Rogers 2015 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

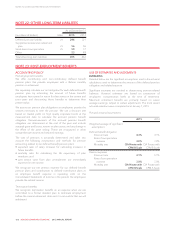

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

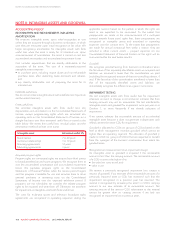

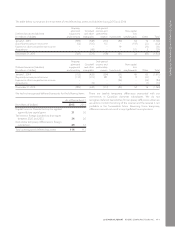

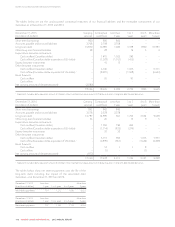

The tables below set out the undiscounted contractual maturities of our financial liabilities and the receivable components of our

derivatives as at December 31, 2015 and 2014.

December 31, 2015

(In millions of dollars)

Carrying

amount

Contractual

cash flows

Less than

1year

1to3

years

4to5

years

More than

5years

Short-term borrowings 800 800 800 – – –

Accounts payable and accrued liabilities 2,708 2,708 2,708 – – –

Long-term debt 16,870 16,981 1,000 3,188 1,800 10,993

Other long-term financial liabilities 28 28 – 19 5 4

Expenditure derivative instruments:

Cash outflow (Canadian dollar) – 1,415 1,025 390 – –

Cash inflow (Canadian dollar equivalent of US dollar) – (1,578) (1,163) (415) – –

Equity derivative instruments – 15 15 – – –

Debt derivative instruments:

Cash outflow (Canadian dollar) – 6,746 – 1,435 – 5,311

Cash inflow (Canadian dollar equivalent of US dollar) 1– (8,581) – (1,938) – (6,643)

Bond forwards:

Cash outflow – 91 – 91 – –

Cashinflow – –––––

Net carrying amount of derivatives (asset) (2,080)

18,326 18,625 4,385 2,770 1,805 9,665

1Represents Canadian dollar equivalent amount of US dollar inflows matched to an equal amount of US dollar maturities in long-term debt for debt derivatives.

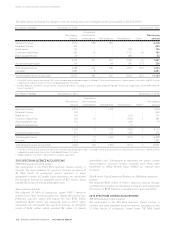

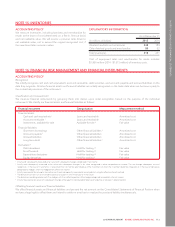

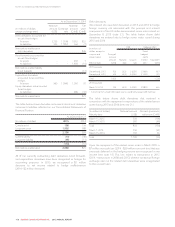

December 31, 2014

(In millions of dollars)

Carrying

amount

Contractual

cash flows

Less than

1year

1to3

years

4to5

years

More than

5years

Short-term borrowings 842 842 842 – – –

Accounts payable and accrued liabilities 2,578 2,578 2,578 – – –

Long-term debt 14,787 14,895 963 1,750 2,524 9,658

Other long-term financial liabilities 26 26 – 12 9 5

Expenditure derivative instruments:

Cash outflow (Canadian dollar) – 1,050 790 260 – –

Cash inflow (Canadian dollar equivalent of US dollar) – (1,114) (835) (279) – –

Equity derivative instruments – 30 30 – – –

Debt derivative instruments:

Cash outflow (Canadian dollar) – 6,313 905 – 1,435 3,973

Cash inflow (Canadian dollar equivalent of US dollar) 1– (6,995) (963) – (1,624) (4,408)

Bond forwards:

Cashoutflow –14338 –

Cash inflow – (1) – – (1) –

Net carrying amount of derivatives (asset) (873)

17,360 17,638 4,313 1,746 2,351 9,228

1Represents Canadian dollar equivalent amount of US dollar inflows matched to an equal amount of US dollar maturities in long-term debt for debt derivatives.

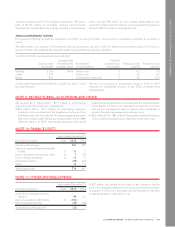

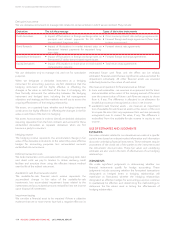

The tables below show net interest payments over the life of the

long-term debt, including the impact of the associated debt

derivatives, as at December 31, 2015 and 2014.

December 31, 2015

(In millions of dollars)

Less than

1year 1to3years 4to5years

More than

5years

Net interest payments 714 1,313 1,042 6,025

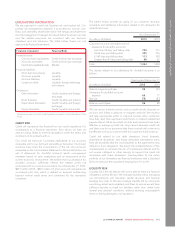

December 31, 2014

(In millions of dollars)

Less than

1year 1to3years 4to5years

More than

5years

Net interest payments 757 1,343 1,143 6,022

116 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT