Rogers 2015 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Derivative instruments

We use derivative instruments to manage risks related to certain activities in which we are involved. They include:

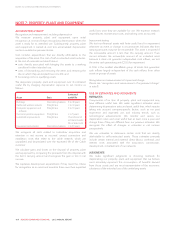

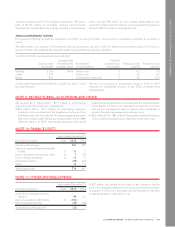

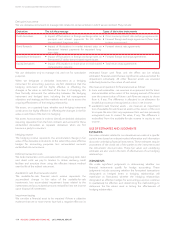

Derivative The risk they manage Types of derivative instruments

Debt derivatives • Impact of fluctuations in foreign exchange rates on

principal and interest payments for US dollar-

denominated long-term debt

• Cross-currency interest rate exchange agreements

• Forward foreign exchange agreements (from time

to time as necessary)

Bond forwards • Impact of fluctuations in market interest rates on

forecasted interest payments for expected long-

term debt

• Forward interest rate agreements

Expenditure derivatives • Impact of fluctuations in foreign exchange rates on

forecasted US dollar-denominated expenditures

• Forward foreign exchange agreements

Equity derivatives • Impact of fluctuations in share price on stock-based

compensation expense

• Total return swap agreements

We use derivatives only to manage risk, and not for speculative

purposes.

When we designate a derivative instrument as a hedging

instrument for accounting purposes, we first determine that the

hedging instrument will be highly effective in offsetting the

changes in fair value or cash flows of the item it is hedging. We

then formally document the relationship between the hedging

instrument and hedged item, including the risk management

objectives and strategy and the methods we will use to assess the

ongoing effectiveness of the hedging relationship.

We assess, on a quarterly basis, whether each hedging instrument

continues to be highly effective in offsetting the changes in the fair

value or cash flows of the item it is hedging.

We assess host contracts in order to identify embedded derivatives

requiring separation from the host contracts and account for these

embedded derivatives as separate derivatives when we first

become a party to a contract.

Hedging reserve

The hedging reserve represents the accumulated change in fair

value of the derivative instruments to the extent they were effective

hedges for accounting purposes, less accumulated amounts

reclassified into net income.

Deferred transaction costs

We defer transaction costs associated with issuing long-term debt

and direct costs we pay to lenders to obtain revolving credit

facilities and amortize them using the effective interest method

over the life of the related instrument.

Available-for-sale financial assets reserve

The available-for-sale financial assets reserve represents the

accumulated change in fair value of the available-for-sale

investments, less accumulated impairment losses related to the

investments and accumulated amounts reclassified into net income

upon disposal of investments.

Impairment testing

We consider a financial asset to be impaired if there is objective

evidence that one or more events have had a negative effect on its

estimated future cash flows and the effect can be reliably

estimated. Financial assets that are significant in value are tested for

impairment individually. All other financial assets are assessed

collectively based on the nature of each asset.

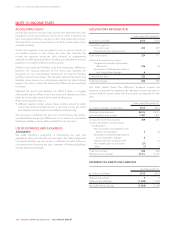

We measure impairment for financial assets as follows:

•loans and receivables – we measure an impairment loss for loans

and receivables as the excess of the carrying amount of the asset

over the present value of future cash flows we expect to derive

from it, if any. The difference is allocated to an allowance for

doubtful accounts and recognized as a loss in net income.

•available-for-sale financial assets – we measure an impairment

loss of available-for-sale financial assets as the excess of the cost

to acquire the asset (less any impairment loss we have previously

recognized) over its current fair value, if any. The difference is

reclassified from the available-for-sale reserve in equity to net

income.

USE OF ESTIMATES AND JUDGMENTS

ESTIMATES

Fair value estimates related to our derivatives are made at a specific

point in time based on relevant market information and information

about the underlying financial instruments. These estimates require

assessment of the credit risk of the parties to the instruments and

the instruments’ discount rates. These fair values and underlying

estimates are also used in the tests of effectiveness of our hedging

relationships.

JUDGMENTS

We make significant judgments in determining whether our

financial instruments qualify for hedge accounting. These

judgments include assessing whether the forecasted transactions

designated as hedged items in hedging relationships will

materialize as forecasted, whether the hedging relationships

designated as effective hedges for accounting purposes continue

to qualitatively be effective, and determining the methodology to

determine the fair values used in testing the effectiveness of

hedging relationships.

114 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT