Rogers 2015 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

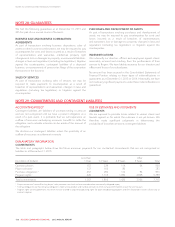

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

possible for us to predict the result or magnitude of the claims due

to the various factors and uncertainties involved in the legal

process. Based on information currently known to us, we believe it

is not probable that the ultimate resolution of any of these

proceedings and claims, individually or in total, will have a material

adverse effect on our business or financial results or financial

condition. If it becomes probable that we will be held liable for

claims against us, we will recognize a provision during the period in

which the change in probability occurs, which could be material to

our Consolidated Statements of Income or Consolidated

Statements of Financial Position.

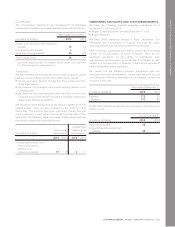

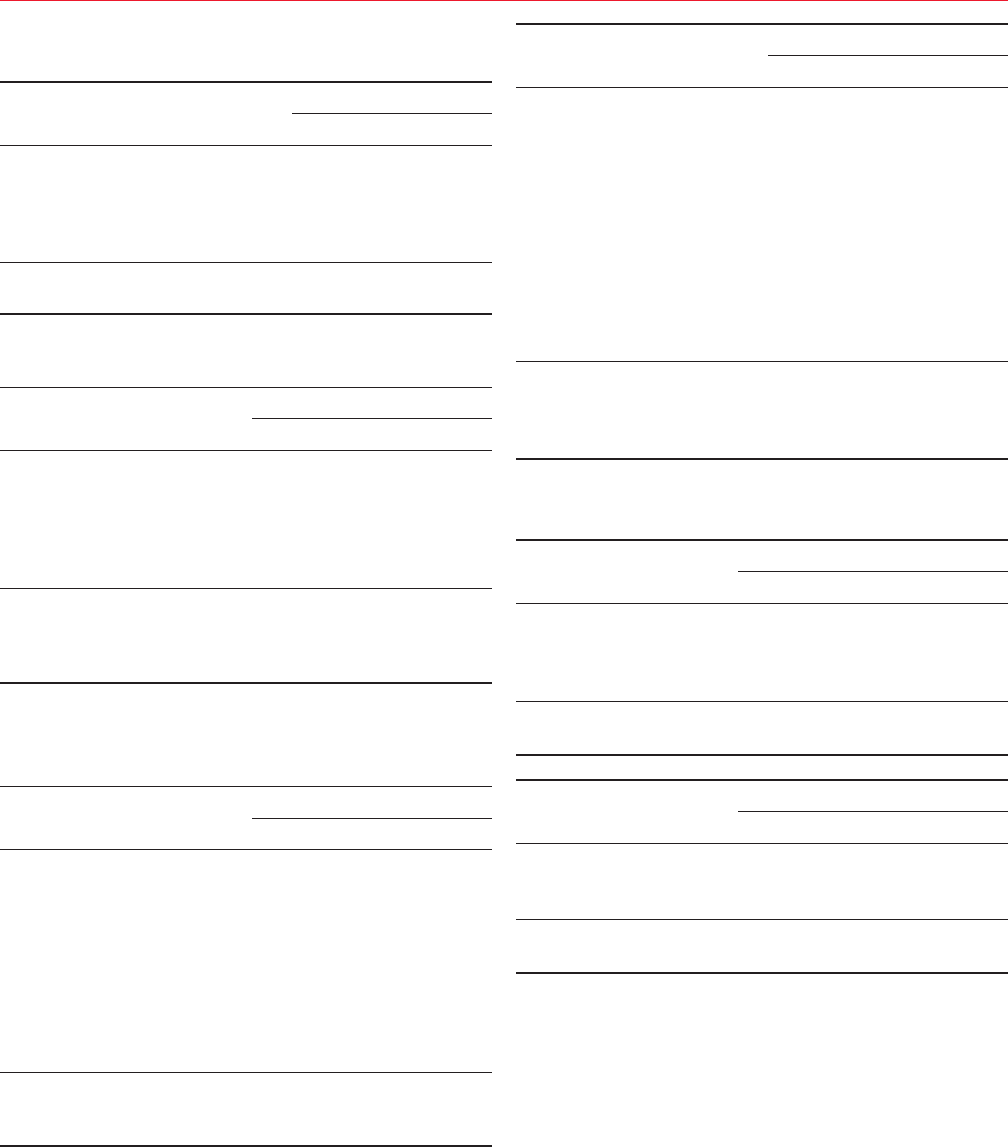

NOTE 30: SUPPLEMENTAL CASH FLOW INFORMATION

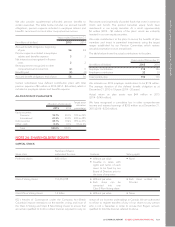

CHANGE IN NON-CASH OPERATING WORKING CAPITAL

ITEMS

Years ended December 31

(In millions of dollars) 2015 2014

Accounts receivable (185) (81)

Inventories (66) 26

Other current assets (23) (18)

Accounts payable and accrued liabilities 33 (2)

Unearned revenue (61) 86

Total change in non-cash working capital

items (302) 11

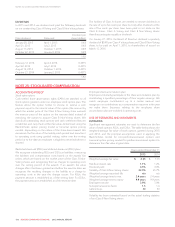

CASH PROVIDED BY FINANCING ACTIVITIES

Years ended December 31

(In millions of dollars) Note 2015 2014

Proceeds on debt derivatives and

foreign exchange forward

contracts 1,059 2,150

Payments on debt derivatives, bond

forwards, and foreign exchange

forward contracts (930) (2,115)

Net cash proceeds on debt

derivatives, bond forwards, and

foreign exchange forward

contracts 21 129 35

Thefollowingtwotablesprovidedetailsonthegrossproceeds

