Rogers 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’S DISCUSSION AND ANALYSIS

FOURTH QUARTER 2015 RESULTS

Results commentary in “Fourth Quarter 2015 Results” compares

the fourth quarter of 2015 with the fourth quarter of 2014.

Operating revenue

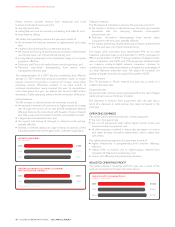

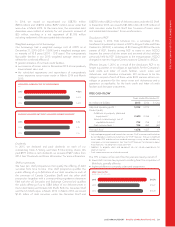

Wireless network revenue increased 3% in the fourth quarter

primarily as a result of the continued adoption of higher-postpaid-

ARPA-generating Rogers Share Everything plans and an

adjustment pertaining to reflected usage of our loyalty programs,

partially offset by a decrease in roaming revenue. Wireless

equipment sales increased 19% in the fourth quarter as a result of

greater device volumes and equipment sales prices.

Cable operating revenue decreased 2% in the fourth quarter as a

result of Television and Phone subscriber losses over the past year,

partially offset by the movement of customers to higher-end

Internet speed and usage tiers and the impact of pricing changes

implemented over the past year.

Business Solutions operating revenue decreased 2% in the fourth

quarter as a result of the continued decline in our legacy off-net

voice and data business, partially offset by continued growth of on-

net and next generation IP-based services revenue.

Media operating revenue increased 3% in the fourth quarter

primarily as a result of higher subscription and advertising revenue

generated by our Sportsnet properties and revenue generated as a

result of the postseason success of the Toronto Blue Jays, partially

offset by continued softness in conventional broadcast television

and print advertising and lower merchandise sales at TSC.

Adjusted operating profit

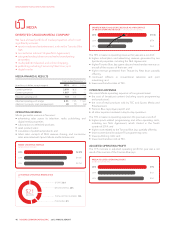

Wireless adjusted operating profit increased 4% in the fourth

quarter primarily as a result of the increased network revenue,

partially offset by the increased net subsidies associated with higher

gross additions and higher cost smartphones.

Cable adjusted operating profit increased marginally in the fourth

quarter primarily as a result of relative shifts in the product mix to

higher-margin Internet from conventional Television broadcasting

and various cost efficiency and productivity initiatives, which more

than offset the decline in revenue.

Business Solution’s adjusted operating profit decreased 12% in the

fourth quarter as a result of the decrease in revenue described

above as well as an increase in operating expenses relating to

higher service costs.

Media’s adjusted operating profit decreased 28% in the fourth

quarter as a result of the declines in conventional areas of TV and

publishing, partially offset by the postseason success of the Toronto

Blue Jays.

Net income and adjusted net income

Net income increased 1% in the fourth quarter primarily as a result

of lower restructuring, acquisition and other costs, lower finance

costs, and lower income taxes, partially offset by higher

depreciation and amortization, while adjusted net income

decreased this quarter as this measure excludes restructuring,

acquisition and other costs.

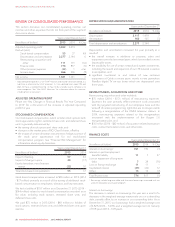

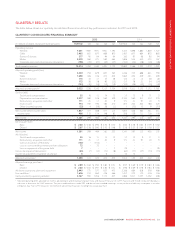

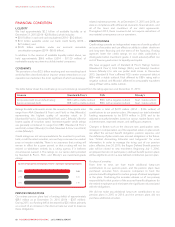

QUARTERLY TRENDS AND SEASONALITY

Our operating results generally vary from quarter to quarter as a

result of changes in general economic conditions and seasonal

fluctuations, among other things, in each of our business

segments. This means our results in one quarter are not necessarily

a good indication of how we will perform in a future quarter.

Wireless, Cable, and Media each have unique seasonal aspects to,

and certain other historical trends in, their businesses.

Fluctuations in net income from quarter to quarter can also be

attributed to losses on the repayment of debt, foreign exchange

gains or losses, changes in the fair value of derivative instruments,

other income and expenses, impairment of assets, and changes in

income taxes.

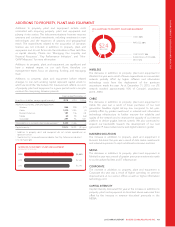

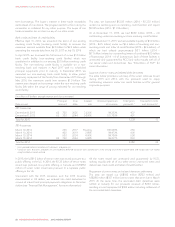

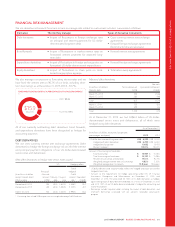

Wireless

The trends in Wireless revenue and adjusted operating profit

reflect:

• the growing number of wireless voice and data subscribers;

• higher usage of wireless data;

• higher handset sales as more consumers shift to smartphones;

and

• stable postpaid churn, which we believe is beginning to reflect

the realization of our heightened focus towards higher valued

customers and our enhanced customer service efforts; partially

offset by

• decreasing voice revenue as rate plans increasingly incorporate

more monthly minutes and calling features, such as long

distance; and

• lower roaming revenue as more subscribers are taking

advantage of value-added roaming plans, such as Roam Like

Home.

The trends in Wireless adjusted operating profit reflect:

• higher handset subsidies that offset the higher handset sales as

more consumers shift to smartphones; and

• higher voice and data costs related to the increasing number of

subscribers.

Notably, over the last two years since the CRTC introduced the

Wireless Code, we have been anticipating the double cohort,

which resulted in term contracts being limited from a three-year

term to a two-year term. As a result of the Wireless Code and the

double cohort, we worked to upgrade subscribers earlier than

usual, causing a significant increase in our fourth quarter 2014

equipment sales and cost of equipment as a result of higher

subsidies. This effect continued in our first and second quarters of

2015, until the Wireless Code took effect in June 2015. The third

and fourth quarters of 2015 had higher equipment sales and costs

than the prior year due to the greater number of term contracts

ending at any point in time.

We expect our equipment sales and cost of equipment to be

higher than they typically have been historically as a result of the

introduction of the Wireless Code, which resulted in term contracts

being limited to a two-year period. We expect this to result in a

greater absolute number of customers upgrading their device

hardware in any given period.

We continue to target organic growth in higher-value postpaid

subscribers. We have maintained a stable mix of postpaid versus

prepaid subscribers excluding the addition of the Mobilicity

54 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT