Rogers 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OPERATING REVENUE

Our operating revenue depends on the size of our subscriber base,

the revenue per account, the revenue from the sale of wireless

devices, and other equipment sales.

Network revenue

Network revenue includes revenue derived from voice and data

services from:

• postpaid and prepaid monthly fees;

•datausage;

•airtime;

•longdistancecharges;

• essential services charges;

• inbound and outbound roaming charges; and

• certain fees.

The 2% increase in network revenue this year was a result of:

• the continued adoption of customer-friendly Rogers Share

Everything plans, which generate higher postpaid ARPA, bundle

in various calling features and long distance, provide the ability

to pool data usage across multiple devices, and grant access to

our other offerings, such as Roam Like Home, Rogers NHL

GameCentre LIVE, Spotify Premium, shomi, and Texture by Next

Issue;

• our acquisition of Mobilicity; and

• an adjustment pertaining to the anticipated usage of our loyalty

programs; partially offset by

• a 13% decrease in roaming revenue this year as a result of

changes to roaming plans, including the introduction of Roam

Like Home in the US, Caribbean, Mexico, Latin America, and

Europe, which simplify the customer experience and provide

greater value to the customer.

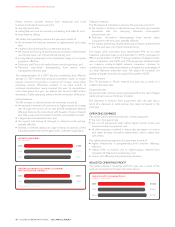

The 4% increase in postpaid ARPA was a result of the continued

adoption of Rogers Share Everything plans relative to the number

of subscriber accounts as customers increasingly utilize the

advantages of premium offerings and access their shareable plans

with multiple devices on the same account.

($)

No data available for the year 2013.

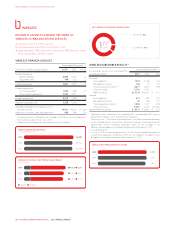

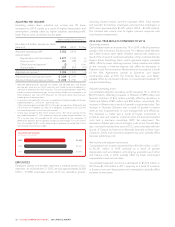

POSTPAID ARPA

2015

2014

$110.74

$106.41

SHARE EVERYTHING SUBSCRIBERS AS A PERCENTAGE OF OUR

ROGERS-BRANDED POSTPAID SUBSCRIBER BASE (%)

2015

2014

2013

51%

31%

7%

The 1% increase in blended ARPU this year was a result of:

• increased network revenue as discussed above; partially offset by

• the impact of expanding our lower-blended-ARPU-generating

prepaid subscriber base relative to our total subscriber base as a

result of our acquisition of Mobilicity and the general increase in

prepaid net additions; and

• the inclusion of lower-blended-ARPU-generating Wireless Home

Phone subscribers in our postpaid base.

Excluding the impact of roaming revenue and the addition of

Mobilicity and Wireless Home Phone subscribers, blended ARPU

would have increased by 4% this year.

We believe the increases in gross and net additions to our postpaid

subscriber base and stable postpaid churn this year were results of

our strategic focus on enhancing the customer experience by

providing higher-value offerings, such as our new Share Everything

plans, and improving our customer service. Significantly, this was

achieved during the industry’s “double cohort” period and with

heightened competitive activity.

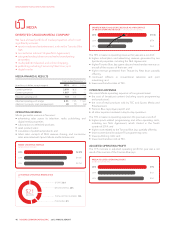

(IN THOUSANDS)

Not applicable for 2013.

ROAM LIKE HOME SUBSCRIBERS

2015

2014

2,252

457

The “double cohort” refers to the greater-than-usual number of

subscriber contracts that ended as both three-year and two-year

contracts expired near the same time. This industry-wide impact

commenced late in the second quarter of 2015 and will generally

result in subscribers being on shorter-term contracts than in the

past.

We activated and upgraded approximately 3.0 million

smartphones for new and existing subscribers this year, compared

to approximately 2.6 million in 2014. The increase was due to an

11% increase in hardware upgrades and a 9% increase in gross

additions.

The increase in our prepaid subscriber base was primarily a result of

the acquisition of approximately 154,000 subscribers upon our

acquisition of Mobilicity and an increase in net additions of 75,000

subscribers mainly due to our chatr national expansion initiative.

Equipment sales

Equipment sales (net of subsidies) include revenue from sales to:

• independent dealers, agents, and retailers; and

• subscribers through fulfillment by Wireless’ customer service

groups, websites, telesales, and corporate stores.

The 33% increase in revenue from equipment sales this year, in part

due to the impact of the industry’s double cohort, was a result of:

• 11% more device upgrades by existing subscribers; and

• increases in equipment sales prices.

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 43