from nil to

1.25% per annum over the bank prime rate or base rate, or 0.85%

to 2.25% (1.00% to 2.25% prior to April 2014) over the bankers’

acceptance rate or London Inter-Bank Offered Rate.

In April 2014, we arranged for the return and cancellation of

approximately $0.4 billion of letters of credit that were issued in

relation to the 700 MHz spectrum licence auction completed in

early 2014 and the corresponding letter of credit facility was

permanently cancelled.

As at December 31, 2015, we had $500 million (2014 – nil)

outstanding under our revolving and non-revolving credit facilities.

As at December 31, 2015, we had available liquidity of $3.0 billion

(2014 – $2.5 billion) under our $3.6 billion of revolving and non-

revolving credit and letter of credit facilities (2014 – $2.6 billion), of

which we had utilized approximately $0.1 billion (2014 – $0.1

billion) related to outstanding letters of credit and $0.5 billion of

borrowings (2014 – nil).

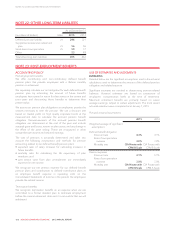

SENIOR NOTES AND DEBENTURES

Interest is paid on our senior notes as follows:

• semi-annually on all of our fixed rate senior notes and

debentures; and

• quarterly on our floating rate senior notes.

We have the option to redeem each of our fixed rate senior notes

and debentures, in whole or in part, at any time, if we pay the

premiums specified in the corresponding agreements.

124 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT