Rogers 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

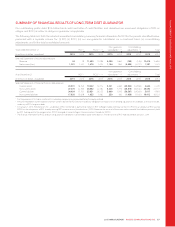

SUMMARY OF FINANCIAL RESULTS OF LONG-TERM DEBT GUARANTOR

Our outstanding public debt, $3.6 billion bank credit and letter of credit facilities, and derivatives are unsecured obligations of RCI, as

obligor, and RCCI, as either co-obligor or guarantor, as applicable.

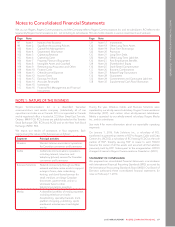

The following table sets forth the selected unaudited consolidating summary financial information for RCI for the periods identified below,

presented with a separate column for: (i) RCI, (ii) RCCI, (iii) our non-guarantor subsidiaries on a combined basis, (iv) consolidating

adjustments, and (v) the total consolidated amounts.

Years ended December 31 RCI 1, 2 RCCI 1, 2, 3, 4

Non-guarantor

subsidiaries 1, 2, 4

Consolidating

adjustments 1, 2 Total

(In millions of dollars, unaudited) 2015 2014 2015 2014 2015 2014 2015 2014 2015 2014

Selected Statements of Income data measure:

Revenue 24 19 11,489 11,096 2,099 1,881 (198) (146) 13,414 12,850

Net income (loss) 1,381 1,341 1,478 1,453 1,104 964 (2,582) (2,417) 1,381 1,341

As at December 31 RCI 1, 2 RCCI 1, 2, 3, 4

Non-guarantor

subsidiaries 1, 2, 4

Consolidating

adjustments 1, 2 Total

(In millions of dollars, unaudited) 2015 2014 2015 2014 2015 2014 2015 2014 2015 2014

Selected Statements of Financial Position data measure:

Current assets 23,891 18,530 19,322 13,473 8,331 3,280 (48,922) (32,938) 2,622 2,345

Non-current assets 27,270 23,760 36,862 33,183 8,236 7,776 (45,815) (40,542) 26,553 24,177

Current liabilities 24,024 17,701 25,951 20,255 5,609 1,545 (50,567) (34,581) 5,017 4,920

Non-current liabilities 17,928 15,619 1,655 1,483 259 180 (1,429) (1,161) 18,413 16,121

1For the purposes of this table, investments in subsidiary companies are accounted for by the equity method.

2Amounts recorded in current liabilities and non-current liabilities for RCCI do not include any obligations arising as a result of being a guarantor or co-obligor, as the case may be,

under any of RCI’s long-term debt.

3On January 1, 2016, Fido Solutions Inc., a subsidiary of RCI, transferred its partnership interest in RCP to Rogers Cable and Data Centres Inc. (RCDCI), a subsidiary of RCI, leaving

RCDCI as the sole partner of RCP, thereby causing RCP to cease to exist (the dissolution). RCDCI became the owner of all the assets and assumed all the liabilities previously held

by RCP. Subsequent to the reorganization, RCDCI changed its name to Rogers Communications Canada Inc. (RCCI).

4The financial information for RCCI and our non-guarantors subsidiaries is presented on a pro-forma basis as if the dissolution of RCP had occurred on January 1, 2014.

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 87