Rogers 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

COMMITMENTS AND OTHER CONTRACTUAL OBLIGATIONS

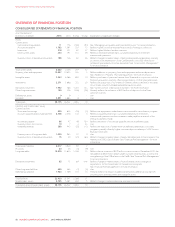

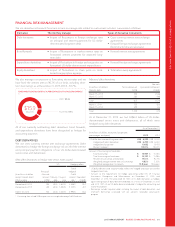

CONTRACTUAL OBLIGATIONS

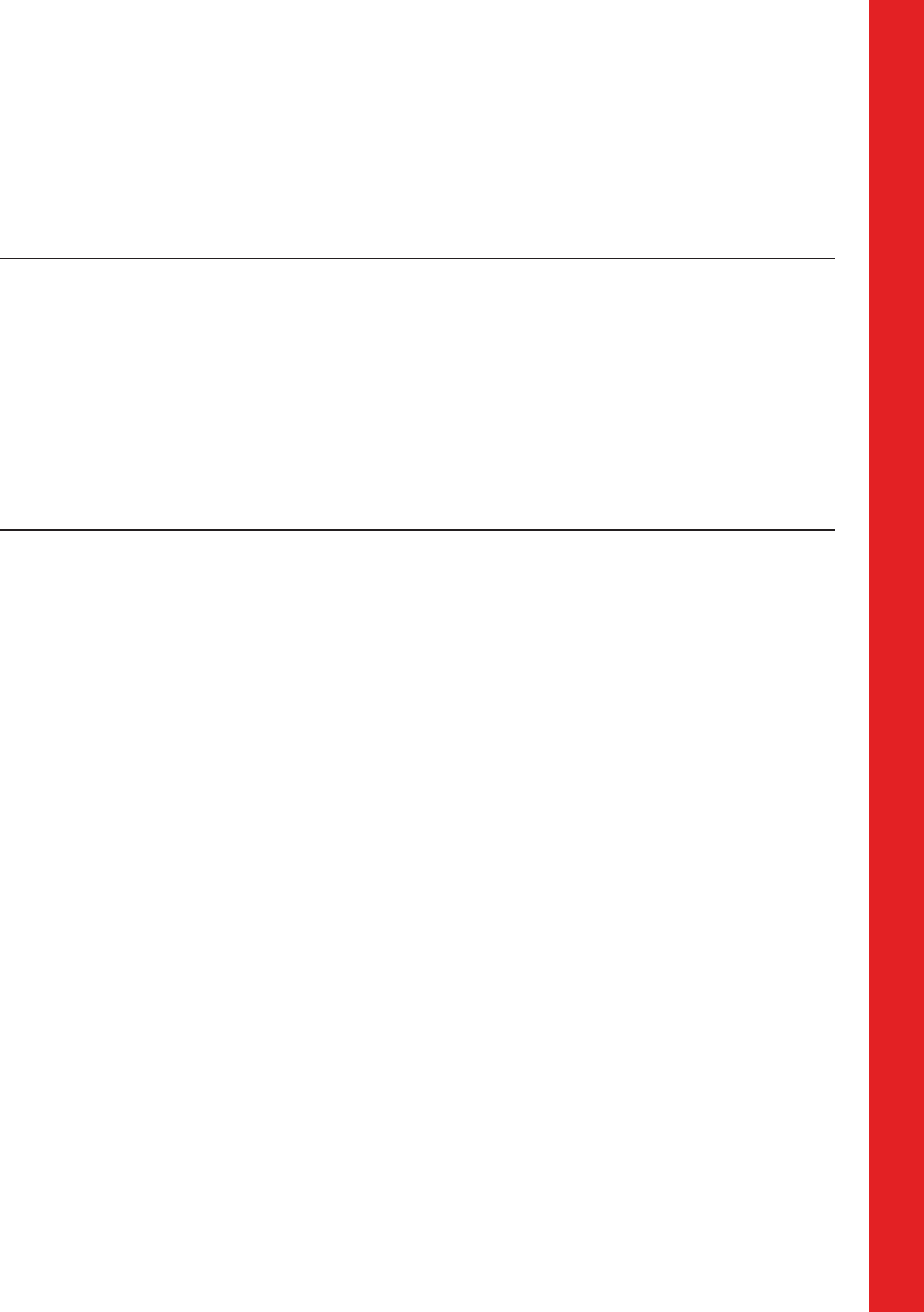

The table below shows a summary of our obligations under firm contractual arrangements as at December 31, 2015. See notes 3, 22, and

29 to our 2015 audited consolidated financial statements for more information.

(In millions of dollars)

Less than

1 Year 1-3 Years 4-5 Years

After

5Years Total

Short-term borrowings 800 – – – 800

Long-term debt 11,000 3,188 1,800 10,993 16,981

Net interest payments 714 1,313 1,042 6,025 9,094

Debt derivative instruments 2– (503) – (1,332) (1,835)

Expenditure derivative instruments 2(138) (25) – – (163)

Bond forwards 2–91 ––91

Operating leases 153 229 114 64 560

Player contracts 3137 166 80 – 383

Purchase obligations 4457 286 136 94 973

Property, plant and equipment 85 110 51 36 282

Intangible assets 45 75 24 12 156

Program rights 5620 1,135 1,096 2,948 5,799

Other long-term liabilities – 19 5 4 28

Total 3,873 6,084 4,348 18,844 33,149

1Principal obligations of long-term debt (including current portion) due at maturity.

2Net (receipts) disbursements due at maturity. US dollar amounts have been translated into Canadian dollars at the Bank of Canada year-end rate.

3Player contracts are Toronto Blue Jays players’ salary contracts into which we have entered and are contractually obligated to pay.

4Purchase obligations are the contractual obligations under service, product, and handset contracts we have committed to for at least the next five years.

5Program rights are the agreements into which we have entered to acquire broadcasting rights for sports broadcasting programs and films for periods in excess of one year at

contract inception.

OFF-BALANCE SHEET ARRANGEMENTS

GUARANTEES

As a regular part of our business, we enter into agreements that

provide for indemnification and guarantees to counterparties in

transactions involving business sale and business combination

agreements, sales of services, and purchases and development of

assets. Due to the nature of these indemnifications, we are unable

to make a reasonable estimate of the maximum potential amount

we could be required to pay counterparties. Historically, we have

not made any significant payment under these indemnifications or

guarantees. See note 28 to our 2015 audited consolidated

financial statements.

OPERATING LEASES

We have entered into operating leases for the rental of premises,

distribution facilities, equipment and wireless towers, and other

contracts. Terminating any of these lease agreements would not

have a material adverse effect on us as a whole. See “Commitments

and Other Contractual Obligations” and note 29 to our 2015

audited consolidated financial statements for quantification.

Governance and Risk Management

GOVERNANCE AT ROGERS

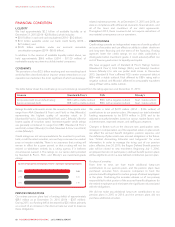

Rogers is a family-founded, family-controlled company and we take

pride in our proactive and disciplined approach to ensuring that

our governance structure and practices instil the confidence of our

shareholders.

With the passing in December 2008 of our founder and previous

President and CEO, Ted Rogers, his voting control of Rogers

Communications passed to a trust, the beneficiaries of which are

members of the Rogers family. The trust holds voting control of

Rogers Communications for the benefit of successive generations

of the Rogers family via the trust’s ownership of 90.9% of the

outstanding Class A Voting shares of the Company. The Rogers

family are substantial stakeholders and owned approximately 28%

of our equity as of December 31, 2015 (2014 – 28%) through its

ownership of a combined total of 142 million Class A Voting and

Class B Non-Voting shares (2014 – 142 million).

Our Board is made up of four members of the Rogers family and

another 11 directors who bring a rich mix of experience as business

leaders in North America. All of our directors are firmly committed

to firm governance, strong oversight, and the ongoing creation of

shareholder value. The Board as a whole is committed to sound

corporate governance and continually reviews its governance

practices and benchmarks them against acknowledged leaders

and evolving legislation. The Board believes that Rogers’

governance system is effective and that there are appropriate

structures and procedures in place.

GOVERNANCE BEST PRACTICES

The majority of our directors are independent and we have

adopted many best practices for effective governance, including:

• separation of CEO and chairman roles;

• independent lead director;

• formal corporate governance policy and charters;

• code of business conduct and whistleblower hotline;

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 65