Rogers 2015 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

RESTRICTED SHARE UNITS

The RSU plan allows employees, officers and directors to

participate in the growth and development of Rogers. Under the

terms of the plan, RSUs are issued to the participant and the units

issued vest over a period of up to three years from the grant date.

On the vesting date, we will redeem all of the participants’ RSUs in

cash or by issuing one Class B Non-Voting share for each RSU. We

have reserved 4,000,000 Class B Non-Voting shares for issue under

this plan. We granted 683,095 RSUs in 2015 (2014 – 1,088,951).

Performance RSUs

We granted 114,979 performance-based RSUs in 2015 (2014 –

313,291) to certain key executives. The number of units that vest

and will be paid three years from the grant date will be within 50%

to 150% of the initial number granted based upon the

achievement of certain annual and cumulative three-year non-

market targets.

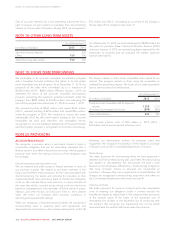

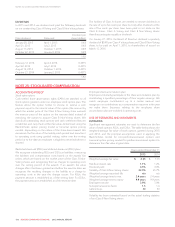

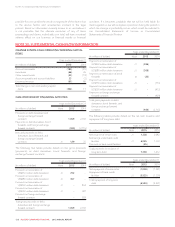

Summary of RSUs

The table below is a summary of the RSUs outstanding, including

performance RSUs.

Years ended December 31

(In number of units) 2015 2014

Outstanding, beginning of year 2,765,255 2,472,390

Granted and reinvested dividends 798,074 1,402,242

Exercised (822,972) (828,645)

Forfeited (255,952) (280,732)

Outstanding, end of year 2,484,405 2,765,255

Unrecognized stock-based compensation expense as at

December 31, 2015 related to these RSUs was $41 million (2014 –

$48 million) and will be recognized in net income over the next

three years as the RSUs vest.

DEFERRED SHARE UNIT PLAN

The DSU plan allows directors, certain key executives, and other

senior management to elect to receive certain types of

compensation in DSUs. Under the terms of the plan, DSUs are

issued to the participant and the units issued cliff vest over a period

of up to three years from the grant date.

Performance DSUs

We granted 443,139 performance-based DSUs in 2015 (2014 – nil)

to certain key executives. The number of units that vest and will be

paid three years from the grant date will be within 50% to 150% of

the initial number granted based upon the achievement of certain

annual and cumulative three-year non-market targets.

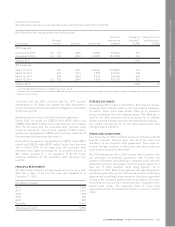

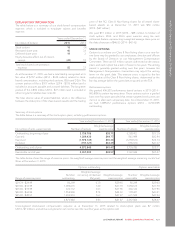

Summary of DSUs

The table below is a summary of the DSUs outstanding, including

performance DSUs.

Years ended December 31

(In number of units) 2015 2014

Outstanding, beginning of year 826,891 700,912

Granted and reinvested dividends 1,324,169 125,979

Exercised (257,677) –

Forfeited (122,512) –

Outstanding, end of year 1,770,871 826,891

Unrecognized stock-based compensation expense as at

December 31, 2015, related to these DSUs was $26 million (2014 –

$2 million) and will be recognized in net income over the next

three years as the executive DSUs vest. All other DSUs are fully

vested.

EMPLOYEE SHARE ACCUMULATION PLAN

Participation in the plan is voluntary. Employees can contribute up

to 10% of their regular earnings through payroll deductions (up to

an annual maximum of $25,000). The plan administrator purchases

our Class B Non-Voting shares on a monthly basis on the open

market on behalf of the employee. At the end of each month, we

make a contribution of 25% to 50% of the employee’s contribution

that month, and the plan administrator uses this amount to

purchase additional shares on behalf of the employee. We

recognize our contributions made as a compensation expense.

Compensation expense related to the employee share

accumulation plan was $38 million in 2015 (2014 – $38 million).

EQUITY DERIVATIVES

We have entered into equity derivatives to hedge a portion of our

stock-based compensation expense (see note 16) and recognized

a $22 million gain (2014 – $10 million loss) in stock-based

compensation expense for these derivatives.

132 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT