Rogers 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

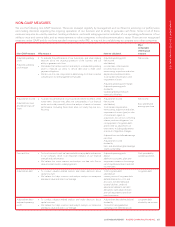

NON-GAAP MEASURES

We use the following non-GAAP measures. These are reviewed regularly by management and our Board in assessing our performance

and making decisions regarding the ongoing operations of our business and its ability to generate cash flows. Some or all of these

measures may also be used by investors, lending institutions, and credit rating agencies as indicators of our operating performance, of our

ability to incur and service debt, and as measurements to value companies in the telecommunications sector. These are not recognized

measures under GAAP and do not have standard meanings under IFRS, so may not be a reliable way to compare us to other companies.

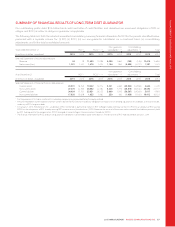

Non-GAAP measure Why we use it How we calculate it

Most

comparable

IFRS financial

measure

Adjusted operating

profit

Adjusted operating

profit margin

•To evaluate the performance of our businesses, and when making

decisions about the ongoing operations of the business and our

ability to generate cash flows.

•We believe that certain investors and analysts use adjusted operating

profit to measure our ability to service debt and to meet other

payment obligations.

•We also use it as one component in determining short-term incentive

compensation for all management employees.

Adjusted operating profit:

Net income

add (deduct)

income taxes, other expense

(income), finance costs,

restructuring, acquisition and other,

depreciation and amortization,

stock-based compensation, and

impairment of assets.

Adjusted operating profit margin:

Adjusted operating profit

divided by

Operating revenue (network

revenue for Wireless)

Net income

Adjusted net income

Adjusted basic and

diluted earnings per

share

•To assess the performance of our businesses before the effects of the

noted items, because they affect the comparability of our financial

results and could potentially distort the analysis of trends in business

performance. Excluding these items does not imply they are non-

recurring.

Adjusted net income:

Net income

add (deduct)

stock-based compensation,

restructuring, acquisition and other,

impairment of assets, (gain) on sale

of investments, (gain) on

acquisitions, loss on non-controlling

interest purchase obligations, loss

on repayment of long-term debt,

and income tax adjustments on

these items, including adjustments

as a result of legislative changes.

Adjusted basic and diluted earnings

per share:

Adjusted net income

divided by

basic and diluted weighted average

shares outstanding.

Net income

Basic and diluted

earnings per share

Free cash flow •To show how much cash we have available to repay debt and reinvest

in our company, which is an important indicator of our financial

strength and performance.

•We believe that some investors and analysts use free cash flow to

value a business and its underlying assets.

Adjusted operating profit

deduct

additions to property, plant and

equipment, interest on borrowings

net of capitalized interest, and cash

income taxes.

Cash provided by

operating activities

Adjusted net debt •To conduct valuation-related analysis and make decisions about

capital structure.

•We believe this helps investors and analysts analyze our enterprise

and equity value and assess our leverage.

Total long-term debt

add (deduct)

current portion of long-term debt,

deferred transaction costs and

discounts, net debt derivative

(assets) liabilities, credit risk

adjustment related to net debt

derivatives, bank advances (cash

and cash equivalents) and short-

term borrowings.

Long-term debt

Adjusted net debt /

adjusted operating

profit

•To conduct valuation-related analysis and make decisions about

capital structure.

•We believe this helps investors and analysts analyze our enterprise

and equity value and assess our leverage.

Adjusted net debt (defined above)

divided by

12 months trailing adjusted

operating profit (defined above).

Long-term debt

divided by net income

2015 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 85