Rogers 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

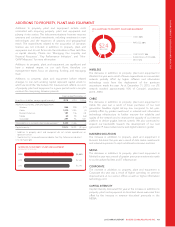

Loss on repayment of long-term debt

We recognized a $7 million loss on repayment of long-term debt

this year (2014 – $29 million loss) related to debt derivatives

associated with the repayment or repurchase of certain senior

notes in March 2015 and March 2014. These losses were deferred

in the hedging reserve until maturity of the notes and were then

recognized in net income. The 2015 loss relates to transactions in

2013 (2014 – transactions in 2008 and 2013) wherein foreign

exchange rates on the related debt derivatives were updated to

then-current rates.

Foreign exchange losses recognized in 2015 and 2014 were

primarily related to the impact of fluctuations in the value of the

Canadian dollar relative to the US dollar on working capital,

consisting mainly of the unhedged portion of our US dollar-

denominated accounts payable. During 2015, all of our US dollar-

denominated debt was hedged for accounting purposes.

See “Managing our Liquidity and Financial Resources” for more

information about our debt and related finance costs.

OTHER (INCOME) EXPENSE

Theincreaseinotherincomethisyearwasaresultof:

• a $102 million gain on acquisition of Mobilicity; partially offset by

• lower equity income pertaining to our various investments and

joint ventures, which included a $72 million loss related to our

share of an obligation to purchase at fair value the non-

controlling interest in one of our joint ventures, partially offset by

our share of a gain related to tax recoveries in one of our joint

ventures.

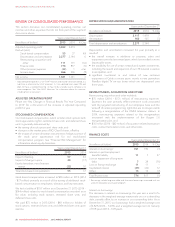

INCOME TAXES

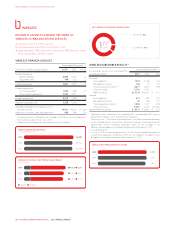

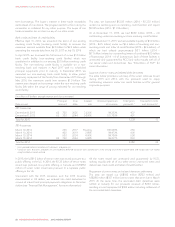

The table below shows the difference between income taxes

computed by applying the statutory income tax rate to income

before income taxes and the actual income tax expense for the

year:

Years ended December 31

(In millions of dollars, except tax rates) 2015 2014

Statutory income tax rate 26.5% 26.5%

Income before income taxes 1,847 1,847

Computed income tax expense 489 489

Increase (decrease) in income taxes

resulting from:

Non-deductible (non-taxable)

stock-based compensation 5(2)

Income tax adjustment, legislative

tax change 614

Non-taxablegainonacquisition (27) –

Other items (7) 5

Total income taxes 466 506

Effectiveincometaxrate 25.2% 27.4%

Cash income taxes paid 184 460

Our effective income tax rate this year was 25.2% compared to

27.4% for 2014. The effective income tax rate for 2015 was lower

than the statutory tax rate primarily as a result of the non-taxable

gain on the acquisition of Mobilicity, partially offset by a deferred

tax revaluation due to an increase in the Alberta corporate income

tax rate.

Cash income taxes paid this year decreased as a result of the

utilization of tax loss carryforwards acquired as part of the Mobilicity

transaction.

In 2011, legislative changes eliminated the deferral of partnership

income, thereby accelerating the payment of approximately

$700 million of previously deferred cash taxes over a five-year

amortization period, beginning in 2012, at 15%, 20% in each of

2013 through 2015, and 25% in 2016. Our cash income tax

payments for the 2016 taxation year will continue to include this

additional amount. While the elimination of the deferral of

partnership income affects the timing of cash income tax

payments, it does not affect our income tax expense for accounting

purposes. See “About Forward-Looking Information” for more

information.

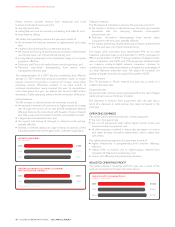

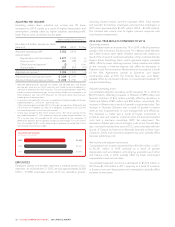

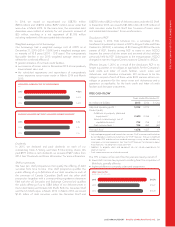

NET INCOME

Net income was 3% higher than last year. See “Key Changes in

Financial Results this Year Compared to 2014” for more

information.

Years ended December 31

(In millions of dollars, except per share

amounts) 2015 2014 % Chg

Net income 1,381 1,341 3

Basic earnings per share $2.68 $2.60 3

Diluted earnings per share $2.67 $2.56 4

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 51