Rogers 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’S DISCUSSION AND ANALYSIS

ROGERS NHL GAMECENTRE LIVE GAMEPLUS

On November 20, 2014, we responded to a CRTC complaint by

certain companies claiming that Rogers NHL GameCentre LIVE

Plus, the exclusive content tier of Rogers NHL GameCentre LIVE,

violates CRTC regulations on the basis that it was not content

designed primarily for Internet use by individual customers. On

March 16, 2015, the CRTC denied the complaint.

MEDIA

COPYRIGHT RETRANSMISSION OF DISTANT SIGNALS

Pursuant to section 31(2) of the Copyright Act, television service

providers are permitted to retransmit programming within distant

over-the-air television signals as part of a compulsory licensing

regime. Rates for the distribution of the programming are

established through negotiation or set by the Copyright Board.

Distributors and content providers were unable to agree on a new

rate for the distribution of distant signals after the expiration of the

current agreement in 2013. A proceeding was initiated by the

Copyright Board, which began on November 23, 2015. The

proceeding will continue into 2016 with a decision expected in 2017.

The Collectives (content providers) have proposed a royalty rate

that is approximately double the current rate, which, if certified,

would have a significant financial impact on Rogers with additional

costs of approximately $30 million per year.

LICENCE RENEWALS

The CRTC considers group-based (conventional and discretionary

specialty) licence renewal applications for major media companies.

The Rogers group includes the City conventional television stations

and specialty channels Sportsnet 360, The Biography Channel,

G4Tech, and Outdoor Life.

On July 31, 2014, the CRTC renewed our licences for a two-year

period as we had requested. In addition, the decision placed no

restrictions on the amount of sports programming expenditures

that can be used to meet Canadian program expenditure

obligations and deleted the previous condition of licence requiring

specific expenditures of local programming outside of Toronto.

These conditions were replaced with a requirement to produce

original hours of local programming which cannot include

professional sports programming. Consistent with the requirement

for other large broadcast groups, pursuant to the decision the

Rogers group is now required to achieve a Canadian program

expenditure of 30% rather than the previous 25%, 5% of which

must be directed to programs of national interest. In addition, the

CRTC determined that the imposition of the Wholesale Code as

condition of licence would be an appropriate measure to ensure a

level playing field with other entities that may have business

relationships with Rogers.

Other Information

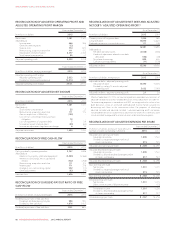

ACCOUNTING POLICIES

CRITICAL ACCOUNTING ESTIMATES AND JUDGMENTS

Management makes judgments, estimates, and assumptions that

affect how accounting policies are applied, the amounts we report in

assets, liabilities, revenue, and expenses, and our related disclosure

about contingent assets and liabilities. Significant changes in our

assumptions, including those related to our future business plans

and cash flows, could materially change the amounts we record.

Actual results could be different from these estimates.

These estimates are critical to our business operations and

understanding our results of operations. We may need to use

additional judgment because of the sensitivity of the methods and

assumptions used in determining the asset, liability, revenue, and

expense amounts.

ESTIMATES

FAIR VALUE

We use estimates to determine the fair value of assets acquired and

liabilities assumed in an acquisition, using the best available

information, including information from financial markets. These

estimates include key assumptions such as discount rates, attrition

rates, and terminal growth rates for performing discounted cash

flow analyses.

USEFUL LIVES

We depreciate the cost of property, plant and equipment over their

estimated useful lives by considering industry trends and company-

specific factors, including changing technologies and expectations

for the in-service period of certain assets at the time. We reassess our

estimates of useful lives annually, or when circumstances change, to

ensure they match the anticipated life of the technology from a

revenue-producing perspective. If technological change happens

more quickly, or in a different way, than anticipated, we might have to

reduce the estimated life of property, plant and equipment, which

could result in a higher depreciation expense in future periods or an

impairment charge to write down the value. We monitor and review

our depreciation rates and asset useful lives at least once a year and

change them if they are different from our previous estimates. We

recognize the effect of changes in estimates in net income

prospectively.

CAPITALIZING DIRECT LABOUR, OVERHEAD, AND

INTEREST

Certain direct labour, overhead, and interest costs associated with

the acquisition, construction, development, or improvement of our

networks are capitalized to property, plant and equipment. The

capitalized amounts are calculated based on estimated costs of

projects that are capital in nature, and are generally based on a per-

hour rate. In addition, interest costs are capitalized during

development and construction of certain property, plant and

equipment. Capitalized amounts increase the cost of the asset and

result in a higher depreciation expense in future periods.

IMPAIRMENT OF ASSETS

Indefinite-life intangible assets (including goodwill and spectrum

and/or broadcast licences) are assessed for impairment on an

annual basis, or more often if events or circumstances warrant, and

finite-life assets (including property, plant and equipment and

other intangible assets) are assessed for impairment if events or

80 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT