Rogers 2015 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

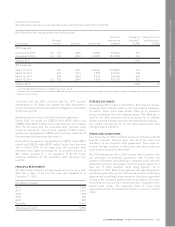

NOTE 17: INVESTMENTS

ACCOUNTING POLICY

Investments in publicly traded and private companies

We classify our investments in publicly traded and private

companies where we have no control or significant influence as

available-for-sale investments and account for them as follows:

• publicly traded companies – at fair value based on publicly

quoted prices; and

• private companies – at fair value using implied valuations from

follow-on financing rounds, third party sale negotiations, or

market-based approaches.

Investments in associates and joint arrangements

An entity is an associate when we have significant influence over the

entity’s financial and operating policies but do not control it. We

are generally presumed to have significant influence over an entity

when we hold more than 20% of the voting power.

A joint arrangement exists when there is a contractual agreement

that establishes joint control over activities and requires unanimous

consent for strategic financial and operating decisions. We classify

our interests in joint arrangements into one of two categories:

• joint ventures – when we have the rights to the net assets of the

arrangement; and

• joint operations – when we have the rights to the assets and

obligations for the liabilities related to the arrangement.

We use the equity method to account for our investments in

associates and joint ventures; we recognize our proportionate

interest in the assets, liabilities, revenue, and expenses of our joint

operations.

We recognize our investments in associates and joint ventures

initially at cost and then increase or decrease the carrying amounts

based on our share of each entity’s income or loss after initial

recognition. Distributions we receive from these entities reduce the

carrying amounts of our investments.

We eliminate unrealized gains and losses from our investments in

associates or joint ventures against our investments, up to the

amount of our interest in the entities.

Impairment in associates and joint ventures

At the end of each reporting period, we assess whether there is

objective evidence that impairment exists in our investments in

associates and joint ventures. If objective evidence exists, we

compare the carrying amount of the investment to its recoverable

amount and recognize the excess over the recoverable amount, if

any, as a loss in net income.

EXPLANATORY INFORMATION

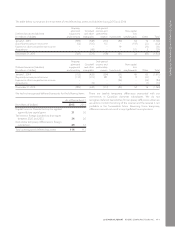

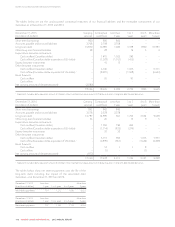

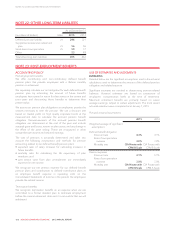

As at December 31

(In millions of dollars) 2015 2014

Investments in:

Publicly traded companies 966 1,130

Private companies 212 161

Investments, available-for-sale 1,178 1,291

Investments, associates and joint ventures 1,093 607

Total investments 2,271 1,898

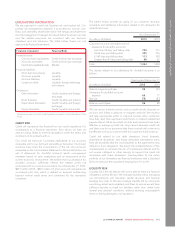

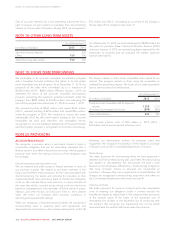

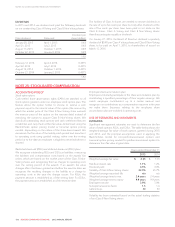

INVESTMENTS, AVAILABLE-FOR-SALE

Publicly traded companies

We hold interests in a number of publicly traded companies. This

yearwerecognizedrealizedlossesofnilandunrealizedlossesof

$164 million (2014 – $3 million of realized gains and $325 million

of unrealized gains) with a corresponding decrease in net income

and other comprehensive income, respectively.

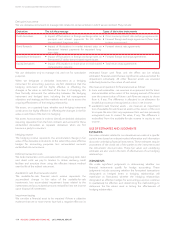

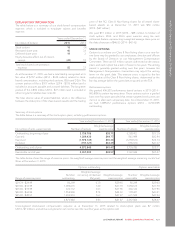

INVESTMENTS, ASSOCIATES, AND JOINT VENTURES

We have interests in a number of associates and joint ventures,

some of which include:

Maple Leaf Sports and Entertainment Limited (MLSE)

MLSE, a sports and entertainment company, owns and operates

the Air Canada Centre, the NHL’s Toronto Maple Leafs, the NBA’s

Toronto Raptors, MLS’ Toronto FC, the AHL’s Toronto Marlies, and

other assets. We, along with BCE Inc. (BCE), jointly own an indirect

net 75% equity interest in MLSE with our portion representing a

37.5% equity interest in MLSE. Our investment in MLSE is

accounted for as a joint venture using the equity method.

shomi

In 2014, we entered into a joint venture equally owned by Rogers

and Shaw to develop, launch, and operate a premium subscription

video-on-demand service offering movies and television series for

viewing online and through cable set-top boxes. Our investment in

shomi is accounted for as a joint venture using the equity method.

Glentel

In 2015, we completed our purchase of 50% of the common

shares of Glentel Inc. (Glentel) from BCE for cash consideration of

$473 million such that Glentel is jointly owned by us and BCE.

Glentel is a large, multicarrier mobile phone retailer with several

hundred Canadian wireless retail distribution outlets, as well as

operations in the US and Australia. Our investment in Glentel is

accounted for as a joint venture using the equity method.

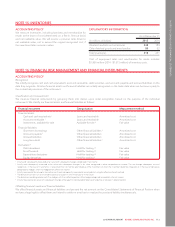

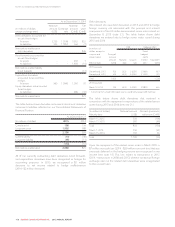

The following table provides summary financial information on all

our associates and joint ventures and our portions thereof. We

recognize our investments in joint ventures and associates using

the equity method.

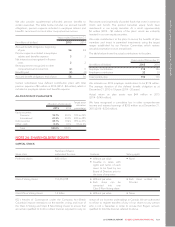

As at or years ended December 31

(In millions of dollars) 2015 2014

Current assets 1,024 261

Long-term assets 3,295 2,577

Current liabilities (935) (432)

Long-term liabilities (1,221) (1,247)

Total net assets 2,163 1,159

Our share of net assets 1,086 580

Revenue 1,958 714

Expenses (2,178) (736)

Total net loss (220) (22)

Our share of net loss (99) (11)

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 121