Rogers 2015 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

KEY ACHIEVEMENTS

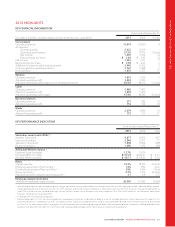

HIGHER OPERATING REVENUE

• Consolidated revenue increased by 4% this year, reflecting

revenue growth of 5% in Wireless and 14% in Media, while

Cable revenue remained stable and Business Solutions revenue

decreased by 1%. Wireless revenue increased on higher network

revenue from the continued adoption of higher-postpaid-ARPA-

generating Rogers Share Everything plans and greater

smartphone sales. Cable revenue was stable as the increase in

Internet revenue from the movement of customers to higher-end

speed and usage tiers was offset by lower Television and Phone

revenue primarily due to Television and Phone subscriber losses

over the past year. Business Solutions revenue decreased this

year primarily as a result of the continued reduction in lower

margin, off-net legacy revenue, which more than offset the

growth in on-net next generation services, including our data

centre businesses. Media revenue increased as a result of the

National Hockey League (NHL) licensing agreement, growth at

Sportsnet, and higher revenue at the Toronto Blue Jays, partially

offset by lower sales at The Shopping Channel (TSC) and

continued softness in conventional broadcast TV and print

advertising.

• Consolidated adjusted operating profit was stable this year, with

a consolidated adjusted operating profit margin of 37.5%,

resulting from higher revenue offset by higher net subsidies in

Wireless and higher operating expenses in Media. Our net

income increased 3% to $1,381 million, mainly due to lower

restructuring, acquisition and other costs, finance costs, and

income taxes, partially offset by higher depreciation and

amortization.

• Postpaid Wireless subscriber net additions of 106,000 and

Internet net additions of 37,000 this year.

HIGHER CASH FLOW

• Free cash flow increased 17% this year to $1,676 million as a

result of lower cash income tax payments, partially offset by

higher additions to property, plant and equipment. Our cash

provided by operating activities increased 1% this year to

$3,747 million.

LIQUIDITY POSITION

• Ended the year with approximately $3.3 billion of available

liquidity (2014 – $2.8 billion), comprised of $0.01 billion cash on

hand (2014 – $0.2 billion), $3.0 billion available under our bank

credit facilities (2014 – $2.5 billion), and $0.25 billion available

under our $1.05 billion accounts receivable securitization

program (2014 – $0.06 billion available under our $0.9 billion

accounts receivable securitization program).

• Issued US$1,000 million ($1,338 million) of senior notes,

consisting of US$700 million ($937 million) 3.625% senior notes

due 2025 and US$300 million ($401 million) 5.000% senior

notes due 2044.

• Our overall weighted average cost of borrowings was 4.82% as

at December 31, 2015 (2014 – 5.20%) and our overall weighted

average term to maturity on our debt was 10.8 years as at

December 31, 2015 (2014 – 10.8 years).

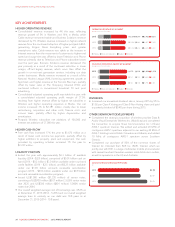

(IN MILLIONS OF DOLLARS)

OPERATING REVENUE BY SEGMENT

2015

2014

2013

2,079 377 3,465 7,651

1,826 382 3,467 7,3 0 5

1,704 374 3,475 7,270

WirelessCableBusiness SolutionsMedia

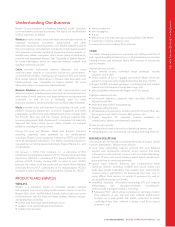

(IN MILLIONS OF DOLLARS)

ADJUSTED OPERATING PROFIT BY SEGMENT

2015

2014

2013

172 116 1,658 3,239

131 122 1,665 3,246

161 106 1,718 3,157

WirelessCableBusiness SolutionsMedia

DIVIDENDS

• Increased our annualized dividend rate in January 2015 by 5% to

$1.92 per Class A Voting and Class B Non-Voting share and paid

a quarterly dividend of $0.48 per share during 2015.

OTHER SIGNIFICANT DEVELOPMENTS

• Completed the strategic acquisition of wireless provider Data &

Audio-Visual Enterprises Wireless Inc. (Mobilicity) and completed

the transaction to acquire Shaw Communication Inc.’s (Shaw)

AWS-1 spectrum licences. We added and activated 20 MHz of

contiguous AWS-1 spectrum adjacent to our existing 20 MHz of

AWS-1 holdings across British Columbia and Alberta, and added

10 MHz of contiguous AWS-1 spectrum across Southern

Ontario.

• Completed our purchase of 50% of the common shares of

GlentelInc.(Glentel)fromBCEInc.(BCE).Glentel,whichwe

jointly own with BCE, is a large, multicarrier mobile phone retailer

with several hundred Canadian wireless retail distribution outlets,

as well as operations in the US and Australia.

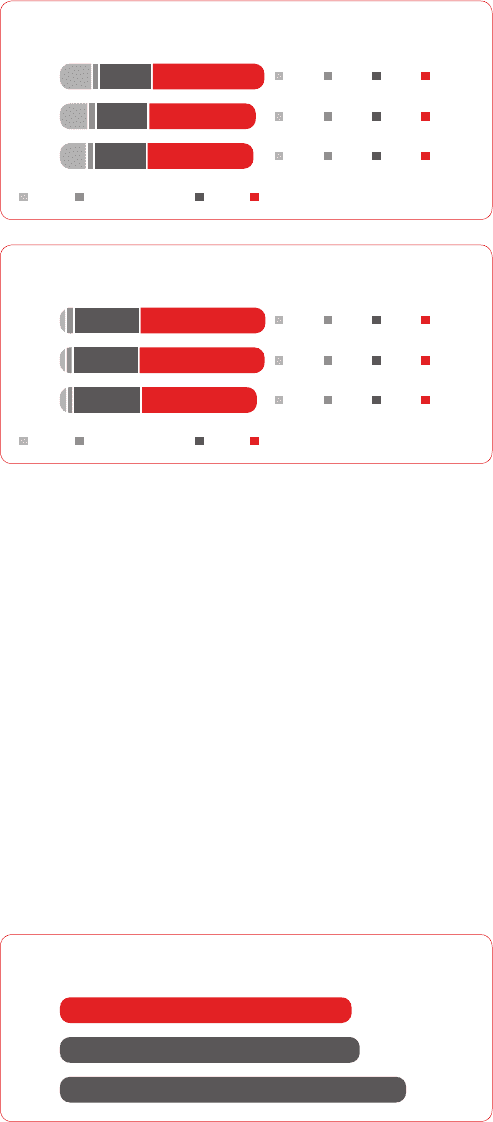

($)

ADJUSTED BASIC EARNINGS PER SHARE

2015

2014

2013

$2.89

$2.97

$3.43

24 ROGERS COMMUNICATIONS INC. 2015 ANNUAL REPORT