(payments) on debt derivatives, bond forwards, and foreign

exchange forward contracts.

Years ended December 31

(In millions of dollars) Note 2015 2014

Proceeds on termination of

US$550 million debt derivatives 21 702 –

Proceeds on termination of

US$280 million debt derivatives 21 357 –

Proceeds on termination of

US$750 million debt derivatives 21 –834

Proceeds on termination of

US$350 million debt derivatives 21 –387

Proceeds on foreign exchange

forward contracts –929

Total gross proceeds on debt

derivatives and foreign exchange

forward contracts 1,059 2,150

Years ended December 31

(In millions of dollars) Note 2015 2014

Payments on termination of

US$550 million debt derivatives 21 (596) –

Payments on termination of

US$280 million debt derivatives 21 (309) –

Payments on termination of bond

forwards 16 (25) –

Payments on termination of

US$750 million debt derivatives 21 –(773)

Payments on termination of

US$350 million debt derivatives 21 –(413)

Payments on foreign exchange

forward contracts –(929)

Total gross payments on debt

derivatives, bond forwards, and

foreign exchange forward

contracts (930) (2,115)

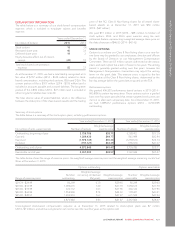

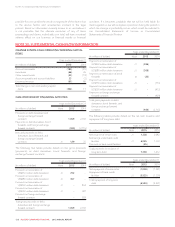

The following tables provide details on the net cash issuance and

repayment of long-term debt.

Years ended December 31

(In millions of dollars) Note 2015 2014

Net issuance of senior notes 21 1,338 2,082

Borrowings under bank credit

facilities 21 6,025 1,330

Discount on bank credit facilities (25) –

Total proceeds on issuance of

long-term debt 7,338 3,412

Years ended December 31

(In millions of dollars) Note 2015 2014

Net repayment of senior notes 21 (1,059) (1,221)

Repayment of bank credit

facilities 21 (5,525) (1,330)

Total repayment of long-term

debt (6,584) (2,551)

138 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT