Rogers 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

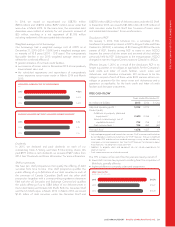

subscribers effective July 2015. Prepaid plans are evolving to have

properties similar to those of traditional postpaid plans. We believe

this evolution provides Canadians with greater choice of

subscribing to a postpaid or prepaid service plan. Growth in our

customer base over time has resulted in higher costs for customer

service, retention, credit, and collection; however, most of the cost

increases have been offset by gains in operating efficiencies.

Wireless operating results are influenced by the timing of our

marketing and promotional expenditures and higher levels of

subscriber additions and related subsidies, resulting in higher

subscriber acquisition and activation-related expenses, typically in

the third and fourth quarters. The launch of popular new wireless

handset models can also affect the level of subscriber additions.

Highly-anticipated device launches typically occur in the fall season

of each year. We typically see lower subscriber additions in the first

quarter of the year, which is a direct impact of the higher additions

around the fourth quarter holiday season. Wireless roaming

revenue is dependent on customer travel volumes, which is

impacted by the value of the foreign exchange rate of the

Canadian dollar and general economic conditions.

Recently, we have noticed a significant increase in customers

choosing to bring their own devices. We believe customers have

chosen to do this as a result of the introduction of the Wireless

Code as carriers have increased the upfront cost of a mobile device

to offset the shorter time period in which subscribers have to fully

payoffthedevicesubsidy.

Cable

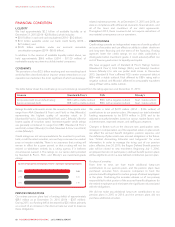

The trends in Cable services revenue primarily reflect:

• higher Internet subscription fees as customers increasingly

upgrade to higher-tier speed plans, including those with

unlimited usage; and

• general pricing increases over the past year; offset by

• competitive losses of Television and Phone subscribers;

• Television subscribers downgrading their service plans; and

• lower additional usage of Internet, Television, and Phone

products and services as service plans are increasingly bundling

more features, such as unlimited bandwidth or a greater number

of TV channels.

The trends in Cable adjusted operating profit primarily reflect:

• higher Internet operating expenses, in line with the increased

Internet subscription fees; and

• higher premium supplier fees in Television as a result of

bundling more value-added offerings into our Cable products;

offset by

• lower general Television and Phone operating expenses.

Cable’s operating results are affected by modest seasonal

fluctuations in subscriber additions and disconnections, typically

caused by:

• university and college students who live in residences moving

out early in the second quarter and cancelling their service as

well as students moving in late in the third quarter and signing

up for cable service;

• individuals temporarily suspending service for extended

vacations or seasonal relocations; and

• the concentrated marketing we generally conduct in our fourth

quarter.

Cable operating results are also influenced by trends in cord

shaving and cord cutting, which has resulted in fewer subscribers

watching traditional cable television, as well as a lower number of

Television subscribers. In addition, trends in the use of wireless

products and Internet or social media to substitute for traditional

home Phone products have resulted in fewer Phone subscribers.

Business Solutions

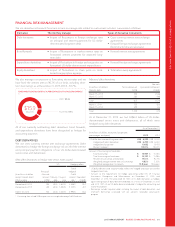

The trends in Business Solutions operating profit margin primarily

reflect the ongoing shift from lower-margin, off-net legacy long

distance and data services to higher-margin, next generation

services and data centre businesses.

Business Solutions does not generally have any unique seasonal

aspects to its business.

Media

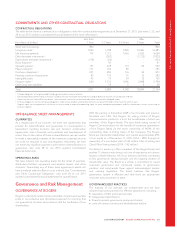

The trends in Media’s results are generally the result of:

• continual investment in primetime and specialty programming

relating to both our broadcast networks (such as City) and our

specialty channels (such as FX (Canada));

• higher sports rights costs as we move further along in our NHL

Agreement;

• subscriber rate increases; and

• fluctuations in advertising and consumer market conditions.

Seasonal fluctuations relate to:

• periods of increased consumer activity and their impact on

advertising and related retail cycles, which tend to be most active

in the fourth quarter due to holiday spending and slower in the

first quarter;

• the MLB season, where:

• games played are concentrated in the spring, summer, and fall

months (generally the second and third quarters of the year);

• revenue related to game day ticket sales, merchandise sales,

and advertising are concentrated in the spring, summer, and

fall months (generally the second and third quarters of the

year), with postseason games commanding a premium in

advertising revenue and additional revenue from game day

ticket sales and merchandise sales, when the Toronto Blue

Jays play in the postseason; and

• programming and production costs and player payroll are

expensed based on the number of games aired; and

• the NHL season, where:

• regular season games are concentrated in the fall and winter

months (generally the first and fourth quarters of the year) and

playoff games are concentrated in the spring months

(generally the second quarter of the year);

• programming and production costs are expensed based on

the timing of when the rights are aired or are expected to be

consumed; and

• advertising revenue and programming expenses are

concentrated in the fall, winter, and spring months, with playoff

games commanding a premium in advertising revenue.

Other expenses

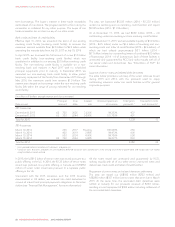

Depreciation and amortization has been trending upward over the

past several years as a result of an increase in our general

depreciable asset base, related significantly to our recent rollout and

expansion of our wireless network. This is a direct result of increasing

additions to property, plant and equipment in previous and current

yearsasweworkedtoupgradeourwirelessnetwork,purchase

NextBox set-top boxes, and roll out IGNITE Gigabit Internet and 4K

TV to our Cable footprint. We expect the depreciation and

amortization to be relatively stable for the next several years as our

additions to property, plant and equipment moderate.

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 55